|

|

Post by pat on May 29, 2022 8:12:27 GMT -5

“Anticipation among shareholders” is a key point I think. I am not directly involved in the investment decision making process. But I’m fairly certain there is no way most large institutional managers - be it insurance companies, pensions, mutual fund managers - will take a position of any size in a company with no earnings and negative cash flow. The Cathy woods of the world being an exception. This has been the MNKD reality these past years and why we’ve been so heavily manipulated. The proven royalties from tyvasso over the next year should open MNKD investment up to a much larger pool of capital from large managers. They will want the growth that monetizing the techno sphere platform will bring in the years ahead. So, some portion of that future growth will be priced in to the stock in the near term when they bid the company up in the coming months, along with the increasing royalty stream. Just a thought anyway….

|

|

|

|

Post by phdedieu12 on May 29, 2022 15:33:44 GMT -5

“Anticipation among shareholders” is a key point I think. I am not directly involved in the investment decision making process. But I’m fairly certain there is no way most large institutional managers - be it insurance companies, pensions, mutual fund managers - will take a position of any size in a company with no earnings and negative cash flow. The Cathy woods of the world being an exception. This has been the MNKD reality these past years and why we’ve been so heavily manipulated. The proven royalties from tyvasso over the next year should open MNKD investment up to a much larger pool of capital from large managers. They will want the growth that monetizing the techno sphere platform will bring in the years ahead. So, some portion of that future growth will be priced in to the stock in the near term when they bid the company up in the coming months, along with the increasing royalty stream. Just a thought anyway…. Could not agree with you more! Well said.... |

|

|

|

Post by stockwhisperer on May 30, 2022 21:54:06 GMT -5

Someone posted on ST’s that MNKD is on Watch Breakout on Weekly Chart. From the chart perspective what does that really mean? Thanks

|

|

|

|

Post by cjm18 on May 30, 2022 22:42:47 GMT -5

Someone posted on ST’s that MNKD is on Watch Breakout on Weekly Chart. From the chart perspective what does that really mean? Thanks It’s bullish. |

|

|

|

Post by peppy on May 31, 2022 8:47:25 GMT -5

At 15 mins of trade, MNKD volume is once again relatively large.

real time, 193,243 shares.

summary, 234,504

Avg. Volume 4,185,236

4.39. -0.05 (-1.1261%)

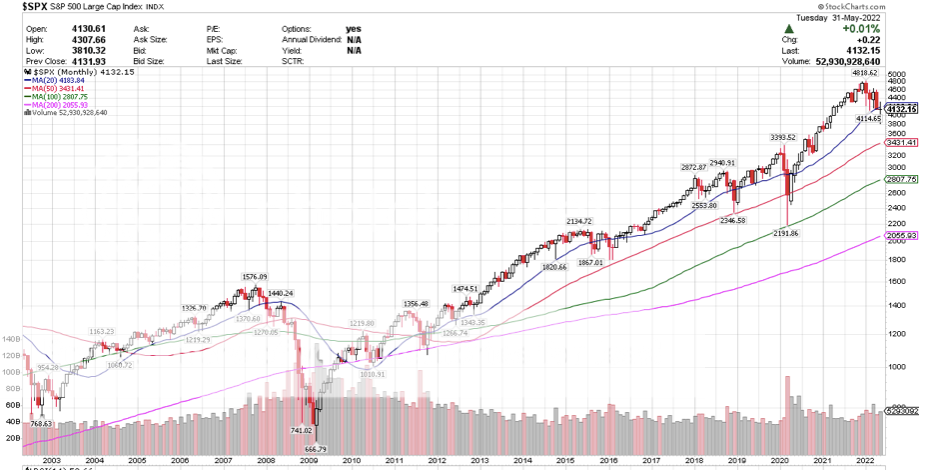

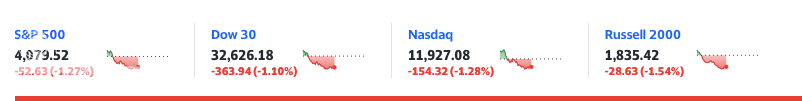

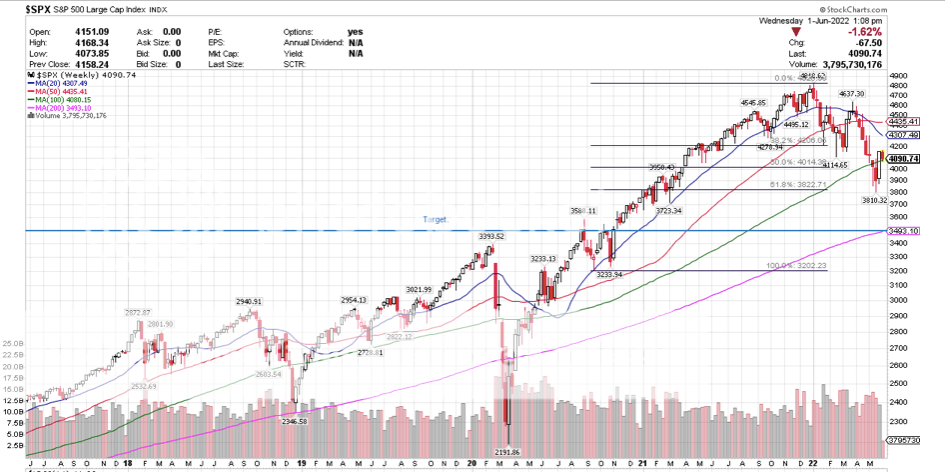

$SPX - 40.

Added, MNKD Volume at 1/2 hour of trade.

real time, 286,751

summary, 357,220

4.39. -0.05 (-1.1261%)

MNKD volume at 45 mins of trade, huge for MNKD.

real time, 634,699 shares.

summary, 1,006,777 shares. ******

4.325. -0.115. (-2.5901%)

@ 1 1/2 hours of trade.

real time volume, 1,379,877 shares.

summary, 2,105,271

Avg. Volume 4,185,236

4.32 -0.12 (-2.7027%)

|

|

|

|

Post by peppy on May 31, 2022 11:46:57 GMT -5

|

|

|

|

Post by peppy on May 31, 2022 15:21:48 GMT -5

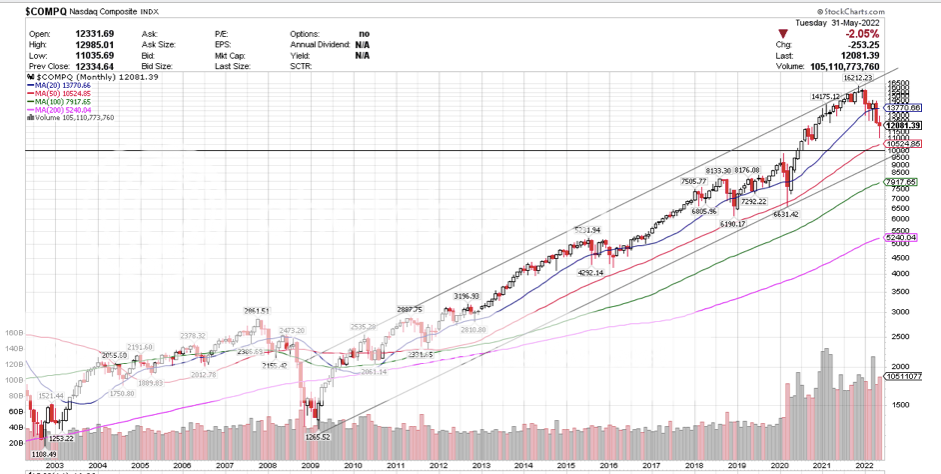

MNKD Nasdaq real time volume, 5,717,192 shares. MNKD Nasdaq summary volume, 7,371,804 shares. $4.18. -0.26 (-5.86%) Monthly charts, the month has ended.      |

|

|

|

Post by biffn on May 31, 2022 20:08:48 GMT -5

finishing above the 20 month MA looks like a big deal.

|

|

|

|

Post by prcgorman2 on Jun 1, 2022 6:42:39 GMT -5

Great volume for weeks, and yet here we are. What the heck is the strategy for covering the shorting? Are we going to test $4 as the floor today? Inquiring minds hope not.

|

|

|

|

Post by peppy on Jun 1, 2022 9:01:50 GMT -5

Volume in MNKD once again today is large.

At 30 mins of trade.

real time, 321,970

summary, 461,225

Avg. Volume 4,203,855

4.14. -0.04 (-0.9569%)

|

|

|

|

Post by peppy on Jun 1, 2022 11:47:13 GMT -5

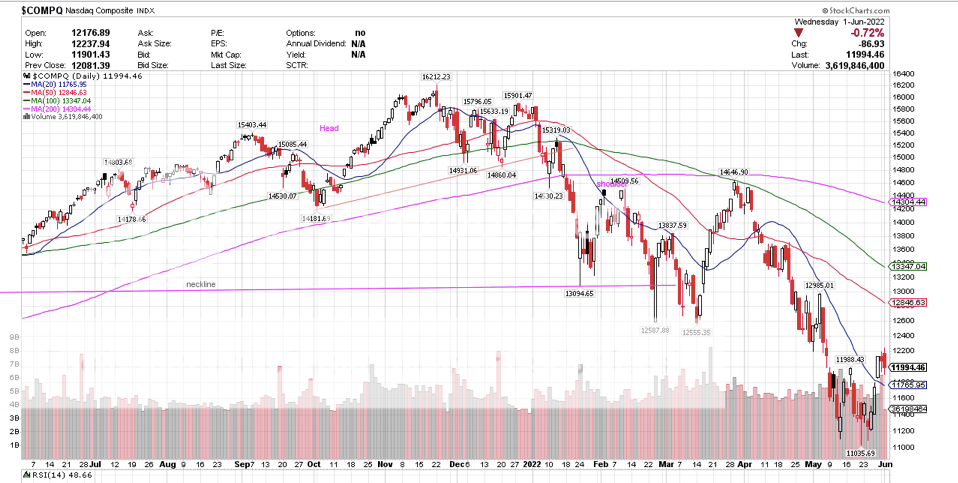

Volume in MNKD once again today is large. At 30 mins of trade. real time, 321,970 summary, 461,225 4.14. -0.04 (-0.9569%) MNKD Volume at the half day of trade. High volume. Real time, 2,542,112 shares. Summary, 3,579,849 Avg. Volume 4,203,855 4.01. -0.17 (-4.07%) As of 12:45PM EDT. Market open.  |

|

|

|

Post by joeypotsandpans on Jun 1, 2022 12:00:47 GMT -5

Volume in MNKD once again today is large. At 30 mins of trade. real time, 321,970 summary, 461,225 4.14. -0.04 (-0.9569%) MNKD Volume at the half day of trade. High volume. Real time, 2,542,112 shares. Summary, 3,579,849 Avg. Volume 4,203,855 4.01. -0.17 (-4.07%) As of 12:45PM EDT. Market open.  Normal retrace/retest of the 200d, and former resistance/breakout, nice area to catch shares for those that didn't want to get left behind IMO 😉 |

|

|

|

Post by peppy on Jun 1, 2022 12:10:20 GMT -5

MNKD Volume at the half day of trade. High volume. Real time, 2,542,112 shares. Summary, 3,579,849 Avg. Volume 4,203,855 4.01. -0.17 (-4.07%) As of 12:45PM EDT. Market open. of the 200d, and former resistance/breakout, nice area to catch shares for those that didn't want to get left behind IMO 😉   |

|

|

|

Post by joeypotsandpans on Jun 1, 2022 12:47:58 GMT -5

A retrace to the 100W (green MA on that MNKD weekly chart) would be a gift and not out of the realm but suspect it would be fleeting at best. Right now the 50W (similar to 200d) is where it seems to want to give it a good test. XBI is still weak, however it's RSI is diverging so may be trying to bottom in the mid 60's here.

|

|

|

|

Post by peppy on Jun 1, 2022 15:45:38 GMT -5

MNKD Nasdaq real time volume, 6,240,650 shares. MNKD Nasdaq summary volume, 7,882,056 Avg. Volume 4,203,855 $4.16. -0.0200 (-0.48%) Daily charts    |

|