|

|

Post by celo on Nov 8, 2022 9:57:16 GMT -5

Nice upward breakout of a upward channel that it's been in for the last month. My analysis is usually the kiss of death

|

|

|

|

Post by castlerockchris on Nov 8, 2022 11:07:25 GMT -5

Oh Castle. All this talk about 10% move up on earnings over 30MM gets me very, very concerned with MNKD. If history is any guide, we will be disappointed tomorrow as MNKD tends to spend all it gets and the losses keep mounting. There is no balance between R&D and reducing the quarterly losses to a repeatable trend towards a profit. Ok, but would you take 32mm in revenue, a 6% move up in the stock price and more than $30mm in deferred revenue? I, like you, continue to be concerned with the expense side of the income statement. However, without real insight into the SG&A number I am hoping that most of the increase it is a reflection of ramping up T-DPI production, in which case it will continue for several quarters along with the cost of revenue line. But if MNKD continues to grow revenue at 78% YOY I think we will be in good shape. |

|

|

|

Post by celo on Nov 8, 2022 11:16:37 GMT -5

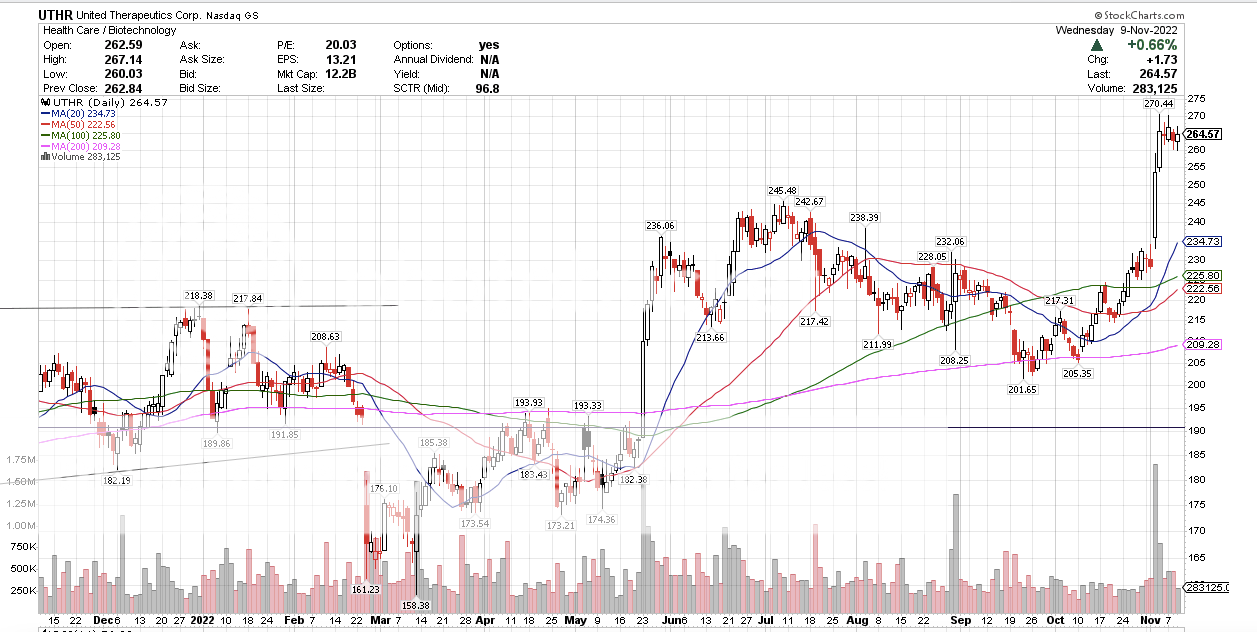

Oh Castle. All this talk about 10% move up on earnings over 30MM gets me very, very concerned with MNKD. If history is any guide, we will be disappointed tomorrow as MNKD tends to spend all it gets and the losses keep mounting. There is no balance between R&D and reducing the quarterly losses to a repeatable trend towards a profit. Ok, but would you take 32mm in revenue, a 6% move up in the stock price and more than $30mm in deferred revenue? I, like you, continue to be concerned with the expense side of the income statement. However, without real insight into the SG&A number I am hoping that most of the increase it is a reflection of ramping up T-DPI production, in which case it will continue for several quarters along with the cost of revenue line. But if MNKD continues to grow revenue at 78% YOY I think we will be in good shape. Where is that in explaining current and future cost of revenue for DPI? It could/should be a bottom line gold mine. UTHR's patients love DPI. Massive growth. |

|

|

|

Post by peppy on Nov 8, 2022 12:51:28 GMT -5

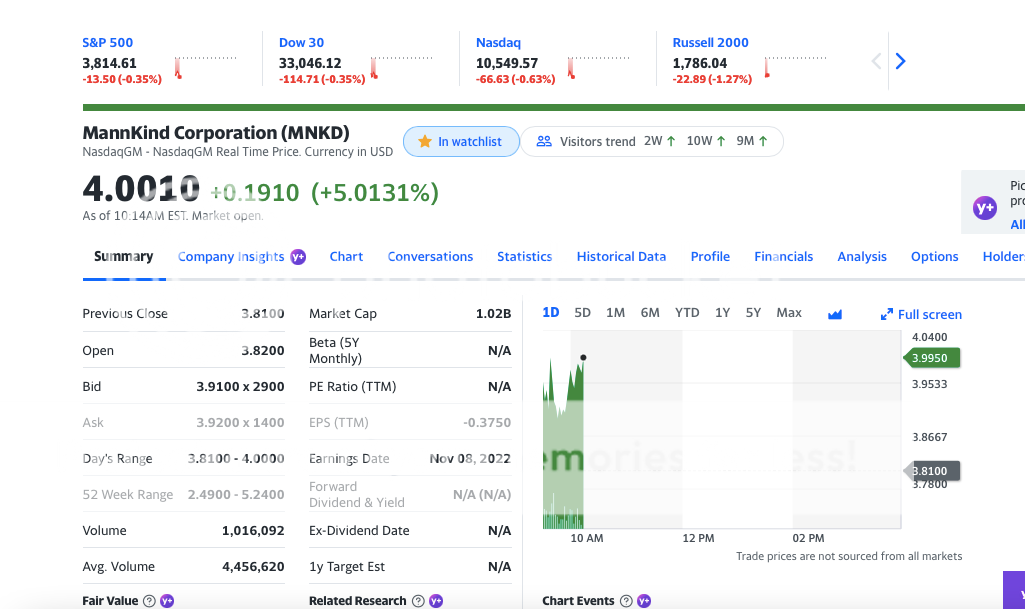

MNKD volume at the half day of trade, real time, 1,897,217 summary, 1,897,217 Avg. Volume 4,450,075 $3.88. +0.25 (+6.8871%) finance.yahoo.com/quote/MNKD?p=MNKDresistance here at $3.88, $3.97 $4.05 POINT of break out looks like $4.40. with resistance at $4.75. |

|

|

|

Post by castlerockchris on Nov 8, 2022 13:56:21 GMT -5

Ok, but would you take 32mm in revenue, a 6% move up in the stock price and more than $30mm in deferred revenue? I, like you, continue to be concerned with the expense side of the income statement. However, without real insight into the SG&A number I am hoping that most of the increase it is a reflection of ramping up T-DPI production, in which case it will continue for several quarters along with the cost of revenue line. But if MNKD continues to grow revenue at 78% YOY I think we will be in good shape. Where is that in explaining current and future cost of revenue for DPI? It could/should be a bottom line gold mine. UTHR's patients love DPI. Massive growth. I agree, T-DPI has a very bright future and we are only seeing the very tip of the iceberg. Dr. R is not in the habit of overhyping and setting the bar too high - she knows the price the company would pay for that. They see the trajectory and see the results that none of us are privilaged to see. If anybody thinks MNKD is going to have to take 10 years to recognize the differed 30mm that is on the books, I have a bridge up for sale. The fact that the inventory of DPI grew so significantly during Q3 tells me UT is placing its orders well in advance and they are much bigger than originally projected. Binder saying the differed revenue can be recognized over the life of the contract, is accurate, but it also gives them an ace in the hole to play when needed to hit revenue or cash flow targets. My other thoughts on the inventory build up - I am projecting the build up will continue going forward. UT is most likely providing a 12 to 18 month non-binding forecast to MNKD - boy would I like to get my hands on that report. Dr. C sees a time in the future when they might not be able to keep up with the production needs of UT (T-DPI growth, Afrezza's slow growth, MNKD 101 phase 2/3, PEDs coming on line in 2024), so he builds the inventory to protect against that moment while carefully expanding capability through better automation and physical expansion - some of which will be paid for by UT. Can't wait to continue seeing T-DPI's growth trajectory and to read about MNKD 101's preliminary findings and pre IND meeting with the FDA in late December. I am hoping MNKD 101 is the sleeper in the room that wakes up to slap the market in the face. |

|

|

|

Post by peppy on Nov 8, 2022 17:10:36 GMT -5

MNKD volume at the half day of trade, real time, 1,897,217 summary, 1,897,217 Avg. Volume 4,450,075 $3.88. +0.25 (+6.8871%) finance.yahoo.com/quote/MNKD?p=MNKDresistance here at $3.88, $3.97 $4.05 POINT of break out looks like $4.40. with resistance at $4.75. MNKD Nasdaq real time volume, 4,521,031 MNKD Nasdaq summary volume, 4,521,731 Avg. Volume 4,450,075 $3.81. +0.18 (+4.96%) Average volume,      ===================================================================================================  |

|

|

|

Post by peppy on Nov 9, 2022 9:34:03 GMT -5

Seroius volume 2 mins into the day of trade, 115,547 Avg. Volume 4,456,620 3.9450+0.1350 (+3.5433%) As of 09:33AM EST. Market open. let's see what happens. finance.yahoo.com/quote/MNKD?p=MNKDMNKD Volume at 30 mins of trade, real time, 683,369 summary, 734,642 Avg. Volume 4,456,620 3.96. +0.15. (+3.9370%) As of 10:00AM EST. Market open. |

|

|

|

Post by peppy on Nov 9, 2022 10:16:28 GMT -5

MNKD has volume, 1 million shares at the 44 min mark. added, volume at 1 hour of trade, 1,232,859 Avg. Volume 4,456,620 3.9900+0.1800 (+4.7244%) resistance to break, $4.00, $4.05, $4.25, $4.50.  |

|

|

|

Post by peppy on Nov 9, 2022 16:25:13 GMT -5

MNKD Nasdaq real time volume, 7,212,330 shares. MNKD Nasdaq summary volume, 7,196,202 Avg. Volume 4,456,620 $3.86. +0.05 (+1.31%) Charts.       |

|

|

|

Post by runner on Nov 9, 2022 16:42:53 GMT -5

Good to see we stayed in the green in a sea of red. Healthy volume too.

Thanks for the charts, Peppy.

|

|

|

|

Post by peppy on Nov 10, 2022 9:41:24 GMT -5

MNKD has volume this morning.10 mins of trade, real time, 322,372 summary,332,993 4.0760+0.2160 (+5.5959%) As of 09:41AM EST. Market open. finance.yahoo.com/quote/MNKD?p=MNKD&.tsrc=fin-srchMNKD Volume at 30 mins of trade, real time, 692,875 shares. summary, 697,490 Avg. Volume 4,499,100 4.0650+0.2050 (+5.3109%) As of 10:00AM EST. Market open. MNKD catching the Nasdaq % up now, come on you laggard.  With this type of volume MNKD should keep moving up. MNKD volume at 1 hour of trade, real time, 1,137,187 shares. summary, 1,141,203 Avg. Volume 4,499,100 3.96. +0.10 +2.4611% MNKD volume at 2 hours of trade,.........( trade slowed down to 600,000 an hour which is still high volume.) real time, 1,738,572 summary, 1,740,486 $4.0350. +0.1750 (+4.5337%) biotech in general lagging today. Nasdaq up 6% |

|

|

|

Post by peppy on Nov 10, 2022 12:46:06 GMT -5

MNKD Volume at the half day of trade,

real time, 2,473,287 shares.

summary, 2,473,345

Avg. Volume 4,499,100

$4.00. +0.14. (+3.6269%)

As of 12:45PM EST. Market open.

Push.

|

|

|

|

Post by sayhey24 on Nov 10, 2022 15:07:24 GMT -5

Peppy - not to jinx things but is this the first time we have had good news and the pps went up a lot?

|

|

|

|

Post by celo on Nov 10, 2022 15:26:24 GMT -5

Awesome day!

|

|

|

|

Post by pat on Nov 10, 2022 15:28:04 GMT -5

Where is that in explaining current and future cost of revenue for DPI? It could/should be a bottom line gold mine. UTHR's patients love DPI. Massive growth. I agree, T-DPI has a very bright future and we are only seeing the very tip of the iceberg. Dr. R is not in the habit of overhyping and setting the bar too high - she knows the price the company would pay for that. They see the trajectory and see the results that none of us are privilaged to see. If anybody thinks MNKD is going to have to take 10 years to recognize the differed 30mm that is on the books, I have a bridge up for sale. The fact that the inventory of DPI grew so significantly during Q3 tells me UT is placing its orders well in advance and they are much bigger than originally projected. Binder saying the differed revenue can be recognized over the life of the contract, is accurate, but it also gives them an ace in the hole to play when needed to hit revenue or cash flow targets. My other thoughts on the inventory build up - I am projecting the build up will continue going forward. UT is most likely providing a 12 to 18 month non-binding forecast to MNKD - boy would I like to get my hands on that report. Dr. C sees a time in the future when they might not be able to keep up with the production needs of UT (T-DPI growth, Afrezza's slow growth, MNKD 101 phase 2/3, PEDs coming on line in 2024), so he builds the inventory to protect against that moment while carefully expanding capability through better automation and physical expansion - some of which will be paid for by UT. Can't wait to continue seeing T-DPI's growth trajectory and to read about MNKD 101's preliminary findings and pre IND meeting with the FDA in late December. I am hoping MNKD 101 is the sleeper in the room that wakes up to slap the market in the face. Regarding expenses - I imagine the comment about high fixed cost and low marginal applies to DPI production as well. As DPI ramps up it should act to lower the per unit cost of everything manufactured in Danbury. |

|