|

|

Post by dh4mizzou on Jan 27, 2022 16:06:07 GMT -5

It seems like there is a big disconnect between UTHR and MNKD price action. It seems odd (disconcerting) to me since MNKD is going to benefit from Tyvaso as well. Can someone who understands this better than me ( could be almost all of you  ) explain this? |

|

|

|

Post by cjm18 on Jan 27, 2022 16:32:48 GMT -5

They are already getting tyvaso revenue. What % of their total revenue is from tyvaso?

|

|

|

|

Post by akemp3000 on Jan 27, 2022 16:39:38 GMT -5

While many of the dots with these two companies connect, my guess is that investors in these companies are vastly different. One is a thriving company with a market cap approaching $9B whereas the other is an emerging and speculative biotech with a market cap currently under $1B. There are also significant differences in the business models and target markets of these two companies. I see this as apples and oranges as opposed to being disconcerting.

|

|

|

|

Post by neil36 on Jan 27, 2022 17:04:08 GMT -5

For United, Tyvaso DPI approval just means a conversion of patients to a different delivery system and maybe a modest expansion in patient population.

For MNKD, Tyvaso DPI approval is a bit more existential. Approval can lead to a virtuous cycle of increased revenue, a possible second molecule, and possibly additional partners once the platform is proven viable on the market. If it doesn't get approved, MNKD will have tough sledding attracting partners and promoting Afrezza.

The longer approval drags out with uncertainty, the stock price action of the two companies makes sense. If we wake up one morning to Tyvaso DPI approval, I would expect a very significant rise in MNKD and just a modest bump in price for UTHR.

|

|

|

|

Post by castlerockchris on Jan 27, 2022 17:17:06 GMT -5

I agree with the above statements. Like every other investor, I am trying to figure out what approval means for MNKD's share price. My estimate is a return to the high $4 low $5 range upon approval, with a move toward $6 by the end of the year as we see a couple of quarterly reports with Tyvaso revenue and maybe a quarter with royalty payments. As I have posted elsewhere on this board, after more than a decade, I am getting to the end of my rope with MNKD. I hope we see a little bit of Tyvaso manufacturing revenue in the upcoming quarterly report. MC had been hinting that we started some manufacturing. I do not expect it to be much. If you want to see divergence in stock price between MNKD and UTHR, just model Tyvaso DPI not being approved. That will be one ugly divergence.

|

|

|

|

Post by peppy on Jan 27, 2022 17:19:04 GMT -5

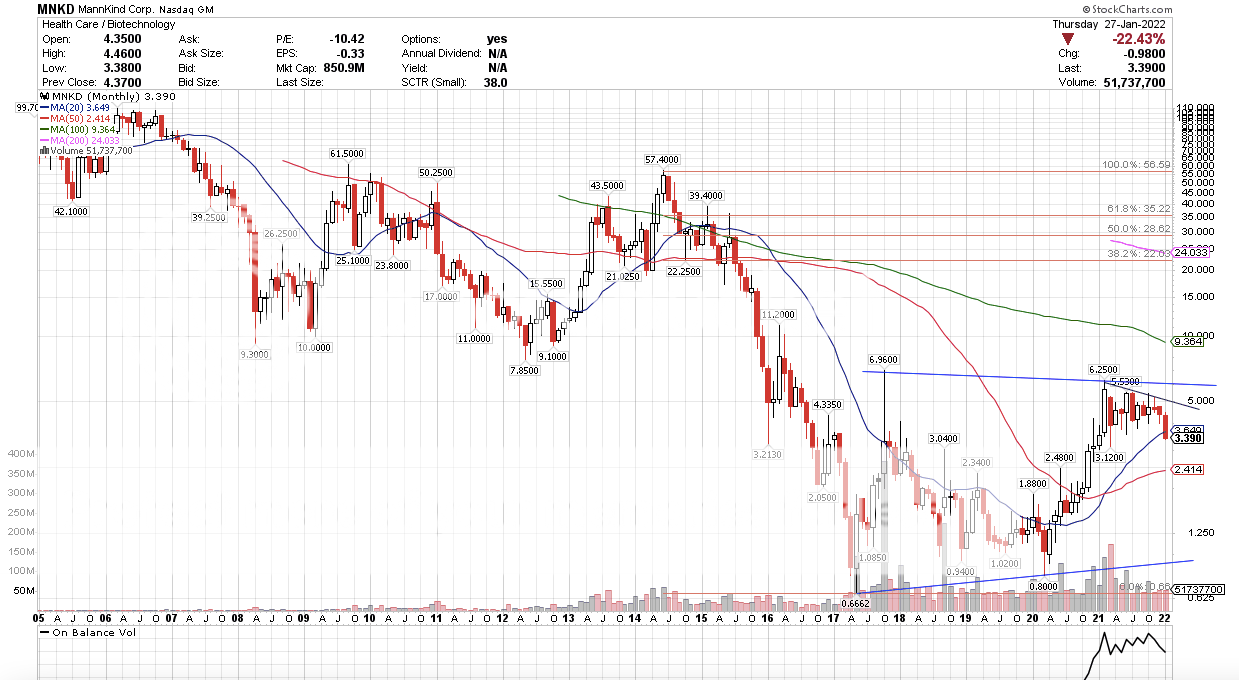

It seems like there is a big disconnect between UTHR and MNKD price action. It seems odd (disconcerting) to me since MNKD is going to benefit from Tyvaso as well. Can someone who understands this better than me ( could be almost all of you  ) explain this? The disconnect, UTHR makes money. UTHR trading at highs with new products on the way. MNKD, has over head resistance. As in people that have lost money in MNKD. UTHR Monthly, no over head resistance.  MNKD Monthly with over head resistance.  |

|

|

|

Post by MnkdWASmyRtrmntPlan on Jan 27, 2022 18:09:26 GMT -5

I agree with the above statements. Like every other investor, I am trying to figure out what approval means for MNKD's share price. My estimate is a return to the high $4 low $5 range upon approval, with a move toward $6 by the end of the year as we see a couple of quarterly reports with Tyvaso revenue and maybe a quarter with royalty payments. As I have posted elsewhere on this board, after more than a decade, I am getting to the end of my rope with MNKD. I hope we see a little bit of Tyvaso manufacturing revenue in the upcoming quarterly report. MC had been hinting that we started some manufacturing. I do not expect it to be much. If you want to see divergence in stock price between MNKD and UTHR, just model Tyvaso DPI not being approved. That will be one ugly divergence. If mnkd can deliver what's on their plate for this year, I am hoping for more like $10 by end of year, ... or, at least by the release of the 4th quarter results. And $20 by eoy 2023. I am not sure when we will hit break-even, but that will have to bring a big "coming of age" rush of investors that will start our elusive stock price inflection point that we have all been waiting for. And then mid-decade when they turn up the speed on releasing new molecules, it will soar. And, if tyvaso doesn't get approved, I will really start believing that the big-3 are manipulating the FDA. |

|

|

|

Post by sportsrancho on Jan 27, 2022 21:40:43 GMT -5

I agree with the above statements. Like every other investor, I am trying to figure out what approval means for MNKD's share price. My estimate is a return to the high $4 low $5 range upon approval, with a move toward $6 by the end of the year as we see a couple of quarterly reports with Tyvaso revenue and maybe a quarter with royalty payments. As I have posted elsewhere on this board, after more than a decade, I am getting to the end of my rope with MNKD. I hope we see a little bit of Tyvaso manufacturing revenue in the upcoming quarterly report. MC had been hinting that we started some manufacturing. I do not expect it to be much. If you want to see divergence in stock price between MNKD and UTHR, just model Tyvaso DPI not being approved. That will be one ugly divergence. Chris what bothers me is the stock action. Before the market selloff… it doesn’t bode for TrepT being a slam dunk. The other side of it is there’s action at Danbury that’s for sure. They must be confident. The stock is not acting right, you know how I am about that ..hopefully we start climbing. |

|

|

|

Post by buyitonsale on Jan 28, 2022 0:00:38 GMT -5

FDA response is expected In February instead of June.

As an investor that’s is all I care about at the moment.

I’m expecting approval until I see otherwise.

Therefore, I will be adding any chance I have until then.

|

|

|

|

Post by neil36 on Jan 31, 2022 7:00:43 GMT -5

Lemonhead on stocktwits posted an estimated PDUFA date of February 23rd. Can anyone else confirm this or provide a link?

|

|

|

|

Post by sayhey24 on Jan 31, 2022 7:26:49 GMT -5

I agree with the above statements. Like every other investor, I am trying to figure out what approval means for MNKD's share price. My estimate is a return to the high $4 low $5 range upon approval, with a move toward $6 by the end of the year as we see a couple of quarterly reports with Tyvaso revenue and maybe a quarter with royalty payments. As I have posted elsewhere on this board, after more than a decade, I am getting to the end of my rope with MNKD. I hope we see a little bit of Tyvaso manufacturing revenue in the upcoming quarterly report. MC had been hinting that we started some manufacturing. I do not expect it to be much. If you want to see divergence in stock price between MNKD and UTHR, just model Tyvaso DPI not being approved. That will be one ugly divergence. Chris what bothers me is the stock action. Before the market selloff… it doesn’t bode for TrepT being a slam dunk. The other side of it is there’s action at Danbury that’s for sure. They must be confident. The stock is not acting right, you know how I am about that ..hopefully we start climbing. I think its as simple as there is so much overhang with afrezza. At this point the street sees MNKD as a failed company. Maybe this is good for true believers as it still provides a great entry point. Then again I know if I want a good laugh from my friends all I have to say is "Mannkind". Then I get the look from my wife. I think Tyvaso is getting approved. Martin S. is no longer in the picture, we hope. Lets see if Mike can put a real deal together after Tyvaso approval for afrezza. Based on what Sayer said DXCM has been working with Ondou and from what Mike said MNKD has been working with DXCM. Who knows but it seems things we have discussed on this board for years may just be coming together. I sure hope Bill can share in the pie when this breaks because I am sure VDex results have been used more than once as a reference point. |

|

|

|

Post by prcgorman2 on Feb 1, 2022 14:08:56 GMT -5

Lemonhead on stocktwits posted an estimated PDUFA date of February 23rd. Can anyone else confirm this or provide a link? That sounds about right. The FDA has a user fee date which is the deadline and by regulation is two months after a refile of an NDA (I think). The acknowledgement of the refile for Tyvaso had to happen within 30 days of the refile. The refile was December 27th, so late February sounds right, although I doubt it is the 23rd. Also wanted to comment on the MNKD price action as compared to UTHR. I agree apples and oranges. And, MNKD appears to be tracking the sector and NASDAQ while UTHR is trading near all-time highs. Clearly, the Street thinks UTHR is good to go. |

|

|

|

Post by akemp3000 on Feb 1, 2022 15:39:47 GMT -5

To add...with the street thinking UTHR is good to go yet MNKD tracking the sector, this could lead to a really nice pop once the street realizes the significance of an approval. An emerging company trading under $5 obviously does not yet have sufficient attention from the street. Increasing revenue expectations is of course the key. With most projections following approval being in the $6 to $8 range, street recognition may finally arrive. If so, it would really be enjoyable to shift gears and move on to speculating what comes next.

|

|

|

|

Post by sayhey24 on Feb 1, 2022 22:13:25 GMT -5

To add...with the street thinking UTHR is good to go yet MNKD tracking the sector, this could lead to a really nice pop once the street realizes the significance of an approval. An emerging company trading under $5 obviously does not yet have sufficient attention from the street. Increasing revenue expectations is of course the key. With most projections following approval being in the $6 to $8 range, street recognition may finally arrive. If so, it would really be enjoyable to shift gears and move on to speculating what comes next. I hope you are right and I don't really want to be the Debbie Downer but this is MNKD. IMO MNKD will not see any significant pop until they either start showing a profit or they sign some huge partner for afrezza. If Elon Musk starts a new health care company and partners with MNKD we would have a huge pop. A "real" deal with a Google or Amazon would also provide some pop. Those events remake MNKD. UTHR and DXCM and alot of others at this point would be more wait and see. Wait and see I think is where we are with UTHR and the street right now. Does MNKD become profitable with UTHR, probably. Lets see if Mike can now make a big afrezza deal, now that he seems to understand the diabetes industry and seems to understand afrezza. Five years ago he understood neither. Mike is sitting on the golden goose. He now needs to get off the goose and let her produce. Hope springs eternal. |

|

|

|

Post by akemp3000 on Feb 2, 2022 8:10:35 GMT -5

To add...with the street thinking UTHR is good to go yet MNKD tracking the sector, this could lead to a really nice pop once the street realizes the significance of an approval. An emerging company trading under $5 obviously does not yet have sufficient attention from the street. Increasing revenue expectations is of course the key. With most projections following approval being in the $6 to $8 range, street recognition may finally arrive. If so, it would really be enjoyable to shift gears and move on to speculating what comes next. I hope you are right and I don't really want to be the Debbie Downer but this is MNKD. IMO MNKD will not see any significant pop until they either start showing a profit or they sign some huge partner for afrezza. If Elon Musk starts a new health care company and partners with MNKD we would have a huge pop. A "real" deal with a Google or Amazon would also provide some pop. Those events remake MNKD. UTHR and DXCM and alot of others at this point would be more wait and see. Wait and see I think is where we are with UTHR and the street right now. Does MNKD become profitable with UTHR, probably. Lets see if Mike can now make a big afrezza deal, now that he seems to understand the diabetes industry and seems to understand afrezza. Five years ago he understood neither. Mike is sitting on the golden goose. He now needs to get off the goose and let her produce. Hope springs eternal. I certainly understand the caution after following this stock for years but this does beg the question. If not popping to the $6 to $8 range, what is the expectation for the pps following UTHR's approval? This will be the very first time MNKD is virtually guaranteed significant residual income. It may or may not be sufficient to be profitable or break even but it will far surpass what Afrezza has provided to date. IMO, it's hard to imagine the street not recognizing this and moving MNKD out of the penny stock category. |

|