|

|

Post by letitride on May 12, 2022 2:40:04 GMT -5

The volume rises like in a storm. I believe Mannkind has built a foundation capable of withstanding the storm. I have tightened up and covered up and am waiting to sweep up when the storm passes. Trying to make sense of this by evaluating pieces of the storm while in the storm seems futile. All the while I am the eye of the storm.

|

|

|

|

Post by peppy on May 12, 2022 6:36:38 GMT -5

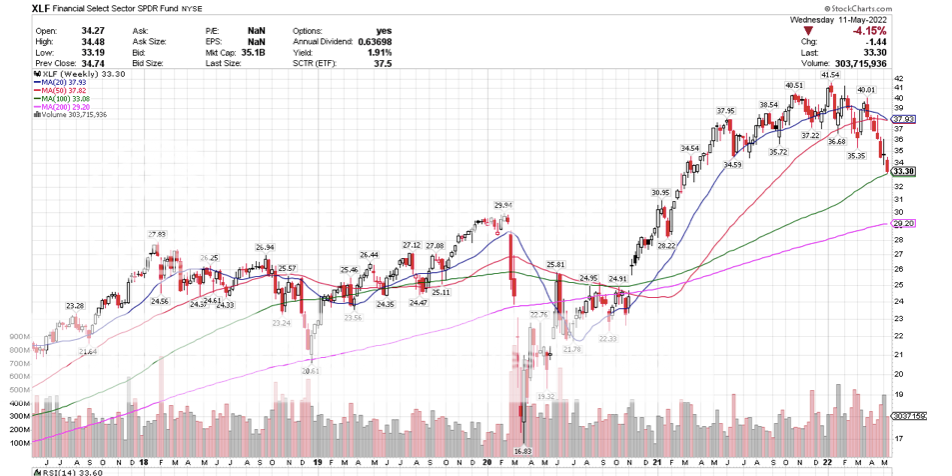

Like Rebby I’m a long time lurker never post, not my thing but an avid Peppy fan with charting. So, my observation is like Peppy says all gaps get filled! Look at the daily chart gap so I don’t think this downtrend is over yet🤷♂️ Perhaps I should NOT have put it that way exactly..... there are exceptions to the rule.... AOL's gap took 15 years to close. However. talking about gaps, the XLF weekly. The banks are in trouble. we know they are carrying China, Russia, US debt. Japan, Europe. I thought I would look being the market slide and all.  Check the date, May 4th information. .png) |

|

|

|

Post by peppy on May 12, 2022 9:01:15 GMT -5

|

|

|

|

Post by oldfishtowner on May 12, 2022 9:26:10 GMT -5

And while MNKD is up $0.13 at the moment, LQDA is down $0.21. Does someone know something? Is it the FDA approval or the patent infringement/intellectual property theft cases or both.

|

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on May 12, 2022 9:30:29 GMT -5

And while MNKD is up $0.13 at the moment, LQDA is down $0.21. Does someone know something? Is it the FDA approval or the patent infringement/intellectual property theft cases or both. Is FDA approval coming on a Friday in AH?? Street is sending that signal. |

|

|

|

Post by peppy on May 12, 2022 9:31:39 GMT -5

MNKD volume at one hour of trade, real time, 637,910 summary, 1,033,263 2.795. +0.125. (+4.6816%) As of 10:31AM EDT. Market open. Pretty large volume for MNKD |

|

|

|

Post by cedafuntennis on May 12, 2022 14:21:20 GMT -5

We all (longs I mean) hope the FDA approval is coming but let's not be presumptuous as it is bad luck

|

|

|

|

Post by RainbowUnicorn on May 12, 2022 14:43:09 GMT -5

If short interest has increased, I wonder why my shares haven’t been loaned out for a couple of years? I would love to have that interest “dividend” rolling into my account every month. Ditto. Don't understand it at all. |

|

|

|

Post by peppy on May 12, 2022 15:17:04 GMT -5

MNKD volume at one hour of trade, real time, 637,910 summary, 1,033,263 2.795. +0.125. (+4.6816%) As of 10:31AM EDT. Market open. Pretty large volume for MNKD MNKD Nasdaq real time volume, 3,113,333 shares. MNKD Nasdaq summary volume, 4,150,548 shares. 2.73. +0.06 (+2.25%) At close: 04:00PM EDT Chop  |

|

|

|

Post by cretin11 on May 12, 2022 18:00:43 GMT -5

If short interest has increased, I wonder why my shares haven’t been loaned out for a couple of years? I would love to have that interest “dividend” rolling into my account every month. Ditto. Don't understand it at all. IMO short interest has increased a tiny bit, but not enough to move the needle. It’s still far below the “old days” when share borrowing and lending rates were astronomically high. While those lending rates were nice for those who took advantage, I think it’s safe to say we don’t want to return to that situation. Also, due to certain events, shares are much more plentiful now than they were then, so the supply/demand equation doesn’t warrant the necessity of lending. |

|

|

|

Post by prcgorman2 on May 12, 2022 21:04:20 GMT -5

Ditto. Don't understand it at all. IMO short interest has increased a tiny bit, but not enough to move the needle. It’s still far below the “old days” when share borrowing and lending rates were astronomically high. While those lending rates were nice for those who took advantage, I think it’s safe to say we don’t want to return to that situation. Also, due to certain events, shares are much more plentiful now than they were then, so the supply/demand equation doesn’t warrant the necessity of lending. No opinion needed. The short interest increased by over a half-million shares during the last reporting period. Not a lot necessarily, but I assume a lot more than 1 millions shares were sold short, but the over all effect of shorting and covering led to the relatively modest increase. Someone who looks at shares outstanding and SIR can give exact numbers, but I think the recent increase is about a 10% increase in shares shorted. i.e., 10% increase leading to around 52 million shares shorted out of 200 million plus. Sorry for being so lazy about the actual numbers. I don’t care very much. I agree with cretin that we don’t want to see the massive shorting again. My only point was that heavy volume isn’t leading to big increases in share prices and I suspect the active shorting during market down days (which have been plentiful) is part of the reason. If the plan is to improve on the cover costs as the traders transition to going long, it makes sense to me. I just hope they soon have an undeniable signal that it’s finally time to make a very long trade. |

|

|

|

Post by peppy on May 13, 2022 10:32:37 GMT -5

Slow board, I'll comment on volume at 2 hours of trade, high volume for MNKD.

real time, 657,210 shares.

summary, 921,045

Avg. Volume 3,332,498

2.8801+0.1501 (+5.4982%)

As of 11:31AM EDT. Market open.

wake me when price gets over $3.04.

Then wake me again when it gets over, $4.05.

|

|

|

|

Post by peppy on May 13, 2022 11:45:23 GMT -5

Slow board, I'll comment on volume at 2 hours of trade, high volume for MNKD. real time, 657,210 shares. summary, 921,045 Avg. Volume 3,332,498 2.8801+0.1501 (+5.4982%) As of 11:31AM EDT. Market open. wake me when price gets over $3.04. Then wake me again when it gets over, $4.05. MNKD volume at the half day of trade, real time,1,147,238 shares. summary, 1,624,815 2.945. +0.215 (+7.8755%) As of 12:44PM EDT. Market open. |

|

|

|

Post by joeypotsandpans on May 13, 2022 13:14:49 GMT -5

wake me when price gets over $3.04.

Then wake me again when it gets over, $4.05

I suspect it should be a relatively short nap 😉

Adding:

As mentioned in the past, XBI is one of the single largest holder's of MNKD shares so with it (XBI) being down quite a bit over the past year it isn't shocking that we broke the $3 handle in MNKD sp. I'm adding here in anticipation of catalysts along with a decent bounce in the XBI from deeply oversold conditions:

XBI:

68.52 USD -54.01 (-44.10%)past year

May 13, 2:55 PM EDT

|

|

|

|

Post by peppy on May 13, 2022 15:05:25 GMT -5

MNKD Nasdaq real time volume, 3,507,637 shares. MNKD Nasdaq summary volume, 4,180,361 Avg. Volume 3,332,498 3.01. +0.28 (+10.26%) At close: 04:00PM EDT  |

|