|

|

Post by prcgorman2 on Dec 18, 2022 16:47:57 GMT -5

PCR, I’m confused by your golden goose statement. I assume you mean that T-DPI and Afrezza are just two applications of Technosphere and many more to come over time (years). Just wish that things would move faster. Sorry for not being clear bocagirl. I meant Afrezza is the Golden Goose that has not (yet) laid golden eggs. Sayhey mentioned what I've counted on which is getting a respectable percentage of the prandial insulin market. For the sake of outcomes, if nothing else, I truly hope that happens. If it does, that will be the golden eggs. You're right though, the Dreamboat and Technosphere technology is the real Golden Goose, but only one of the two eggs so far is looking golden.

|

|

|

|

Post by boca1girl on Dec 18, 2022 16:48:00 GMT -5

Thanks Peppy.

I have MNKD long term options with 3 & $4 strikes that expire in January. I’ve been holding these for about 2 years.

Do your charts give any indication of timing? Right now I’m about break even because of lost time premium.

I’m inclined to sell to get my money back if we’re about $5 by the end of the week.

|

|

|

|

Post by Thundersnow on Dec 18, 2022 16:53:34 GMT -5

I didn't invent the relationship between Earnings Per Share and Price-to-Earnings Ratio. A run-up cannot be sustained on technical indicators alone. There have to be fundamentals which appear on the Income Statement to underwrite the technical behavior. In MNKD's case their fundamentals will support their technicals. |

|

|

|

Post by peppy on Dec 18, 2022 16:57:30 GMT -5

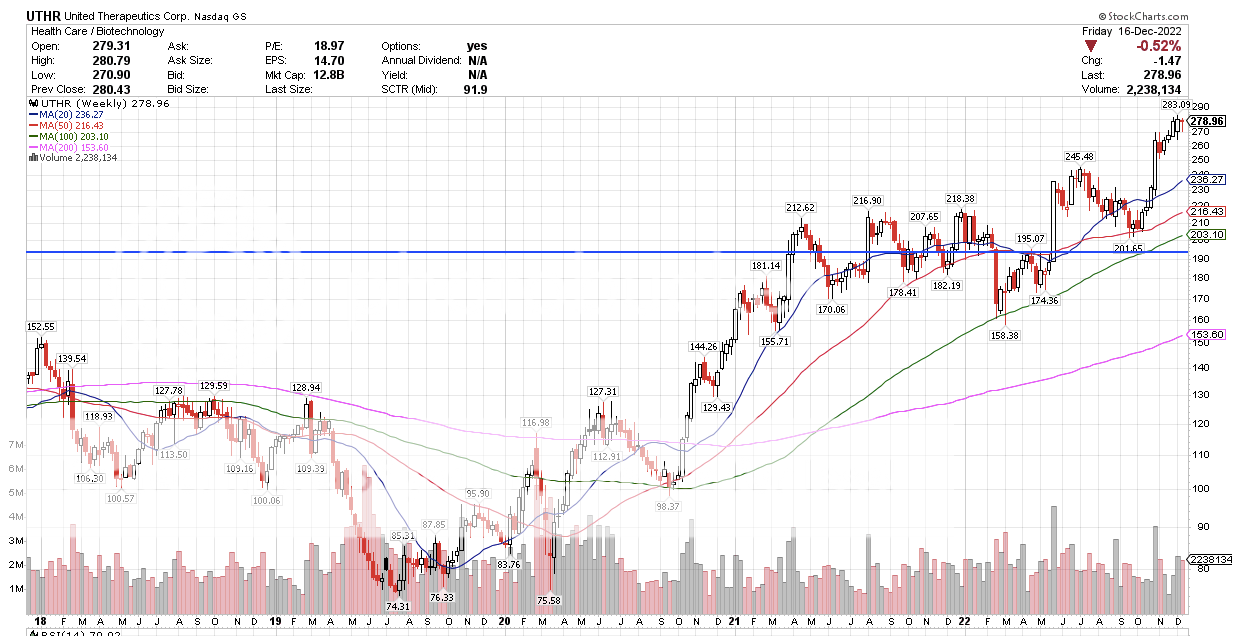

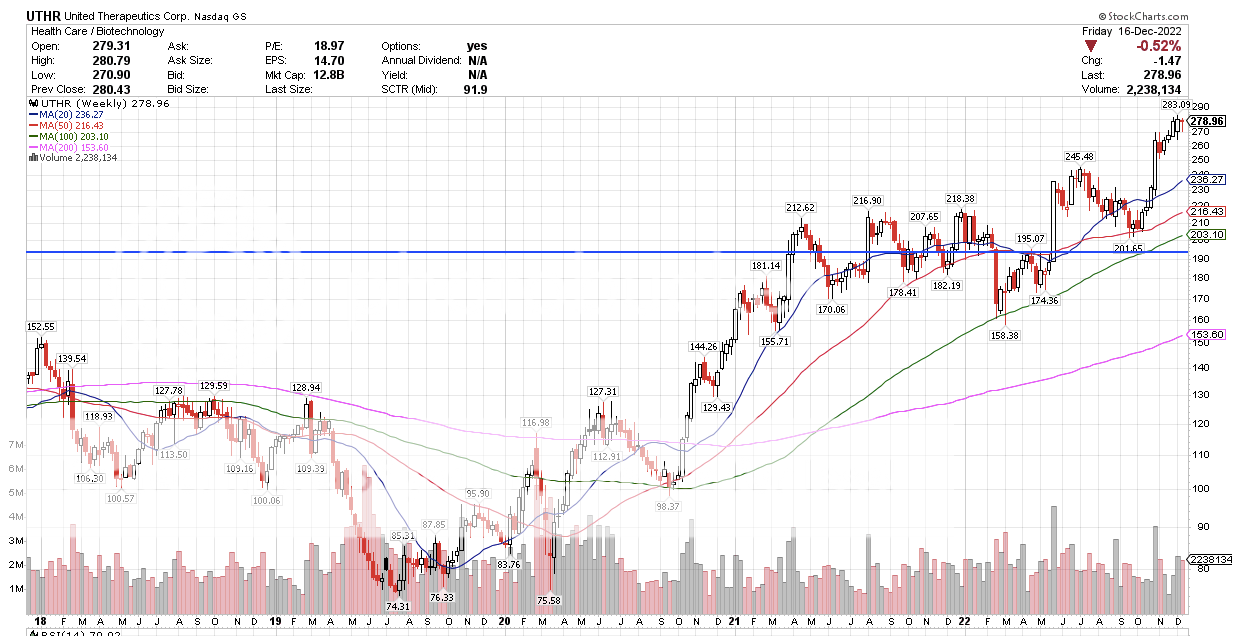

Thanks Peppy. I have MNKD long term options with 3 & $4 strikes that expire in January. I’ve been holding these for about 2 years. Do your charts give any indication of timing? Right now I’m about break even because of lost time premium. I’m inclined to sell to get my money back if we’re about $5 by the end of the week. 6 months to $12? look at UTHR. For how many weeks, it may help. it looks like UTHR started out of that last wedge 9 weeks ago. looks like UTHR point of wedge break may have been 220. $192 the cup. a 1 and 1/2 year handle of sorts.   |

|

|

|

Post by prcgorman2 on Dec 18, 2022 16:57:55 GMT -5

I didn't invent the relationship between Earnings Per Share and Price-to-Earnings Ratio. A run-up cannot be sustained on technical indicators alone. There have to be fundamentals which appear on the Income Statement to underwrite the technical behavior. In MNKD's case their fundamentals will support their technicals. I like your enthusiasm. I hope you're right. |

|

|

|

Post by boca1girl on Dec 18, 2022 17:04:17 GMT -5

I’m just talking about a move from 5 - $6. My options expire in Jan.

|

|

|

|

Post by peppy on Dec 18, 2022 17:05:37 GMT -5

In MNKD's case their fundamentals will support their technicals. I like your enthusiasm. I hope you're right. here is maybe something I found out about charts, I have had this conversation before, perhaps with MNKDfann. The charts say something, and a person asks, what would make it do that.... I say, I do not know, we will find out. The charts are a forward indicator, because someone knows, someone is doing the buying. |

|

|

|

Post by peppy on Dec 18, 2022 17:06:49 GMT -5

I’m just talking about a move from 5 - $6. My options expire in Jan. MNKD will be at 6 by Jan. It may be reach 6 this week. we will see. I am editing myself, anderson said the convertible bonds hit at $5.21. boca1girlAnyone know what to expect from that? |

|

|

|

Post by prcgorman2 on Dec 18, 2022 19:22:48 GMT -5

I’m just talking about a move from 5 - $6. My options expire in Jan. MNKD will be at 6 by Jan. It may be reach 6 this week. we will see. I am editing myself, anderson said the convertible bonds hit at $5.21. boca1girl Anyone know what to expect from that? A bigger float to spread the EPS across (resulting is lower EPS and smaller dividends [Hahaha, as if...]). |

|

|

|

Post by Thundersnow on Dec 18, 2022 21:04:49 GMT -5

Thanks Peppy. I have MNKD long term options with 3 & $4 strikes that expire in January. I’ve been holding these for about 2 years. Do your charts give any indication of timing? Right now I’m about break even because of lost time premium. I’m inclined to sell to get my money back if we’re about $5 by the end of the week. 6 months to $12? look at UTHR. For how many weeks, it may help. it looks like UTHR started out of that last wedge 9 weeks ago. looks like UTHR point of wedge break may have been 220. $192 the cup. a 1 and 1/2 year handle of sorts.   |

|

|

|

Post by Thundersnow on Dec 18, 2022 21:09:17 GMT -5

I have a question - Does the length of the cup n handle formation impact the length of the break out?

My observation is that MNKD has a 5-6 year cup and a year long Handle. Is that considered normal??

I’ve seen shorter Cups w/ shorter handles. There seems to be a correlation.

Any thoughts?

|

|

|

|

Post by cjm18 on Dec 18, 2022 21:55:59 GMT -5

I’m just talking about a move from 5 - $6. My options expire in Jan. MNKD will be at 6 by Jan. It may be reach 6 this week. we will see. I am editing myself, anderson said the convertible bonds hit at $5.21. boca1girlAnyone know what to expect from that? Speculation due to the extra volume on Friday? So they made at most 9 cents a share? Why bother. |

|

|

|

Post by mytakeonit on Dec 19, 2022 1:29:44 GMT -5

We may NEVER hit $6 ... because we could just fly past it and go to $10. Never know ...

But, that's mytakeonit

|

|

|

|

Post by prcgorman2 on Dec 19, 2022 6:57:54 GMT -5

MNKD will be at 6 by Jan. It may be reach 6 this week. we will see. I am editing myself, anderson said the convertible bonds hit at $5.21. boca1girl Anyone know what to expect from that? Speculation due to the extra volume on Friday? So they made at most 9 cents a share? Why bother. To earn 9% of $30+ million? i.e,. bother to earn $2.7M. How much would you let the price rise before converting? What are the drivers that trigger conversion? Is there a tax advantage to converting lower? Or a disadvantage? Don't know, but your question is a good one, so I hope one of the more knowledgeable folks (which may include you) can help answer it. |

|

|

|

Post by hellodolly on Dec 19, 2022 7:43:51 GMT -5

Speculation due to the extra volume on Friday? So they made at most 9 cents a share? Why bother. To earn 9% of $30+ million? i.e,. bother to earn $2.7M. How much would you let the price rise before converting? What are the drivers that trigger conversion? Is there a tax advantage to converting lower? Or a disadvantage? Don't know, but your question is a good one, so I hope one of the more knowledgeable folks (which may include you) can help answer it. Could be better to convert in early 2023 (Jan). |

|