|

|

Post by liane on Feb 13, 2022 16:54:28 GMT -5

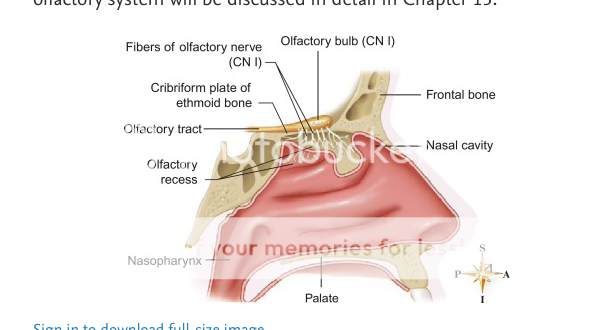

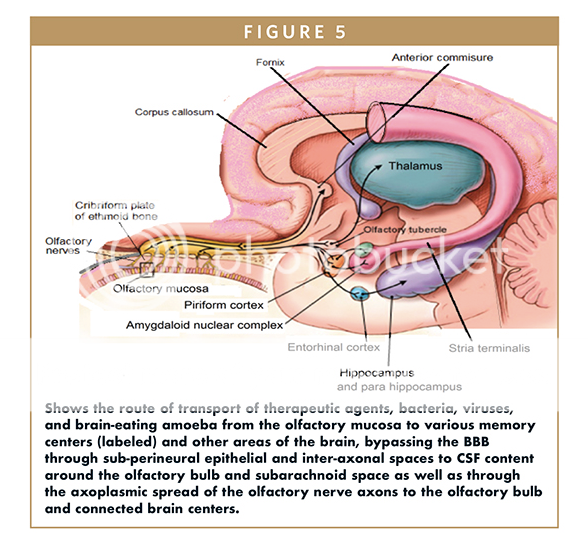

The reason for the nasal route is that the olfactory nerve is right there - just beneath the nasal mucosa. It is a direct extension of the brain. So it is a great way to get drugs to the brain, bypassing the blood-brain barrier.

|

|

|

|

Post by mymann on Feb 13, 2022 17:57:09 GMT -5

I did not realized olfactory nerves can absorb drug molecules. Nerve cells, neurons uses neurotransmitters to transfer volt potential differences to function like fiber optic cables. Do they also function as channels to carry molecules across blood brain barrier?

|

|

|

|

Post by peppy on Feb 13, 2022 18:09:09 GMT -5

I did not realized olfactory nerves can absorb drug molecules. Nerve cells, neurons uses neurotransmitters to transfer volt potential differences to function like fiber optic cables. Do they also function as channels to carry molecules across blood brain barrier? Through the cribriform plate. ? (This came up with covid loss of taste and smell, so I looked.)  |

|

|

|

Post by liane on Feb 13, 2022 18:15:19 GMT -5

|

|

|

|

Post by peppy on Feb 13, 2022 18:22:31 GMT -5

The reason for the nasal route is that the olfactory nerve is right there - just beneath the nasal mucosa. It is a direct extension of the brain. So it is a great way to get drugs to the brain, bypassing the blood-brain barrier. I had never laid eyes on this depiction. I guess it explains cocaine.  |

|

|

|

Post by falconquest on Feb 16, 2022 21:38:19 GMT -5

Earnings are income net of taxes so if Mannkind can achieve positive earnings it will be a first. I believe that's a big stretch. The success will be determined by the market acceptance of Tyvaso. If it languishes or takes a while a to achieve market acceptance then things will not look so good for Mannkind. There has been a lot of hype and enthusiasm for Afrezza/Mannkind over the years. I think pragmatism is the best way to approach this investment for now.

|

|

|

|

Post by prcgorman2 on Feb 17, 2022 7:32:04 GMT -5

Earnings are income net of taxes so if Mannkind can achieve positive earnings it will be a first. I believe that's a big stretch. The success will be determined by the market acceptance of Tyvaso. If it languishes or takes a while a to achieve market acceptance then things will not look so good for Mannkind. There has been a lot of hype and enthusiasm for Afrezza/Mannkind over the years. I think pragmatism is the best way to approach this investment for now. LOL, yeah, we wouldn’t want anybody to get enthusiastic and buy MNKD shares now would we? Hilarious. |

|

|

|

Post by MnkdWASmyRtrmntPlan on Feb 17, 2022 14:04:04 GMT -5

Earnings are income net of taxes so if Mannkind can achieve positive earnings it will be a first. I believe that's a big stretch. The success will be determined by the market acceptance of Tyvaso. If it languishes or takes a while a to achieve market acceptance then things will not look so good for Mannkind. There has been a lot of hype and enthusiasm for Afrezza/Mannkind over the years. I think pragmatism is the best way to approach this investment for now. LOL, yeah, we wouldn’t want anybody to get enthusiastic and buy MNKD shares now would we? Hilarious. I think Falcon makes a good point. In the old days, we all (me included) used to be so enamored with the thought that Afrezza is SO SUPERIOR THAT IT HAS TO BE INCREDIBLY SUCCESSFUL. We have learned (or, should have learned) by now that that is not necessarily true. Of course Afrezza is superior. But, it has been a failure, and it continues to be a failure. If Tyvaso DPI becomes so successful that it can not only be profitable itself, but also cover Afrezza's losses and make Mannkind profitable, then great! Tyvaso will be profitable. Mannkind will be profitable. But, Afrezza will still be a failure. And, if Afrezza's revenue continues on its current 2-1/2 year-long sideways trajectory, it may never become profitable. At least not in this decade, or not before it loses its patent to open up the market to generic competition. Mike said in today's SVC Leerink 2022 that it can't be copied, and that it's unique in that regard. We'll see. The big three may jump on that challenge and end up suffocating Afrezza. Although we all thought it was a no-brainer, Al Mann's masterpiece may end up being an eternal failure. What a shame for diabetics. After all this time, the Disrupter product, Afrezza, is failing in Commercialization. Who woulda thunk? The only thing it is disrupting is its share-holders. So, now our darling is Tyvaso DPI, which is a sure thing because it's an established product, and, it's Martine's baby. So, Martine will be pushing it to success, right? Yes, I believe she will drive it to success for UT. But, MNKD must also manage their business. They will have years of loans to pay off and insure the company's solvency, and generally maintain that it stays in "going concern" status. If making a business with such a "no-brainer" like Afrezza can be such a "no-goer", then don't take Tyvaso DPI or even Technosphere itself for granted. They may both be no-brainer stars by themselves, but don't forget, we will be using the same management team that failed with Afrezza. I still believe that the two products that Al gave to MNKD (Afrezza and TS) will still be successful, even with a mediocre team, so I am staying invested. And if and when it hits $20 I will probably cash in half of my shares and retire for good. But, I am not expecting a rocket-ship anymore. Ha!, imagine those star-struck people who bought-in at over $100/share in 2004. I wonder how many of them are still holding out to make money on that investment. Over 20 years to break even. I think staying pragmatic is a good policy for investing in MNKD's future. You can still hope for the best, but keep expecting the worst. |

|

|

|

Post by sr71 on Feb 17, 2022 14:10:36 GMT -5

LOL, yeah, we wouldn’t want anybody to get enthusiastic and buy MNKD shares now would we? Hilarious. I think Falcon makes a good point. In the old days, we all (me included) used to be so enamored with the thought that Afrezza is SO SUPERIOR THAT IT HAS TO BE INCREDIBLY SUCCESSFUL. We have learned (or, should have learned) by now that that is not necessarily true. Of course Afrezza is superior. But, it has been a failure, and it continues to be a failure. If Tyvaso DPI becomes so successful that it can not only be profitable itself, but also cover Afrezza's losses and make Mannkind profitable, then great! Tyvaso will be profitable. Mannkind will be profitable. But, Afrezza will still be a failure. And, if Afrezza's revenue continues on its current 2-1/2 year-long sideways trajectory, it may never become profitable. At least not in this decade, or not before it loses its patent to open up the market to generic competition (the big three may jump on that and suffocate Afrezza). Although we all thought it was a no-brainer, Al Mann's masterpiece may end up being an eternal failure. What a shame for diabetics. After all this time, the Disrupter product, Afrezza, is failing in Commercialization. Who woulda thunk? The only thing it is disrupting is its share-holders. So, now our darling is Tyvaso DPI, which is a sure thing because it's an extablished product, and, it's Martine's baby. So, Martine will be pushing it to success, right? Yes, I believe she will drive it to success for UT. But, MNKD must also manage their business. They will have years of loans to pay off and insure the company's solvency, and generally maintain that it stays in "going concern" status. If making a business with such a "no-brainer" like Afrezza can be such a "no-goer", then don't take Tyvaso DPI or even Technosphere itself for granted. They may both be no-brainer stars by themselves, but don't forget, we will be using the same management team that failed with Afrezza. I still believe that the two products that Al gave to MNKD (Afrezza and TS) will still be successful, even with a mediocre team, so I am staying invested. And if and when it hits $20 I will probably cash in half of my shares and retire for good. But, I am not expecting a rocket-ship anymore. Ha!, imagine those star-struck people who bought-in at over $100/share in 2004. I wonder how many of them are still holding out to make money on that investment. Over 20 years to break even. I think staying pragmatic is a good policy for investing in MNKD's future. You can still hope for the best, but keep expecting the worst. Very Well Said! |

|

|

|

Post by awesomo on Feb 17, 2022 14:22:49 GMT -5

Earnings are income net of taxes so if Mannkind can achieve positive earnings it will be a first. I believe that's a big stretch. The success will be determined by the market acceptance of Tyvaso. If it languishes or takes a while a to achieve market acceptance then things will not look so good for Mannkind. There has been a lot of hype and enthusiasm for Afrezza/Mannkind over the years. I think pragmatism is the best way to approach this investment for now. LOL, yeah, we wouldn’t want anybody to get enthusiastic and buy MNKD shares now would we? Hilarious. Pretty sure buying MNKD during periods of high enthusiasm has worked out poorly. LOL at trying to call someone out for saying pragmatism is good. 1) Afrezza approval 2) Sanofi partnership 3) Pump up to $5+ in 2017 4) David Kendall hiring and "veins of gold" 5) Excitement over Tyvaso FDA decision |

|

|

|

Post by prcgorman2 on Feb 18, 2022 7:07:31 GMT -5

LOL, yeah, we wouldn’t want anybody to get enthusiastic and buy MNKD shares now would we? Hilarious. Pretty sure buying MNKD during periods of high enthusiasm has worked out poorly. LOL at trying to call someone out for saying pragmatism is good. 1) Afrezza approval 2) Sanofi partnership 3) Pump up to $5+ in 2017 4) David Kendall hiring and "veins of gold" 5) Excitement over Tyvaso FDA decision Depends on your point of view I guess. For those who “bought on the rumor” prior to Afrezza approval and prior to Sanofi partnership and “sold on the news” afterwards, it worked out pretty well. But sure, I agree, past performance should be the watch word. Whatever. Suit yourself. |

|

|

|

Post by mango on Feb 19, 2022 8:41:00 GMT -5

From the recent fireside chat:

Just listened to the SVB Leerink 2022 Global Healthcare Conference. Fantastic suit, Mike! Looks like an Al Mann style suit.

🥭 FDA approval of Tyvaso DPI is ANY DAY NOW

🥭 >$100 MILLION in annual royalties by 2024

🥭 Tyvaso DPI is revolutionary

🥭 Tyvaso DPI will have two initial indications: PAH and PH-ILD

🥭Additional indications for Tyvaso DPI to be added to label: PH-COPD & PH-IPF

🥭 Tyvaso DPI is a multi-billion dollar opportunity

🥭 NEW Afrezza Phase 4 Pilot clinical trial registered—pump switch trial

🥭 Significantly scaling up Afrezza education & awareness THIS YEAR

🥭 FDA Afrezza dosing label change incoming

🥭 Afrezza Pediatric Phase 3 clinical trial ongoing

🥭 Afrezza India clinical trial readout 2023

🥭 Afrezza Primary Care Pilot study THIS YEAR

🥭 MannKind is very excited about Clofazimine—Phase 1 initiation soon

🥭 NO BP company could copy what MannKind does—one of a kind dry powder technology and inhalation devices

|

|