|

|

Post by liane on Jun 15, 2022 4:51:09 GMT -5

Outrageous number of $3.5 calls for this Friday. Currently 10,961 contracts - which will expire worthless if the share price is below that price. So I fear that is where we are headed in the short term.

|

|

|

|

Post by joeypotsandpans on Jun 15, 2022 10:22:56 GMT -5

Outrageous number of $3.5 calls for this Friday. Currently 10,961 contracts - which will expire worthless if the share price is below that price. So I fear that is where we are headed in the short term. 🤔 Unless you were short MNKD and those calls are your long hedge in which case you want to exercise those and call them away, surely you wouldn't want them to expire worthless and have the cost of having to roll the hedge out...volume should be interesting today through friday 🤷🏻♂️ 😉 |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jun 15, 2022 10:57:05 GMT -5

Outrageous number of $3.5 calls for this Friday. Currently 10,961 contracts - which will expire worthless if the share price is below that price. So I fear that is where we are headed in the short term. I'm placing a BUY Order at $3.51 till Friday AH. |

|

|

|

Post by factspls88 on Jun 15, 2022 12:41:59 GMT -5

On our way unfortunately.

|

|

|

|

Post by sr71 on Jun 15, 2022 13:09:27 GMT -5

Wow 😀

We didn’t have to wait long for the $3.51 order to fill 👍

Thanks for the heads-up Liane!

|

|

|

|

Post by mytakeonit on Jun 15, 2022 13:48:58 GMT -5

Why does liane get a thumbs up at $3.50 ... and I didn't when I said to buy all the cheap shares at 80 cents  But, that's mytakeonit |

|

|

|

Post by parrerob on Jun 15, 2022 14:05:02 GMT -5

I did, my takeonit, I did...

|

|

|

|

Post by u1682002 on Jun 15, 2022 15:04:01 GMT -5

Just wonder if anyone has a reasonable explanation about why UTHR stays steady while MNKD got a huge haircut in recent days. Even LQDA went up for last two sessions.

|

|

|

|

Post by mnkdfann on Jun 15, 2022 15:21:12 GMT -5

Just wonder if anyone has a reasonable explanation about why UTHR stays steady while MNKD got a huge haircut in recent days. Even LQDA went up for last two sessions. I don't know. But if I look at the Balance Sheet numbers (things like debt or equity or book value per share, and various ratios) for the three companies (e.g. at Yahoo Finance), MNKD looks much worse than the other two. If investors are going risk off and looking for safe havens, I guess MNKD may not be what they are looking for. finance.yahoo.com/quote/MNKD/key-statistics?p=MNKD |

|

|

|

Post by peppy on Jun 15, 2022 15:26:54 GMT -5

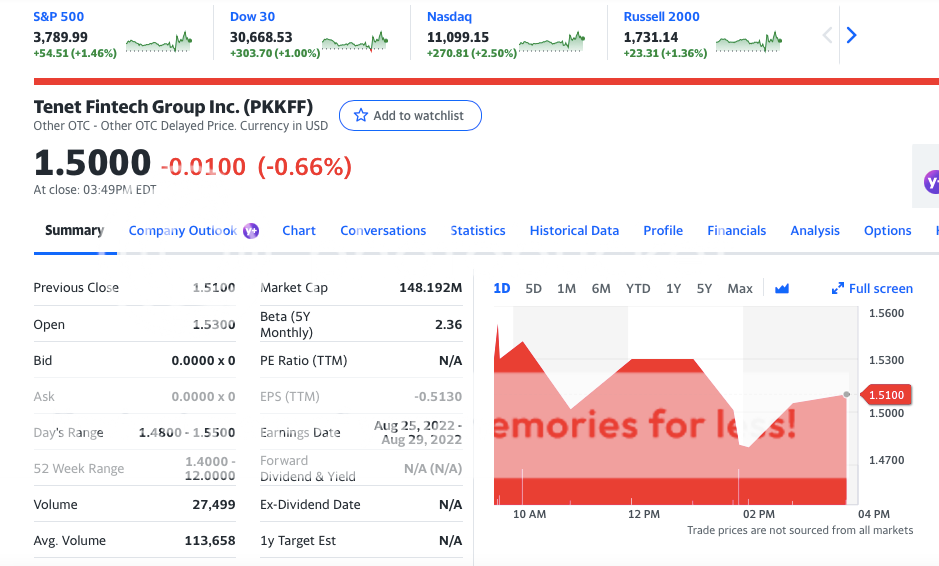

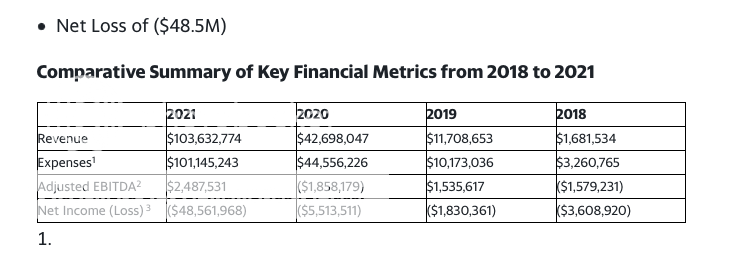

Just wonder if anyone has a reasonable explanation about why UTHR stays steady while MNKD got a huge haircut in recent days. Even LQDA went up for last two sessions. I don't know. But if I look at the Balance Sheet numbers (things like debt or equity or book value per share, and various ratios) for the three companies (e.g. at Yahoo Finance), MNKD looks much worse than the other two. If investors are going risk off and looking for safe havens, I guess MNKD may not be what they are looking for. finance.yahoo.com/quote/MNKD/key-statistics?p=MNKDYou are a pkkff owner correct? How did you evaluate pkkff using the parameters you have named above? LQDA market cap is 300 million.  |

|

|

|

Post by mnkdfann on Jun 15, 2022 15:34:19 GMT -5

I don't know. But if I look at the Balance Sheet numbers (things like debt or equity or book value per share, and various ratios) for the three companies (e.g. at Yahoo Finance), MNKD looks much worse than the other two. If investors are going risk off and looking for safe havens, I guess MNKD may not be what they are looking for. finance.yahoo.com/quote/MNKD/key-statistics?p=MNKDYou are a pkkff owner correct? How did you evaluate pkkff using the parameters you have named above? I currently own hundreds of shares, not thousands, in several 'risky' stocks. They are a minuscule part of my portfolio. I have 100s (if not 1000s) of times more invested in other things like oil and gas. But to answer your question, based on the particular Balance Sheet parameters I mentioned (and assuming Yahoo Finance numbers are reasonably accurate), I think Tenet looks to be in better shape than MNKD. Which is a surprise to me, actually. |

|

|

|

Post by peppy on Jun 15, 2022 15:43:25 GMT -5

You are a pkkff owner correct? How did you evaluate pkkff using the parameters you have named above? I currently own hundreds of shares, not thousands, in several 'risky' stocks. They are a minuscule part of my portfolio. I have 100s (if not 1000s) of times more invested in other things like oil and gas. But to answer your question, based on the particular Balance Sheet parameters I mentioned (and assuming Yahoo Finance numbers are reasonably accurate), I think Tenet looks to be in better shape than MNKD. Which is a surprise to me, actually. alrighty then. I'm following pkkff as I think China is in trouble as perviously mentioned, on the pkkff thread, when it was trading nine dollars as well as on change of trend thread. if you say so.  |

|

|

|

Post by sportsrancho on Jun 15, 2022 17:52:17 GMT -5

China is coming out of trouble. And yes PKKFF is in better shape and has the capacity to be a growth stock. If they get back on the NASDAQ. The Canadian exchange will come in the third quarter this year.

|

|

|

|

Post by cjc04 on Jun 15, 2022 18:28:03 GMT -5

Just wonder if anyone has a reasonable explanation about why UTHR stays steady while MNKD got a huge haircut in recent days. Even LQDA went up for last two sessions. I was going to ask this in another thread, but I guess I can do it here… How can anyone put a value on MNKD when they know nothing more than the current financials say? We haven’t been told the details of what the royalty deal looks like with UTHR (WHY?!?) and no one really knows what the conversion rate will really look like and how long it will take. WHEN will MNKD pull the revenue and HOW MUCH will it be?? Will the Q2 calls shed enough light to revalue MNKD? It feels like that’s what we’re waiting for. |

|

|

|

Post by peppy on Jun 15, 2022 18:30:04 GMT -5

China is coming out of trouble. And yes PKKFF is in better shape and has the capacity to be a growth stock. If they get back on the NASDAQ. The Canadian exchange will come in the third quarter this year. off topic, Hong Kong raises benchmark rate for the third time after fed rate hike. I think they raised it .75 to 2% I can't find it on the net, it is on Bloomberg. Whatever you say about pkkff. You know the gig. |

|