|

|

Post by cretin11 on Dec 15, 2022 9:55:39 GMT -5

Hi All, Remember, this is MNKD... " And FTR my cigar reference is only metaphorical personally, as I've quit smoking those things. But I will enjoy a nice whiskey, a nicer one when we hit $8". A WIN FOR HEALTH! I am happy to hear this! I spent a couple of months in Scotland and learned a lot about Scotch! Hope we all drink up! WE all deserve it. (; Excellent. To analogize with scotch, I’ll celebrate $5 a share with Johnny Walker Red, $10 with Lagavulin and $20 with Johnny Walker Blue 😄 |

|

|

|

Post by prcgorman2 on Dec 15, 2022 12:26:18 GMT -5

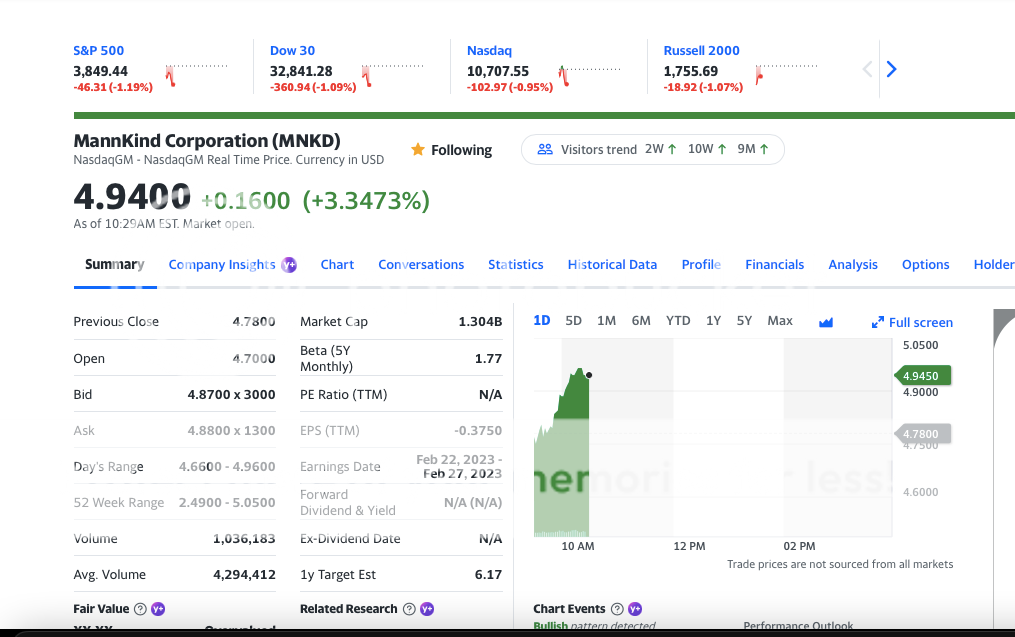

Moderate volume. Gee, I can't believe the stock market is down (he wrote sarcastically). I'm curious to see if the "power hour" takes us positive.

|

|

|

|

Post by peppy on Dec 15, 2022 12:46:58 GMT -5

MNKD volume at the half day of trade. Real time, 1,465,092 shares. Summary, 1,465,492 Avg. Volume 4,532,871 $4.785. -0.165. (-3.3333%) Cogs still holding.  |

|

|

|

Post by peppy on Dec 15, 2022 16:18:08 GMT -5

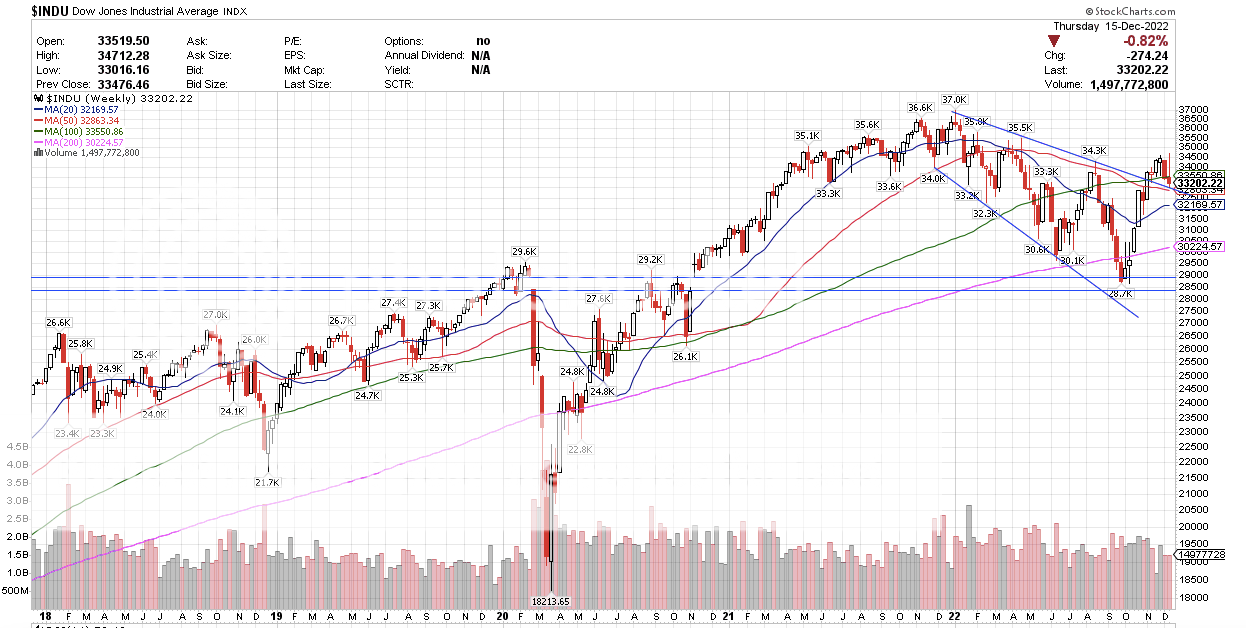

MNKD Nasdaq real time volume, 3,458,734 shares MNKD Nasdaq summary volume, 4,535,694 Avg. Volume 4,532,871 $4.78. -0.17 (-3.43%) Status Quo. The plan remains the same. Point of break out was $4.40.   Nasdaq looking like it is going to retest it's lows.  $SPX a lower high again.  Switching time frames to weekly, The DOW, the strength. The Trendline break up. so far this is a retest., Through that trend line a failure to test top and back in the quagmire. Outside week so far which chops everyone up.  |

|

|

|

Post by mymann on Dec 15, 2022 22:12:39 GMT -5

Haha, well i certainly see the nice movement over the past two and a half months. We got back to $5, aka $1 reverse split adjusted, and that is at least a psychological milestone (and maybe a substantive one depending on the views of various fund managers). We topped the same mark several times in 2021, with consensus here being we were leaving $5 behind for bigger things. So I'm not making predictions now, just gonna enjoy the recent trajectory and hope it continues. And FTR my cigar reference is only metaphorical personally, as I've quit smoking those things. But I will enjoy a nice whiskey, a nicer one when we hit $8, and so on... Here are the cigar moments, what ever the cigar means. $5.00 a mark because we haven't hit it for a year. The next cigar moment will be break and hold of $6.25. Look at the chart. That is where what ever stops there are will hit. Side note, Anderson stated the other day, the convertible bonds convert at $5.21. Those are going to hit and convert, and some debt will move to shares. That maybe our Christmas surprise. anderson wrote, $230 mil notes can convert at $5.21. So if share price goes above $5.21 before 1 DEC 2025 there shouldn't be a problem with the $230 debt, just dilution from the conversion which should not surprise anyone. $8.8 mil Mann Group can convert $2.50, so these will be converted. $40 mil Midcap. This is the bad one. "The Company must also comply with a financial covenant relating to trailing twelve month minimum Afrezza net revenue, tested on a monthly basis, unless the Company has $90.0 million or more of unrestricted cash and short-term investments." So the Midcap loan actually ties up $50 million more than is needed to repay it since Afrezza net revenue is not on target. Midcap has an interest cap of 8.5% so if Mannkind can invest and get returns greater than that it isn't a problem. It also has early termination fees, which drop to the min of 1% after April 22, 2023. Loan repayments start September 1, 2023, until paid in full on August 1, 2025. So Mannkind will probably just pay back as scheduled, unless they get in a bind and need to drop below the $90 mil reserve. This also explains why they are not spending a lot of cash. So at current burn 14.4 mil a quarter (177.8-90)/14.4 = 6 quarters at current burn before we go below the 90 mil. [b Break out the expensive whiskey and fine cigars. Mnkd will disappoint every one again. Stuck at $5. All the charts and Break through predictions looks good but crooks that control the market will fight to keep mnkd in penny land. |

|

|

|

Post by mytakeonit on Dec 16, 2022 2:49:11 GMT -5

You sound like a major short ... sell me all of your $5 shares and be gone. OR ... be more realistic and wait for the next conference call.

But, that's mytakeonit

|

|

|

|

Post by peppy on Dec 16, 2022 5:58:07 GMT -5

Here are the cigar moments, what ever the cigar means. $5.00 a mark because we haven't hit it for a year. The next cigar moment will be break and hold of $6.25. Look at the chart. That is where what ever stops there are will hit. Side note, Anderson stated the other day, the convertible bonds convert at $5.21. Those are going to hit and convert, and some debt will move to shares. That maybe our Christmas surprise. anderson wrote, $230 mil notes can convert at $5.21. So if share price goes above $5.21 before 1 DEC 2025 there shouldn't be a problem with the $230 debt, just dilution from the conversion which should not surprise anyone. $8.8 mil Mann Group can convert $2.50, so these will be converted. $40 mil Midcap. This is the bad one. "The Company must also comply with a financial covenant relating to trailing twelve month minimum Afrezza net revenue, tested on a monthly basis, unless the Company has $90.0 million or more of unrestricted cash and short-term investments." So the Midcap loan actually ties up $50 million more than is needed to repay it since Afrezza net revenue is not on target. Midcap has an interest cap of 8.5% so if Mannkind can invest and get returns greater than that it isn't a problem. It also has early termination fees, which drop to the min of 1% after April 22, 2023. Loan repayments start September 1, 2023, until paid in full on August 1, 2025. So Mannkind will probably just pay back as scheduled, unless they get in a bind and need to drop below the $90 mil reserve. This also explains why they are not spending a lot of cash. So at current burn 14.4 mil a quarter (177.8-90)/14.4 = 6 quarters at current burn before we go below the 90 mil. [b Break out the expensive whiskey and fine cigars. Mnkd will disappoint every one again. Stuck at $5. All the charts and Break through predictions looks good but crooks that control the market will fight to keep mnkd in penny land. MNKD does need to go through the $5 dollar mark before $6 dollars. Thoughtful observation. Stuck at 5 better than $4 limbo. Little tiny baby steps. So you are selling today? as in bye-bye? Also Mymann before you go, if you are so good at knowing where price is going; can you give me the dates you were calling top on the overall US equity markets? Where and when will the US markets bottom? Since I have the oracle, I thought I would ask before your jet plane takes off. You are ready for take off correct? Thanks in advance. |

|

|

|

Post by peppy on Dec 16, 2022 7:28:40 GMT -5

I am sorry. It looks like I am irritable. Sorry. mymann . Direct hit on my nervous system, however point taken. I am sorry for the harsh words. added, MNKD price is back into the $4 dollar limbo. Here is the thing with this charting pattern, it is the rule, the golden rule. The point of break out was $4.40. The pattern is good on the break and hold. This is a weekly pattern. The pattern should have some push. so far price has done the slow weekly push, and was picking up. The overall markets are going down large percentages now. We have to see what shakes out. OVERall, MNKD revenues are going up. It's future secure for now. It's bills can be met. 1.25 billion dollar market cap. |

|

|

|

Post by peppy on Dec 16, 2022 9:31:59 GMT -5

options expiration.

MNKD volume at less than a min of trade,

479,891

Avg. Volume 4,294,412

4.7650-0.0150 (-0.3138%)

As of 09:31AM EST. Market open.

MNKD volume at 30 mins of trade,

real time, 617,304 shares.

summary, 668,295

Avg. Volume 4,294,412

$4.87. +0.09. (+1.8828%)

As of 10:00AM EST. Market open.

|

|

|

|

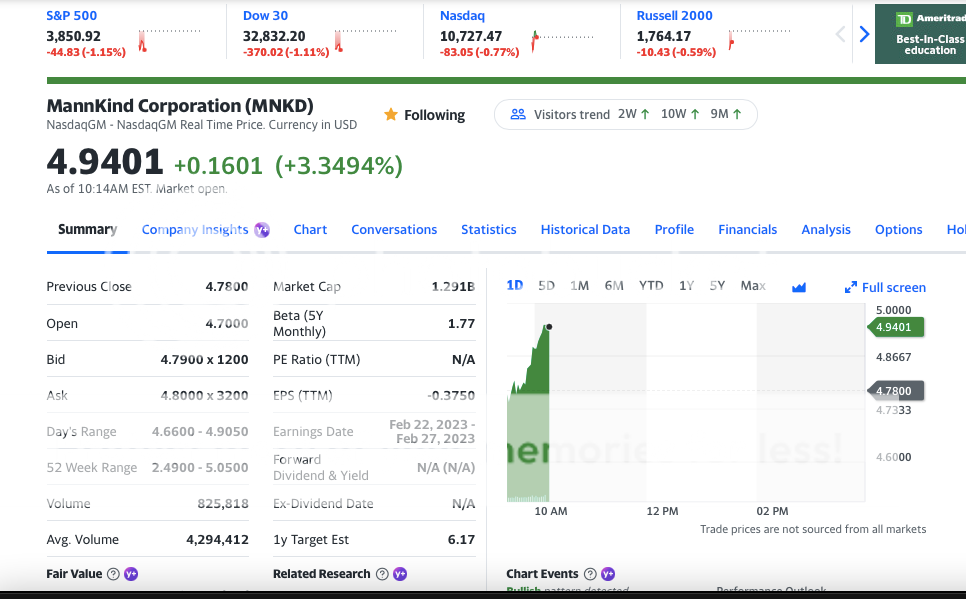

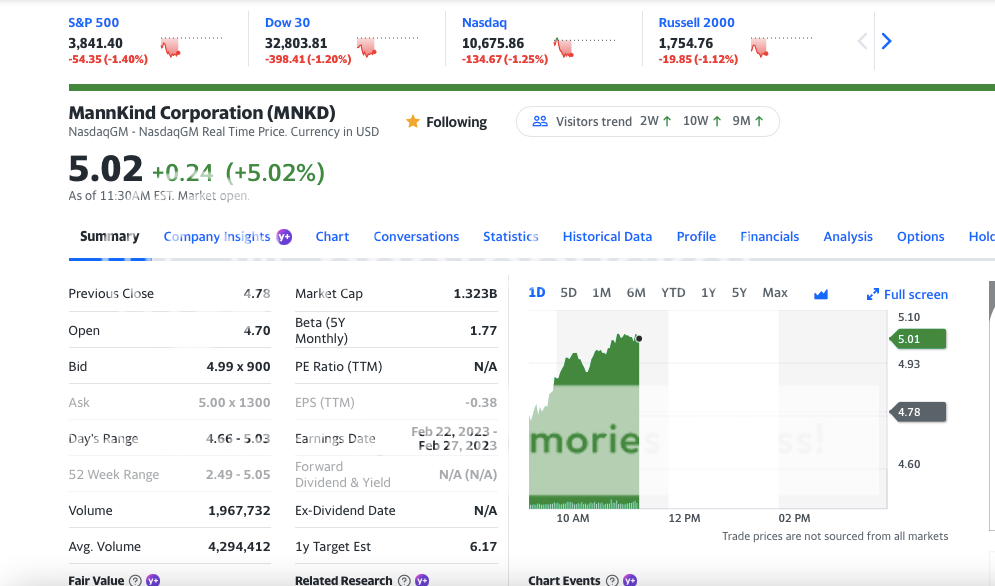

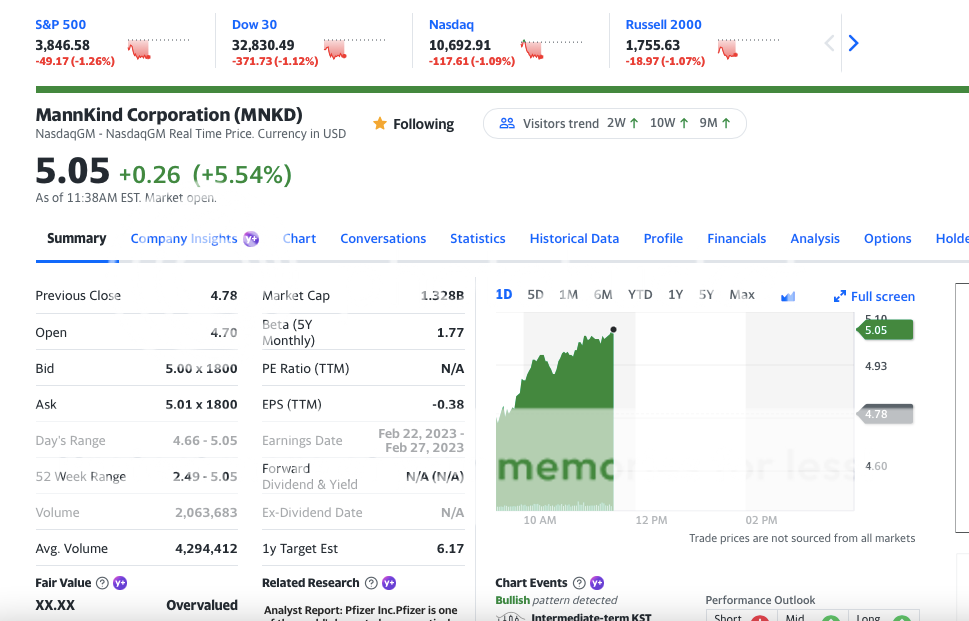

Post by peppy on Dec 16, 2022 10:17:34 GMT -5

MNKD share price is acting so well today, with volume, the photo's are going to start flying. Let's see. I got lucky being I was huffing and puffing this morning. 1 million shares at 1 hour. $4.96 hit. Recall the $4.97/$4.98 past swing highs, through these, the $5.05 once again. 175,000 shares in these 15 min snap shots.   |

|

|

|

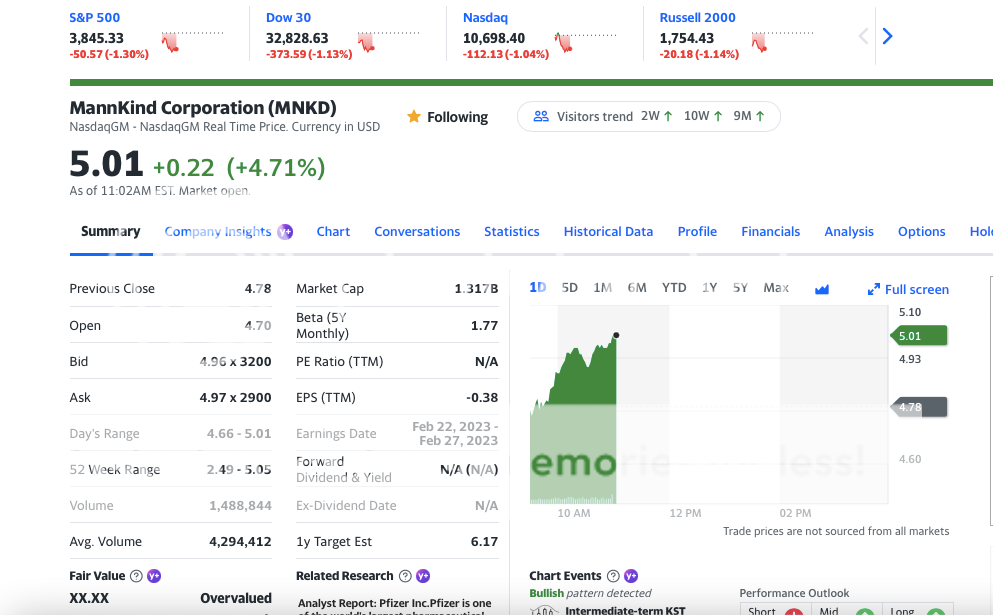

Post by peppy on Dec 16, 2022 11:07:43 GMT -5

I am watching so closely, because the set up is one pattern into another, and I have been typing this crap for a long time and the target is $12, blah blah blah. At 1 and 1/2 hours of trade, The overall market under plenty of pressure and MNKD is trading $5.01. 500,000 shares an hour. added, $5.06 is a new 52 week high over 5 dollars, will show up on the new 52 week high lists. The lists the smart traders watch.  |

|

|

|

Post by peppy on Dec 16, 2022 11:33:16 GMT -5

MNKD volume at two hours of 1,992,007. Ride em cowboy, weehaw.  |

|

|

|

Post by peppy on Dec 16, 2022 11:39:25 GMT -5

Through $5.05, $5.24 targets.  |

|

|

|

Post by runner on Dec 16, 2022 11:59:06 GMT -5

Pep, I so hope you are right. The markets just hit new lows for the day. I hope everything doesn’t just sink between now and the close.

|

|

|

|

Post by peppy on Dec 16, 2022 12:11:53 GMT -5

Pep, I so hope you are right. The markets just hit new lows for the day. I hope everything doesn’t just sink between now and the close. These facts have added to how difficult it has been for price to take off. however, it is working so far and today. we have a map, it is the UTHR chart in a sense. I hope I have been able to read these charts patterns correctly and that all up targets work out. I just looked, MNKD $5.03 nasdaq - 145. weehaw, years ago, because this has been going on two long, a person on the board said, the institutional shorts will leave through the options market. someone has allowed our bucking bronco out of the barn. I am just talking, blah, blah blah, we will see. |

|