|

|

Post by peppy on Dec 16, 2022 16:31:16 GMT -5

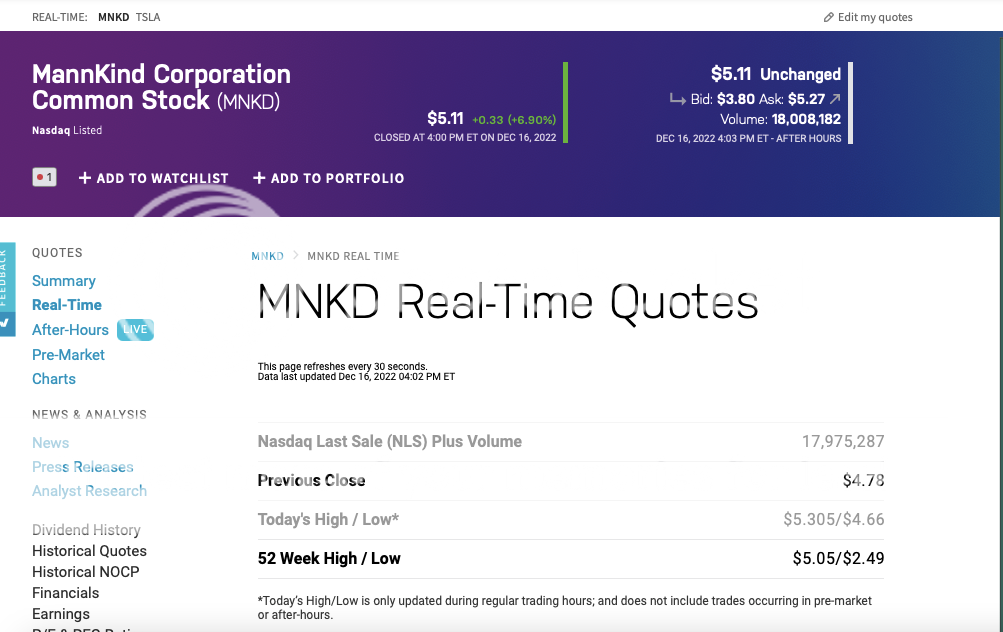

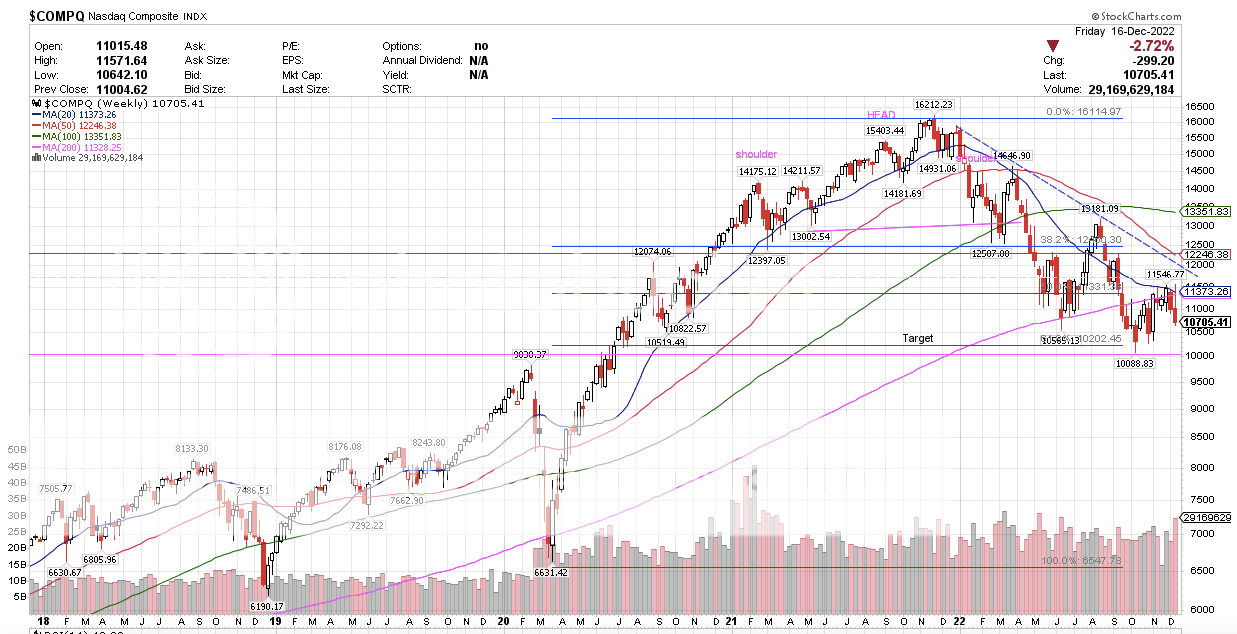

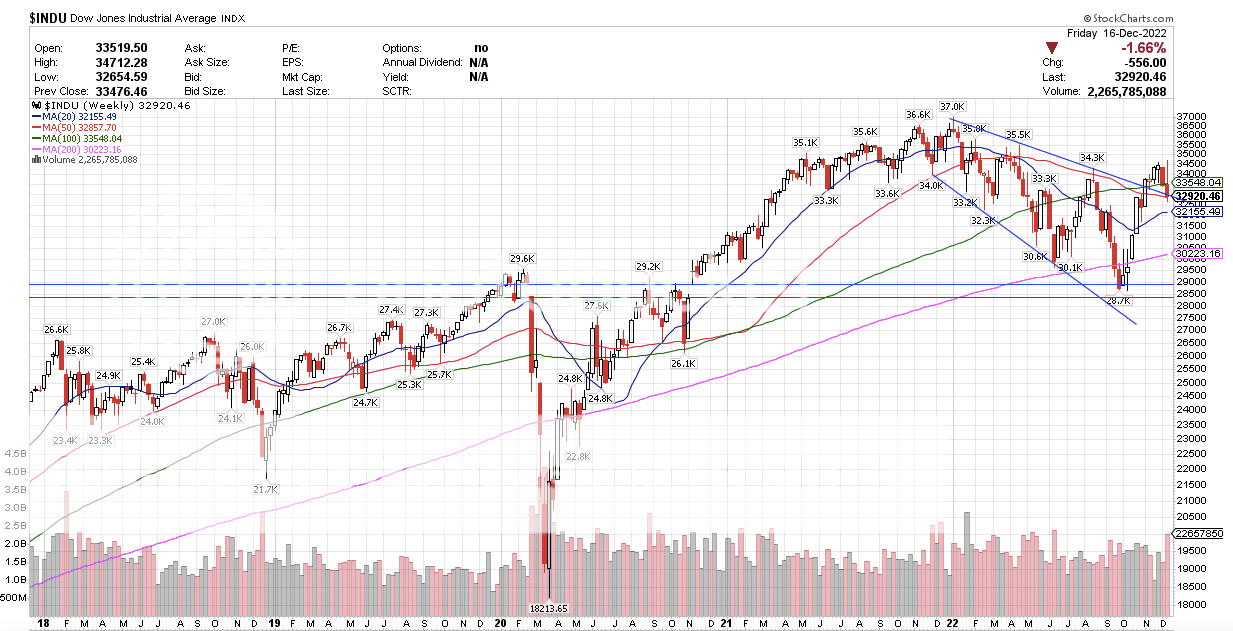

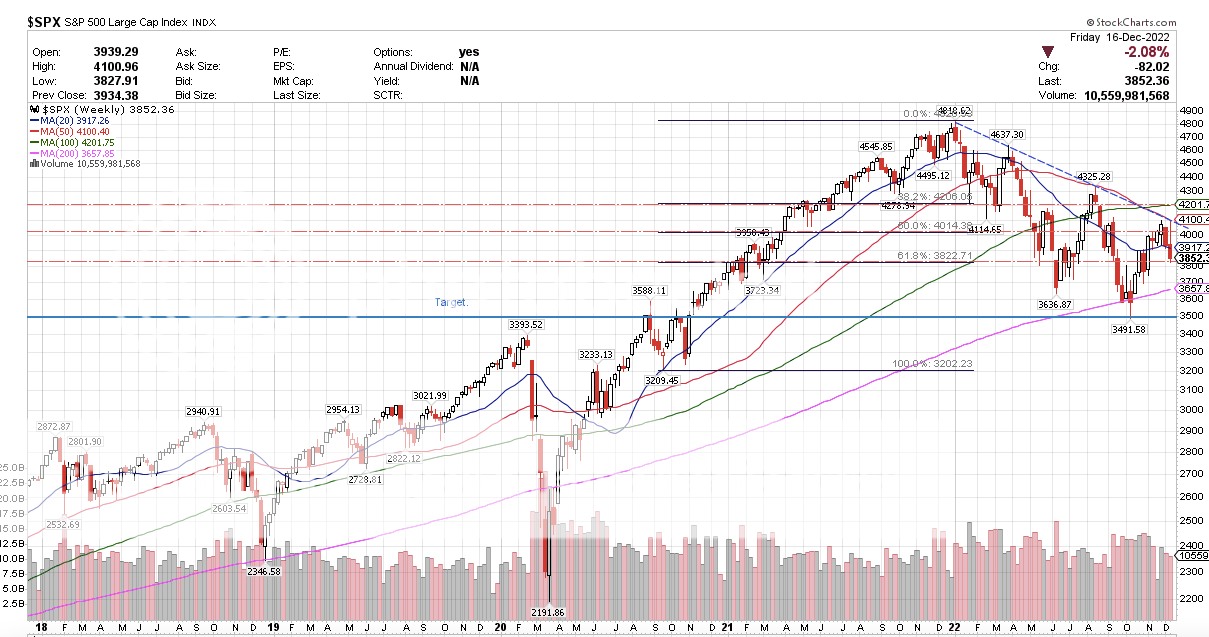

MNKD Nasdaq real time volume, 9,169,127 shares. oh looky people, volume just changed, MNKD Nasdaq real time volume this quadruple witching is, 18,008,386 shares. This is what we wanted, price up with impulse on heavy volume.  real time volume also changed now 17,249,854 shares. Avg. Volume 4,294,412 $5.11. +0.33. (+6.90%) Price would look a bit prettier had it not sold back, however new high on the year. Additionally support and resistance, through the $5.05, to $5.30, back to test the $5.05 which held.  Price is going to push up out of this wedge to the top.  This is our template.    MNKD is up trending in an overall stock market downtrend.  The dow share price took out 4 and 1/2 weeks of trading this week.  The $spx stronger than the $compq, weaker than the Dow.  How about that MNKD? |

|

|

|

Post by celo on Dec 16, 2022 16:38:01 GMT -5

And another 600k of after-hours trades. That is a lot of money trying to change hands while reaching a 52 week high.

|

|

|

|

Post by phdedieu12 on Dec 16, 2022 16:40:24 GMT -5

Most of the volume is from index funds rebalancing, but great day nonetheless

|

|

|

|

Post by awesomo on Dec 16, 2022 16:40:34 GMT -5

Hmm...This kind of movement makes me wonder if there might be an announcement of some kind coming. Insiders always know before us. Will be interesting to see how the day closes. We've seen this enough to not put hope on some future announcement dropping... Just accept the good day and enjoy the weekend lol. |

|

|

|

Post by oldfishtowner on Dec 16, 2022 16:56:36 GMT -5

Closed up 31 cents on about 2x volume and 9.6M trades. I'll take it! I did, but at $5.24.

Just like boca1girl, I am feeling the tax hurt of larger and larger RMDs from my IRA, even though I use some for QCDs. So last month and this I have been selling off a portion of my stocks in that account for Roth conversions. I did one earlier this month and will do another early next year (doing over two years to split the tax payment). Hoping to buy back MNKD and/or other stocks next quarter at somewhat cheaper prices. And if MNKD keeps going up and I can't buy back lower, I have enough left to make me very happy.

A disadvantage of the traditional IRA is that although you don't pay taxes on the income, you do pay taxes on the distribution and at the ordinary rate, so you can't take advantage of the long-term capital gains rate. As you get further into retirement the taxes on the RMD tend to offset the earlier tax advantages of the traditional IRA.

|

|

|

|

Post by akemp3000 on Dec 16, 2022 17:27:06 GMT -5

Hmm...This kind of movement makes me wonder if there might be an announcement of some kind coming. Insiders always know before us. Will be interesting to see how the day closes. We've seen this enough to not put hope on some future announcement dropping... Just accept the good day and enjoy the weekend lol. Agreed. No hope or expectation. Just a passing thought. The drop at the close removed the thought. A good day and hopefully a good weekend for all! |

|

|

|

Post by mnlearner on Dec 16, 2022 19:27:43 GMT -5

"Agreed. No hope or expectation. Just a passing thought. The drop at the close removed the thought." I agree but, can anyone tell me (remember, I am not as experienced/knowledgable as all of you, what about the 'shorts'? Have they be crunched? Anyone enlighten me?

|

|

|

|

Post by prcgorman2 on Dec 16, 2022 19:39:38 GMT -5

"Agreed. No hope or expectation. Just a passing thought. The drop at the close removed the thought." I agree but, can anyone tell me (remember, I am not as experienced/knowledgable as all of you, what about the 'shorts'? Have they be crunched? Anyone enlighten me? Cretin would say the shorts have been making “an orderly exit”. I can’t call it an exit as the Short Interest Rate is still much higher for MNKD than the average, but the SIR has been dropping the last 2 or 3 times that sla4325 reported the numbers in her Short Interest thread. I assume the drop in shares shorted is contributing some to the volume and buoyancy in share price during times of light to moderate volume. I hesitate to call it a trend, but things are looking up for MNKD so it might be. |

|

|

|

Post by letitride on Dec 16, 2022 21:21:06 GMT -5

Great expectations!

|

|

|

|

Post by peppy on Dec 16, 2022 21:31:49 GMT -5

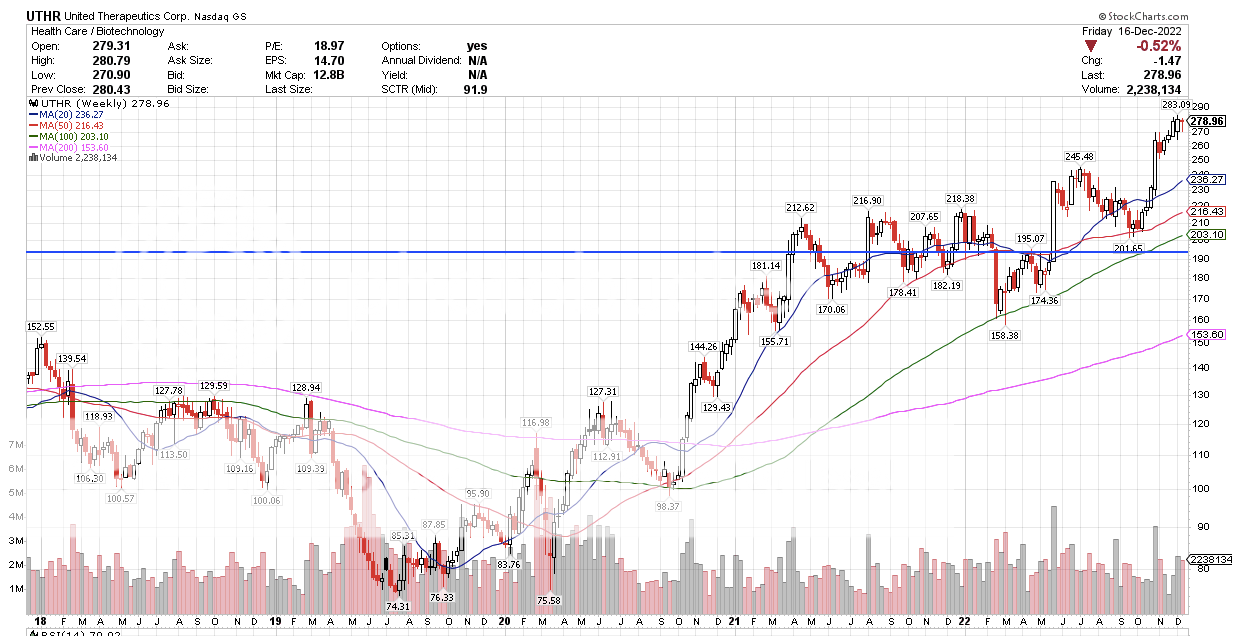

both these patterns are fast, with a punch. Have you seen the work celo has done for us? Let's go. Celo mumbles something humble then writes, "Royalty reported of 6.2 million which at 12.5% would be 50 million in UTHR Tyvaso DPI sales. Based on the So symphony is reporting 25% of all sales. Symphony will report 4Q tyvaso DPI sales of 50 million and that represents the 25% of total sales of 200 million. This would also be about 2/3rds of total UTHR tyvaso sales for 4Q if sales growth continues from previous quarters. 200 million x 12.5% = 25 million in royalties. The way Martine talked with Tyvaso DPI as being the star of the show, I can see it as a possibility. There is also the chunk of change MNKD receives for manufacturing all the Tyvaso DPI. Every day all these investing firms are whacking away at their little calculators trying to figure out what Mannkind will have for revenue for each qtr and I'm sure it looks sweeter and sweeter with every week of symphony sales." |

|

|

|

Post by peppy on Dec 16, 2022 22:01:56 GMT -5

time to look more intently at the Monthly MNKD chart. I'll start from here. Let's say 12 dollars hits, what is next? The 200 month at $20.31 Looking at the price potential in another way, a .382% retrace is a normal intraday retrace in a downtrend, and potentially now for MNKD as well. Switching gears again, once at 12, then there are wedge targets up as well, as MNKD will be climbing the wedge down from $35, The wedge targets on the way up are the monthly highs on the wedge on the way down. $11.20, $16.50, $18.95, $20.35, $22.35, $29.00, $36.50 caps the wedge; also the .618. another normal retrace. Very interesting. Thinking it through with Celo's work through the 12 dollar mark to the .382 which is @ 20 dollars starting to look reasonable. Thoughts? 20 bucks would be a 5 billion dollar market cap. Not only could price go to 20, it could go to 35 from the monthly read. See it? Hey geomean are you going to miss this whole ball of wax?  |

|

|

|

Post by runner on Dec 16, 2022 22:43:11 GMT -5

Pep, Thanks for the glimpse of the future through your charts. This would be a very nice development.

I have been here since 2007 when the price was the equivalent of $45 pre-split.

|

|

|

|

Post by prcgorman2 on Dec 16, 2022 22:44:41 GMT -5

SP = (EPS * P/E)

I think technical attempts to predict movement patterns and time frames, and fundamentals underwrite targets. So for me, $20 SP = .80 cents EPS * 25/1 Price/Earnings ratio (which is approximate market average). If MNKD somehow becomes a darling, the P/E can be 40/1 or even higher which means the EPS can be smaller and still get $20 per share.

Using the average 25/1 EPS, 80 cents a share is $209M in profit spread across 262M shares outstanding. Achievable? Of course! But when?? I'm guessing next 1 to 3 years but many variables could change that timeframe.

The biggest thing I think can affect fundamentals that we know is on the horizon is the Pediatric trial. I'm curious what stevil's opinion is if the Pediatric trial shows very good results and Mannkind gets FDA approval for Afrezza to be prescribed to adolescents. i.e., would those two things do much to improve NRx/TRx for Afrezza?

|

|

|

|

Post by runner on Dec 16, 2022 22:58:52 GMT -5

At the 2015 shareholder meeting in Danbury, I recall Mr. Mann saying that paediatric approval was the long-term goal.

|

|

|

|

Post by celo on Dec 17, 2022 1:08:23 GMT -5

Technosphere has proven to be a success with UTHR. How many doors will this open in the next three years for Mannkind to use technosphere in the future? With each new one, the share price will be affected very rapidly. The future revenue won't be if but when.

|

|