|

|

Post by prcgorman2 on Jan 22, 2022 10:23:58 GMT -5

It will help tremendously if Castagna can move the needle just a tiny bit on Afrezza scripts. He knows what needs to happen-new users need lots of support (and the motivation to actually become involved in the active management of their disease.) Its a great question, by “moving the needle just a tiny bit on Afrezza scripts” - how much movement will it take to help tremendously? We thought we’d be in the tens of thousands per week range by now. We all know there are some legit excuses for this, as well as some missteps that also hurt badly. That’s all been hashed and rehashed. But regardless of excuses or blame, how much script movement would it take now to help our share price tremendously? In the past, script counts have shown to have virtually zero impact on share price (notable exception was when an impressive but sadly incorrect number was reported). I agree with your general premise, but nitpick with the phrase “tiny bit.” But that’s just semantics, and we might agree on raw numbers. For me, if we could break out of this 600-800 range and get to the 1000-2000 range with a steady uptrend (implying growth to that tens of thousands territory we all expected), then it would indeed help share price tremendously. This is off-topic, so I’ll keep it short. I tend to agree with you but now I’m the one that thinks YOU are optimistic! I think my number would be higher than 1000 per week, but yes, at least that and a re-established trend but also a believable path to success such as more studies, pediatric approval, and progress on label change and insurance coverage. |

|

|

|

Post by cretin11 on Jan 22, 2022 14:32:53 GMT -5

Yes, I do agree that a week or two at 1000 isn’t enough to move the needle. Consistent 1000-2000 range with clear uptrend, could be enough to move the share price needle. But even bigger numbers plus those other items you mentioned, we’d need all that to sustain the movement. It’s all just guesswork, but I’d love for us to get to test these guesses in real life.

|

|

|

|

Post by peppy on Jan 24, 2022 9:41:46 GMT -5

Volume is huge @ 10 mins of trade, Real time, 135,879 summary, 245,790 Avg. Volume 2,347,309 3.7000-0.0900 (-2.3747%) www.nasdaq.com/market-activity/stocks/mnkd/real-timefinance.yahoo.com/quote/MNKD?p=MNKDadded, volume at 30 mins of trade, real time, 230,248 summary, 428,086 3.6550-0.1350 (-3.5620%) As of 10:00AM EST. Market open. added @ 1 hour of trade, real time, 464,833 summary, 853,234 Avg. Volume 2,347,309 3.6400-0.1500 (-3.9578%) |

|

|

|

Post by peppy on Jan 24, 2022 12:50:17 GMT -5

MNKD volume at the half day of trade,

real time, 1,259,215

summary, 2,352,844

Avg. Volume 2,347,309

3.5350-0.2550 (-6.7282%)

=====================================

SPX 4,255.36. -142.58 (-3.24%)

Nasdaq 13,242.00. -529.33. (-3.84%)

INDU. 33,356.44. -908.93 (-2.65%)

|

|

|

|

Post by peppy on Jan 24, 2022 16:16:10 GMT -5

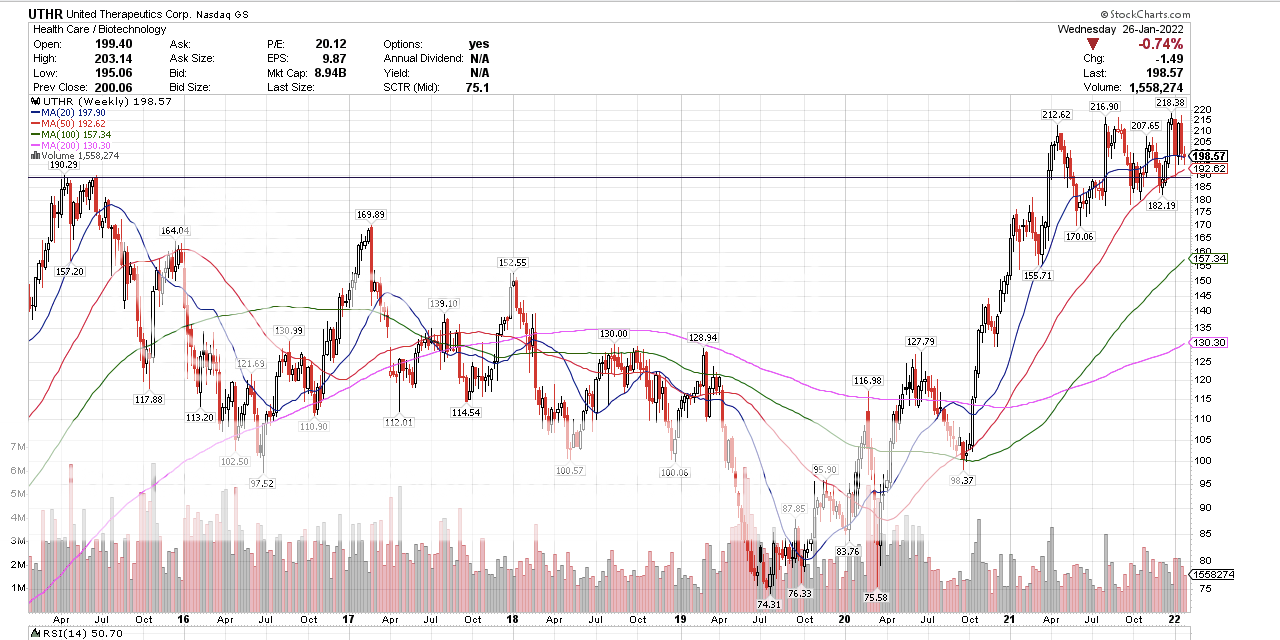

MNKD volume at the half day of trade, real time, 1,259,215 summary, 2,352,844 Avg. Volume 2,347,309 3.5350-0.2550 (-6.7282%) ===================================== SPX 4,255.36. -142.58 (-3.24%) Nasdaq 13,242.00. -529.33. (-3.84%) INDU. 33,356.44. -908.93 (-2.65%) MNKD Nasdaq real time volume, 3,461,001 shares. MNKD Nasdaq summary volume, 4,715,399 $3.71. -0.08 (-2.1108%) As of 04:00PM EST. Market open. Interesting Day. Charts. Daily.    MNKD not as strong as UTHR. MNKD holding much stronger than the IBB. |

|

|

|

Post by peppy on Jan 25, 2022 10:32:46 GMT -5

MNKD volume at 1 hour of trade, real time, 275,335 shares. summary, 432,052 volume coming in fast now, as price is moving up.  The Overall market is in a down trend. |

|

|

|

Post by peppy on Jan 25, 2022 16:23:58 GMT -5

MNKD Nasdaq real time volume, 1,991,738 shares..... 1,077,467 shares 10 mins prior to the close. MNKD Nasdaq summary volume, 2,628,704................1,945,222..................................................... $3.68. -0.03 (-0.8086%) Daily charts. MNKD two day resistance has been $3.75. inside day. I adjusted the bottom triangle line.  UTHR the strength. Inside day.  IBB inside day. weakness.  $SPX, $COMPQ both inside days, $INDU an outside day. |

|

|

|

Post by peppy on Jan 26, 2022 17:22:48 GMT -5

MNKD nasdaq real time volume, 2,208,290shares......... 1,326,946 at the close. MNKD Nasdaq summary volume, 3,093,449...................2,378,337 at close. Avg. Volume 2,408,101 $3.64. -0.04 (-1.09%) At close: 04:00PM EST MNKD is % down from the feb 2021 top of $6.25, I see strength compared to the index. Weekly charts so we can see. MNKD holding. UTHR the strength. IBB the comparator. WEEKLY.    |

|

|

|

Post by celo on Jan 27, 2022 10:21:25 GMT -5

Weird day for this stock to be going down. IBB is up slightly. I can understand it has been going down with biotech, but it will start selling Tyvaso soon. Hmm, someone wants out and I'm not sure why. Shareholders are the last to know.

Downtrend channel for the month of January. Broke the handle of the cup. Today is annoying, market up, bio up slightly, yet MNKD down back into it's channel, for no apparent reason.

|

|

|

|

Post by celo on Jan 27, 2022 10:38:27 GMT -5

The downtrend seems to begin when the home office moved. It was kind of offhandedly presented but maybe was important piece to this puzzle. Any actual office space is kind of useless in this day and age. I thought it was a prudent move. It could of been looked at as downsizing for a company that is supposed to be about growth.

|

|

|

|

Post by celo on Jan 27, 2022 10:55:28 GMT -5

Another option is someone is selling out of a large position and it needed to begin at the start of the year. Today's price action is just all on the sell side. Super annoying. With Tyvaso DPI going to an expedited approval this just makes little sense.

The last piece is all the mom and pop biotechs are getting smashed. If liquidity dries up and these tiny biotechs need a handout, it will not exist. Bankruptcy becomes imminent. Mannkind does not belong in that category. It is small, but in a good financial position and should only be improving.

|

|

|

|

Post by joeypotsandpans on Jan 27, 2022 12:43:07 GMT -5

Another option is someone is selling out of a large position and it needed to begin at the start of the year. Today's price action is just all on the sell side. Super annoying. With Tyvaso DPI going to an expedited approval this just makes little sense. The last piece is all the mom and pop biotechs are getting smashed. If liquidity dries up and these tiny biotechs need a handout, it will not exist. Bankruptcy becomes imminent. Mannkind does not belong in that category. It is small, but in a good financial position and should only be improving. Celo, I think you're overthinking it a bit, the XBI is a better correlation IMO and that's down today. Your fundamental view is correct regarding the positives ahead for the company but Mr.Market doesn't care about that at the moment..."know what you own" and it seems like you do 😉 |

|

|

|

Post by peppy on Jan 27, 2022 12:46:56 GMT -5

Another option is someone is selling out of a large position and it needed to begin at the start of the year. Today's price action is just all on the sell side. Super annoying. With Tyvaso DPI going to an expedited approval this just makes little sense. The last piece is all the mom and pop biotechs are getting smashed. If liquidity dries up and these tiny biotechs need a handout, it will not exist. Bankruptcy becomes imminent. Mannkind does not belong in that category. It is small, but in a good financial position and should only be improving. As you know, the market is weak. Reversering gains every day. Our foot is in the door. MNKD volume at the half day of trade, real time, 452,014 summary, 912,674 Avg. Volume 2,434,733 3.5299. -0.1101 (-3.0247%) As of 12:45PM EST. Market open.  |

|

|

|

Post by mytakeonit on Jan 27, 2022 13:13:13 GMT -5

And there you have the peppy report ... it's low volume manipulation. Buy all the cheap shares you can !!!

But, that's mytakeonit

|

|

|

|

Post by peppy on Jan 27, 2022 16:15:50 GMT -5

MNKD nasdaq real time volume, 1,775,048. MNKD Nasdaq summary volume, 3,085,663 Avg. Volume 2,434,733 3.39. -0.25 (-6.87%) At close: 04:00PM EST  |

|