|

|

Post by peppy on Oct 3, 2022 15:12:43 GMT -5

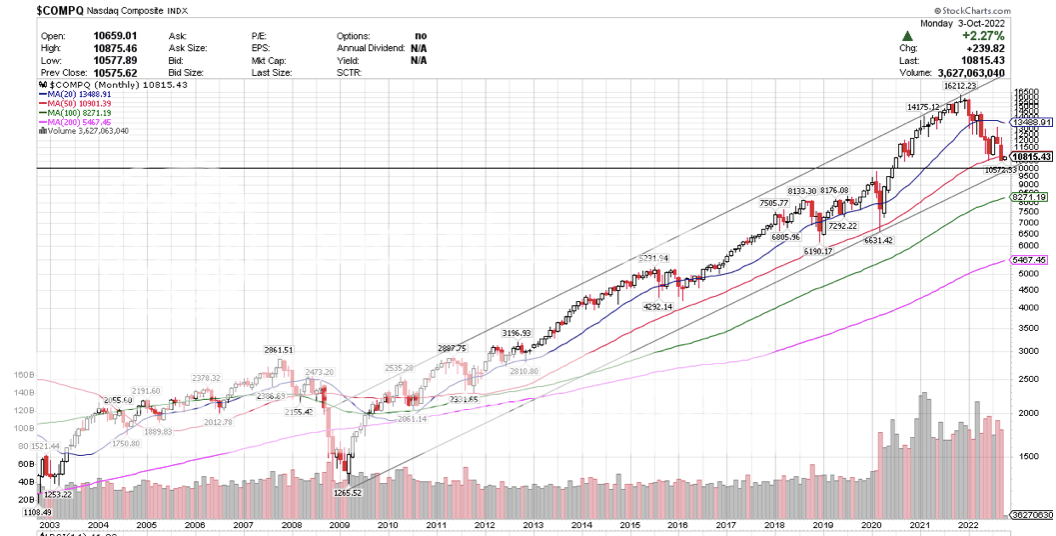

MNKD nasdaq real time volume 3,786,841 shares. MNKD Nasdaq summary volume, 3,693,424 Avg. Volume 4,626,180 $3.090. .00 (0.00%) MNKD no charting change. Before people get all bull market bent, todays action was support and resistance on the Nasdaq. A retrace back up to the 50 month.  |

|

|

|

Post by runner on Oct 4, 2022 15:02:55 GMT -5

Thankfully we got some juice heading into the close.

|

|

|

|

Post by peppy on Oct 4, 2022 15:23:23 GMT -5

MNKD Nasdaq real time volume, 4,910,829 shares. MNKD Nasdaq summary volume, 4,828,332 Avg. Volume 4,613,085 $3.23. +0.14 (+4.5307%) A million shares came in at the end of the day. MNKD did not make new lows with the market.    UN urges Fed to pause interest rate hikes on global recession fears Higher interest rates represent an 'imprudent gamble,' UN agency warns |

|

|

|

Post by peppy on Oct 5, 2022 9:31:04 GMT -5

|

|

|

|

Post by peppy on Oct 6, 2022 11:46:11 GMT -5

MNKD volume at the half day of trade,

real time, 1,109,236 shares.

summary, 1,119,440

Avg. Volume 4,470,170

$3.2206+0.0706 (+2.2413%

$Compq down 8

$SPX down 12

|

|

|

|

Post by prcgorman2 on Oct 6, 2022 12:33:04 GMT -5

And Dow down 200.

|

|

|

|

Post by prcgorman2 on Oct 6, 2022 15:06:59 GMT -5

Dow down 346. Nasdaq Composite down 75. MNKD up .08 on modest volume. Are shares becoming more scarce and more expensive to borrow?

|

|

|

|

Post by peppy on Oct 6, 2022 15:19:22 GMT -5

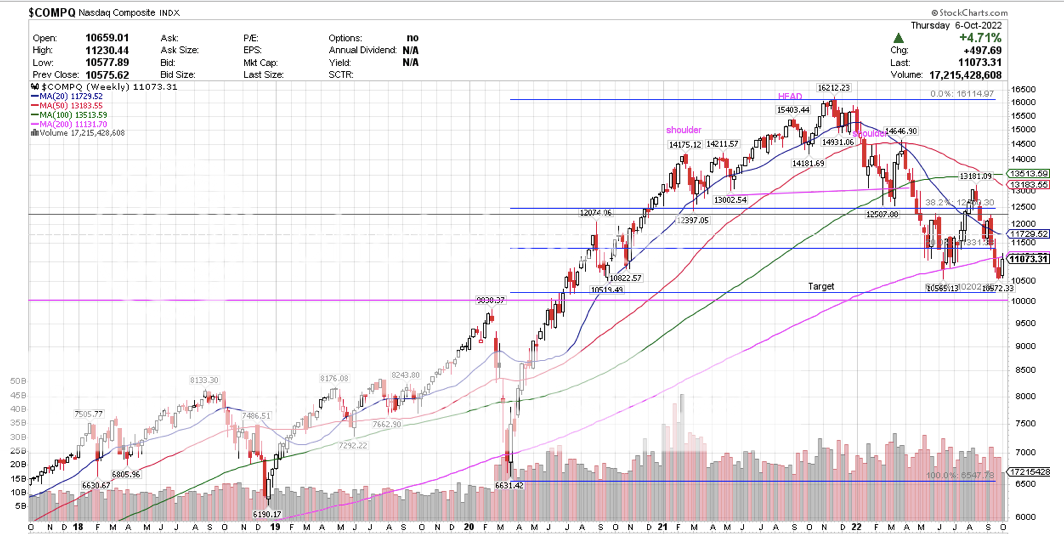

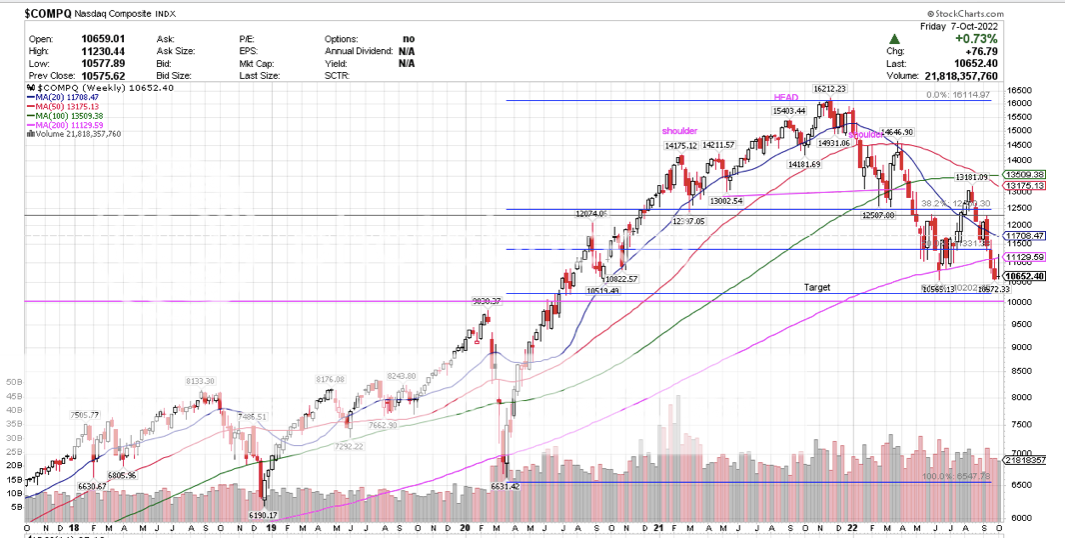

MNKD volume at the half day of trade, real time, 1,109,236 shares. summary, 1,119,440 Avg. Volume 4,470,170 $3.2206+0.0706 (+2.2413% $Compq down 8 $SPX down 12 MNKD Nasdaq real time volume, 3,066,092 shares. MNKD Nasdaq summary volume, 2,996,068 $3.23. +0.08 (+2.54%) Weekly charts. CHOP. MNKD weekly, a difficult lift.  UTHR weekly, the same, difficult lift, however UTHR still holding point of break out and price is holding above it.  COMPQ retracing back up to the 200 week, which is now resistance.  The IBB is running red today. |

|

|

|

Post by cretin11 on Oct 6, 2022 21:51:23 GMT -5

Dow down 346. Nasdaq Composite down 75. MNKD up .08 on modest volume. Are shares becoming more scarce and more expensive to borrow? Shares still plentiful and cheap to borrow (lending rates also correspondingly low). bocagirl, please correct me if wrong. |

|

|

|

Post by boca1girl on Oct 7, 2022 0:38:22 GMT -5

Dow down 346. Nasdaq Composite down 75. MNKD up .08 on modest volume. Are shares becoming more scarce and more expensive to borrow? Shares still plentiful and cheap to borrow (lending rates also correspondingly low). bocagirl, please correct me if wrong. My shares haven’t been out on loan for a couple of years. I don’t know what Fidelity is paying or asking to loan. |

|

|

|

Post by Thundersnow on Oct 7, 2022 1:05:53 GMT -5

Shares still plentiful and cheap to borrow (lending rates also correspondingly low). bocagirl, please correct me if wrong. My shares haven’t been out on loan for a couple of years. I don’t know what Fidelity is paying or asking to loan. It's been a few years since Fidelity or Schwab asked for shares to borrow. Those day are over but I have to say getting 70% interest was great while it lasted. |

|

|

|

Post by cretin11 on Oct 7, 2022 8:04:37 GMT -5

Thanks boca and thunder. Those were indeed the days. Shares scarce, rates sky high, and the expectation of impending MOASS.

|

|

|

|

Post by peppy on Oct 7, 2022 9:33:26 GMT -5

MNKD Volumes at 1 hour of trade, real time, 300,868 shares. summary, 301,491 Avg. Volume 4,475,543 $3.27. +0.04 (+1.24%) www.nasdaq.com/market-activity/stocks/mnkd/real-timefinance.yahoo.com/quote/MNKD?p=MNKD&.tsrc=fin-srchNasdaq 10,785.15 -288.16(-2.60%) $SPX 3,672.37 -72.15(-1.93%) Low volume, Is Tyvasso DPI sales being priced in? |

|

|

|

Post by peppy on Oct 7, 2022 11:47:57 GMT -5

MNKD Volume at the half day of trade.

real time, 1,041,172 shares.

summary,1,041,184

$3.275. +0.045. (+1.3932%)

As of 12:45PM EDT. Market open.

Nasdaq,

10,677

-394.66(-3.56%)

$SPX

3,649.57

-94.95(-2.54%)

|

|

|

|

Post by peppy on Oct 7, 2022 15:30:53 GMT -5

MNKD Nasdaq real time volume, 3,796,570 shares. ...................... www.nasdaq.com/market-activity/stocks/mnkd/real-timeMNKD Nasdaq summary volume, 3,784,166. .................................https://finance.yahoo.com/quote/MNKD?p=MNKD&.tsrc=fin-srch Avg. Volume 4,475,543 $3.21 -0.02 (-0.62%) Weekly charts.  The $COMPQ testing May lows, two weeks in a row, ending on lows. MNKD has not made new lows and did not end the week on lows. COMPQ through its 200 week MA. As I was seeing number, 10,652, I was thinking 652 points to target. 10,000 is target, I think it will hit, I expect bounce at 10,000, a Round number, twice the 5,000 high of 2000. After that I have nothing.  $SPX last weeks low was a lower low, looks stronger than the COMPQ. The $SPX still holding it's 200 week and bouncing from, coming down not as thombstone as the $COMPQ.  The INDU below its 200 week still has a bit to go to close the gap.  MSFT on all three of these indices, has a measured move to 200. That may be a tell.  MNKD price behavior looks like it has some strength. It is a 3 dollar stock. Have you noticed the valuations drop on the individual stock prices? |

|