|

|

Post by sportsrancho on Feb 2, 2022 11:27:40 GMT -5

That’s what we don’t know, will the market go with expectations or wait for revenue…..

|

|

|

|

Post by peppy on Feb 2, 2022 11:37:14 GMT -5

That’s what we don’t know, will the market go with expectations or wait for revenue….. Someone posted, MNKD receives Money on approval. A lot of it. Was it 90 million? I do not recall, that was a guess. Anyone know? |

|

|

|

Post by caesar on Feb 2, 2022 12:04:37 GMT -5

Are you referring to the covenant that permits them to access the $60 million?

|

|

|

|

Post by peppy on Feb 2, 2022 12:11:01 GMT -5

Are you referring to the covenant that permits them to access the $60 million? caesar, I was just trying to find it. The 60 million is the covenant with the firm we have financing from? *UTHR hands over money probably for production upon approval is my memory. www.sec.gov/Archives/edgar/data/899460/000156459018026006/mnkd-ex108_399.htm*looks like my memory is faulty. I am not very good at this.  |

|

|

|

Post by Chris-C on Feb 2, 2022 12:28:59 GMT -5

I hope you are right and I don't really want to be the Debbie Downer but this is MNKD. IMO MNKD will not see any significant pop until they either start showing a profit or they sign some huge partner for afrezza. If Elon Musk starts a new health care company and partners with MNKD we would have a huge pop. A "real" deal with a Google or Amazon would also provide some pop. Those events remake MNKD. UTHR and DXCM and alot of others at this point would be more wait and see. Wait and see I think is where we are with UTHR and the street right now. Does MNKD become profitable with UTHR, probably. Lets see if Mike can now make a big afrezza deal, now that he seems to understand the diabetes industry and seems to understand afrezza. Five years ago he understood neither. Mike is sitting on the golden goose. He now needs to get off the goose and let her produce. Hope springs eternal. I certainly understand the caution after following this stock for years but this does beg the question. If not popping to the $6 to $8 range, what is the expectation for the pps following UTHR's approval? This will be the very first time MNKD is virtually guaranteed significant residual income. It may or may not be sufficient to be profitable or break even but it will far surpass what Afrezza has provided to date. IMO, it's hard to imagine the street not recognizing this and moving MNKD out of the penny stock category. I'd love to agree with you; but if I've learned anything from this stock, it is to never make short term predictions about how the market will react to company news. I have concluded that the street has a generally (and justifiably, based on results) negative attitude toward MNKD and its appetite for speculation on the company's success has been depleted. Under typical circumstances, one would expect a bump on Tyvaso approval; but I for one take nothing for granted and it won't surprise me much if the reaction is "muted." It WILL surprise me if there is a significant pop, and I think we longsuffering longs will be delighted. Mannkind needs to change the street's perception through steady revenue growth and profitability. Once that occurs, there may still be a residual overhang of scepticism and resistance. As I've written here before, what the company needs is another SIGNIFICANT development (deal or milestone) to create the widespread perception of an upward trend. Then we will begin to get noticed on Wall Street and the SP will follow. All in my humble opinion, of course,  . |

|

|

|

Post by boca1girl on Feb 2, 2022 13:20:31 GMT -5

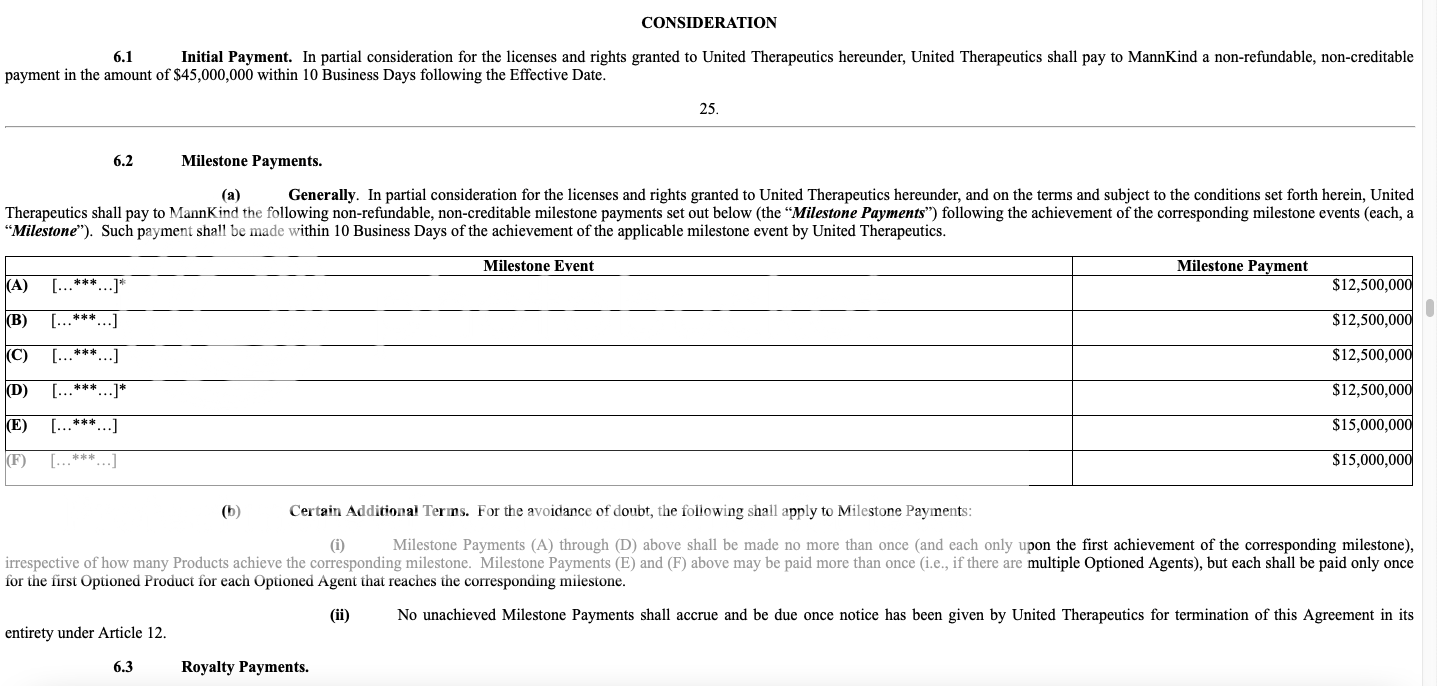

I would think that milestone E would have been met with the FDA approval of MNKD’s manufacturing line and F on final FDA approval. We should know by time 4Q21 earnings are released. Manufacturing approval was met in Sept or Oct 2021.

|

|

|

|

Post by akemp3000 on Feb 2, 2022 13:24:35 GMT -5

No predictions have been made that I'm aware. With the varying perspectives, it would be good to hear what individuals are guessing the pps will be shortly after approval and before it heads back down as we always witness  |

|

|

|

Post by mytakeonit on Feb 2, 2022 13:31:31 GMT -5

I make no guesses. I just hope the pps drops way down ... so I can buy more shares before people realize that they are idiots !!!

But, that's mytakeonit

|

|

|

|

Post by buyitonsale on Feb 2, 2022 14:24:36 GMT -5

All milestones associated with Tyvaso DPI development have been paid.

1.73“Optioned Agent” shall mean (a) […***…]* or (b) any Other Agent that is indicated for use (or being developed for use) in the treatment of Pulmonary Hypertension or is being developed with the objective of seeking approval for the treatment of Pulmonary Hypertension.

Milestone Payments (E) and (F) above may be paid more than once (i.e., if there are multiple Optioned Agents), but each shall be paid only once for the first Optioned Product for each Optioned Agent that reaches the corresponding milestone.

|

|

|

|

Post by peppy on Feb 2, 2022 16:12:19 GMT -5

All milestones associated with Tyvaso DPI development have been paid. 1.73“Optioned Agent” shall mean (a) […***…]* or (b) any Other Agent that is indicated for use (or being developed for use) in the treatment of Pulmonary Hypertension or is being developed with the objective of seeking approval for the treatment of Pulmonary Hypertension. Milestone Payments (E) and (F) above may be paid more than once (i.e., if there are multiple Optioned Agents), but each shall be paid only once for the first Optioned Product for each Optioned Agent that reaches the corresponding milestone. I am still looking for what I read, However at these moments, it looks like I was wrong. sportsrancho |

|

|

|

Post by sportsrancho on Feb 2, 2022 16:13:44 GMT -5

I see, thank you.

|

|

|

|

Post by peppy on Feb 2, 2022 17:10:47 GMT -5

I would think that milestone E would have been met with the FDA approval of MNKD’s manufacturing line and F on final FDA approval. We should know by time 4Q21 earnings are released. Manufacturing approval was met in Sept or Oct 2021. and all.Help me out here. "Initial Payment. In partial consideration for the licenses and rights granted to United Therapeutics hereunder, United Therapeutics shall pay to MannKind a non-refundable, non-creditable payment in the amount of $ 45,000,000 within 10 Business Days following the Effective Date."

Reading through the document, is the effective date, approval? 5.2Manufacture and Supply. (a)Initial Clinical Supply and Clinical Supply for Pivotal Study and Product Launch. The Parties shall establish as soon as practicable following the Effective Date procedures for the supply of Initial Product to United Therapeutics for use by United Therapeutics in continuing the development of the Initial Product, and the Parties shall enter into a clinical supply agreement within three (3) months of the Effective Date pursuant to which MannKind shall supply United Therapeutics with (i) finished Initial Product suitable for use by United Therapeutics in clinical trials, and (ii) semi-finished Product (unkitted, unlabeled Devices and packaged cartridges for Initial Product) for use in the planned pivotal trial for the Initial Product and for subsequent commercial launch, the key terms of which agreement are set forth on an exhibit attached to a separate letter delivered by MannKind to United Therapeutics and agreed to in writing by United Therapeutics as of the Execution Date. added, 1.33“Effective Date” shall have the meaning set forth in Section 15.16. Other than the provisions of this Section 15.16, the rights and obligations of the Parties under this Agreement shall not become effective until the waiting period provided by the HSR Act, and those associated with any other of the Filings which the Parties reasonably conclude must be obtained prior to making the rights and obligations of this Agreement effective, shall have terminated or expired (the date of such termination or expiration shall be the “Effective Date” of this Agreement). On the Effective Date, MannKind shall deliver to United Therapeutics a written certification (the “Closing Certificate”) from an officer of MannKind that MannKind’s representations and warranties in Article 10 are accurate in all material respects as of the date of the Effective Date. Upon the occurrence of the Effective Date, all provisions of this Agreement shall become effective automatically without the need for further action by the Parties. In the event that any such clearance associated with the Filings is not obtained within […***…]* days after the Execution Date (or such later date as agreed in writing by the Parties), this Agreement may be terminated by either Party. Notwithstanding anything to the contrary contained in this Agreement and in this Section 15.16, nothing in this Agreement shall require United Therapeutics or its Subsidiaries to agree or propose to (i) sell, hold separate, license or otherwise dispose of any assets or conduct their business in a specified manner, (ii) permit or agree to the sale, holding separate, licensing or other disposition of, any assets of MannKind, or (iii) take or refrain from taking any action that would result in any modification, amendment, or change to this Agreement. Notwithstanding anything to the contrary contained in this Agreement, if the Effective Date does not occur United Therapeutics shall reimburse MannKind for […***…]* percent ([…***…]%) of all reasonable and documented out-of-pocket fees, costs, and expenses incurred by MannKind in connection with this Section 15.16 after the Execution Date, up to a maximum reimbursement amount of $[…***…] in the aggregate. (I still haven't found the post I am looking for.) |

|

|

|

Post by beardawg on Feb 2, 2022 17:54:34 GMT -5

I would think that milestone E would have been met with the FDA approval of MNKD’s manufacturing line and F on final FDA approval. We should know by time 4Q21 earnings are released. Manufacturing approval was met in Sept or Oct 2021. and all.Help me out here. "Initial Payment. In partial consideration for the licenses and rights granted to United Therapeutics hereunder, United Therapeutics shall pay to MannKind a non-refundable, non-creditable payment in the amount of $ 45,000,000 within 10 Business Days following the Effective Date."

Reading through the document, is the effective date, approval? 5.2Manufacture and Supply. (a)Initial Clinical Supply and Clinical Supply for Pivotal Study and Product Launch. The Parties shall establish as soon as practicable following the Effective Date procedures for the supply of Initial Product to United Therapeutics for use by United Therapeutics in continuing the development of the Initial Product, and the Parties shall enter into a clinical supply agreement within three (3) months of the Effective Date pursuant to which MannKind shall supply United Therapeutics with (i) finished Initial Product suitable for use by United Therapeutics in clinical trials, and (ii) semi-finished Product (unkitted, unlabeled Devices and packaged cartridges for Initial Product) for use in the planned pivotal trial for the Initial Product and for subsequent commercial launch, the key terms of which agreement are set forth on an exhibit attached to a separate letter delivered by MannKind to United Therapeutics and agreed to in writing by United Therapeutics as of the Execution Date. (I still haven't found the post I am looking for.) I read it that the effective date applies to the signing of the partnership and the day it becomes effective. It talks about a planned pivotal trial happening after the effective date. That would be the trial that occurred before applying for approval. |

|

|

|

Post by falconquest on Feb 2, 2022 19:10:48 GMT -5

I certainly understand the caution after following this stock for years but this does beg the question. If not popping to the $6 to $8 range, what is the expectation for the pps following UTHR's approval? This will be the very first time MNKD is virtually guaranteed significant residual income. It may or may not be sufficient to be profitable or break even but it will far surpass what Afrezza has provided to date. IMO, it's hard to imagine the street not recognizing this and moving MNKD out of the penny stock category. I'd love to agree with you; but if I've learned anything from this stock, it is to never make short term predictions about how the market will react to company news. I have concluded that the street has a generally (and justifiably, based on results) negative attitude toward MNKD and its appetite for speculation on the company's success has been depleted. Under typical circumstances, one would expect a bump on Tyvaso approval; but I for one take nothing for granted and it won't surprise me much if the reaction is "muted." It WILL surprise me if there is a significant pop, and I think we longsuffering longs will be delighted. Mannkind needs to change the street's perception through steady revenue growth and profitability. Once that occurs, there may still be a residual overhang of scepticism and resistance. As I've written here before, what the company needs is another SIGNIFICANT development (deal or milestone) to create the widespread perception of an upward trend. Then we will begin to get noticed on Wall Street and the SP will follow. All in my humble opinion, of course,  . Hypothetically speaking if this happens and Technosphere takes off it's possible that the street would perceive Afrezza as the albatross around the companies neck. |

|

|

|

Post by prcgorman2 on Feb 2, 2022 19:42:08 GMT -5

akemp3000 I'd love to agree with you; but if I've learned anything from this stock, it is to never make short term predictions about how the market will react to company news. I have concluded that the street has a generally (and justifiably, based on results) negative attitude toward MNKD and its appetite for speculation on the company's success has been depleted. Under typical circumstances, one would expect a bump on Tyvaso approval; but I for one take nothing for granted and it won't surprise me much if the reaction is "muted." It WILL surprise me if there is a significant pop, and I think we longsuffering longs will be delighted. Mannkind needs to change the street's perception through steady revenue growth and profitability. Once that occurs, there may still be a residual overhang of scepticism and resistance. As I've written here before, what the company needs is another SIGNIFICANT development (deal or milestone) to create the widespread perception of an upward trend. Then we will begin to get noticed on Wall Street and the SP will follow. All in my humble opinion, of course,  . Hypothetically speaking if this happens and Technosphere takes off it's possible that the street would perceive Afrezza as the albatross around the companies neck. More like a White Elephant. Rare, precious, sacred, expensive to maintain. If the Street is not completely dominated by idiots, and I don’t think it is, then Afrezza is not an albatross, but it could still be very difficult for it to obtain marketshare. Mining precious metal is difficult and expensive but it’s not an albatross around the neck of the miners. |

|