|

|

Post by celo on Dec 7, 2022 12:30:38 GMT -5

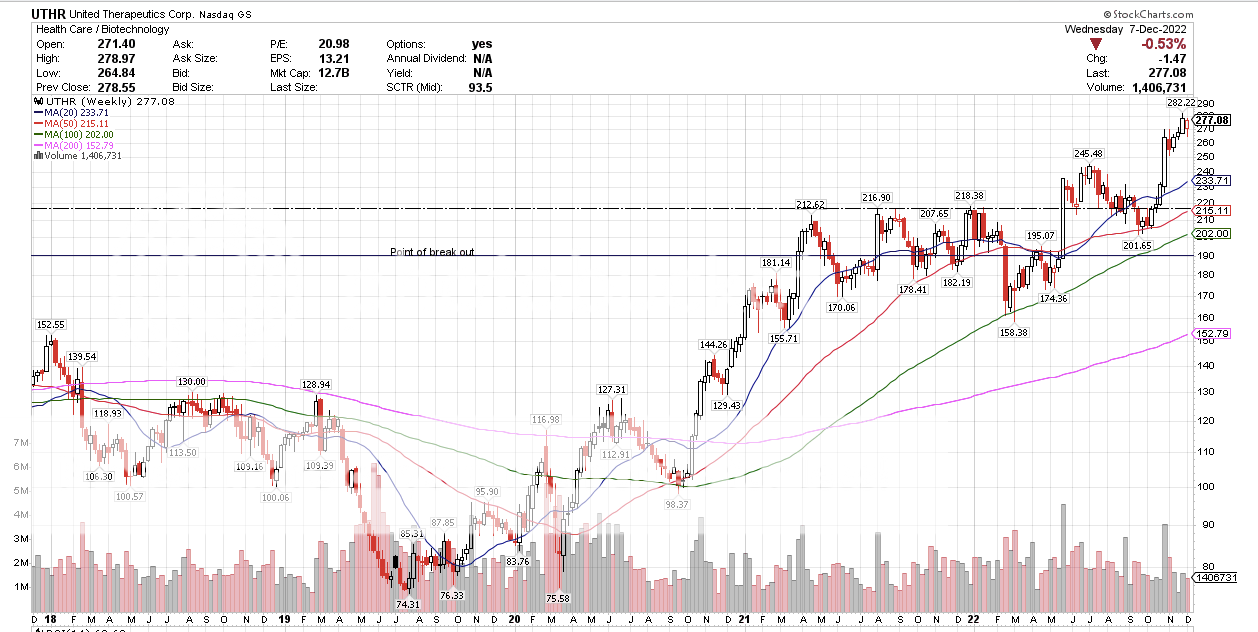

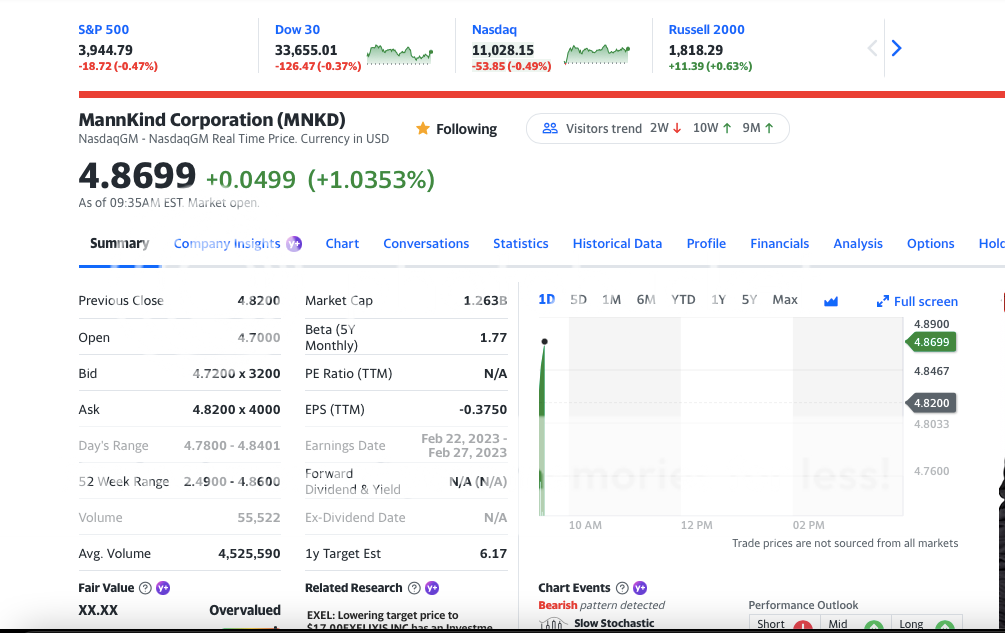

United recovers after GS bad mouths them. MNKD on the other hand ends up down more than 4%. Both stocks broke downward through a small upward trending channel. MNKD will bounce off of 4.50 (top of the previous upward push) or 4.38 which is a 10% drop and also the top of the long term trend line (blue) pep has on her MNKD chart. This is barring some general market disaster. IMO Bounced off of 4.50. Not sure where it is going now after consolidation. |

|

|

|

Post by peppy on Dec 7, 2022 12:48:05 GMT -5

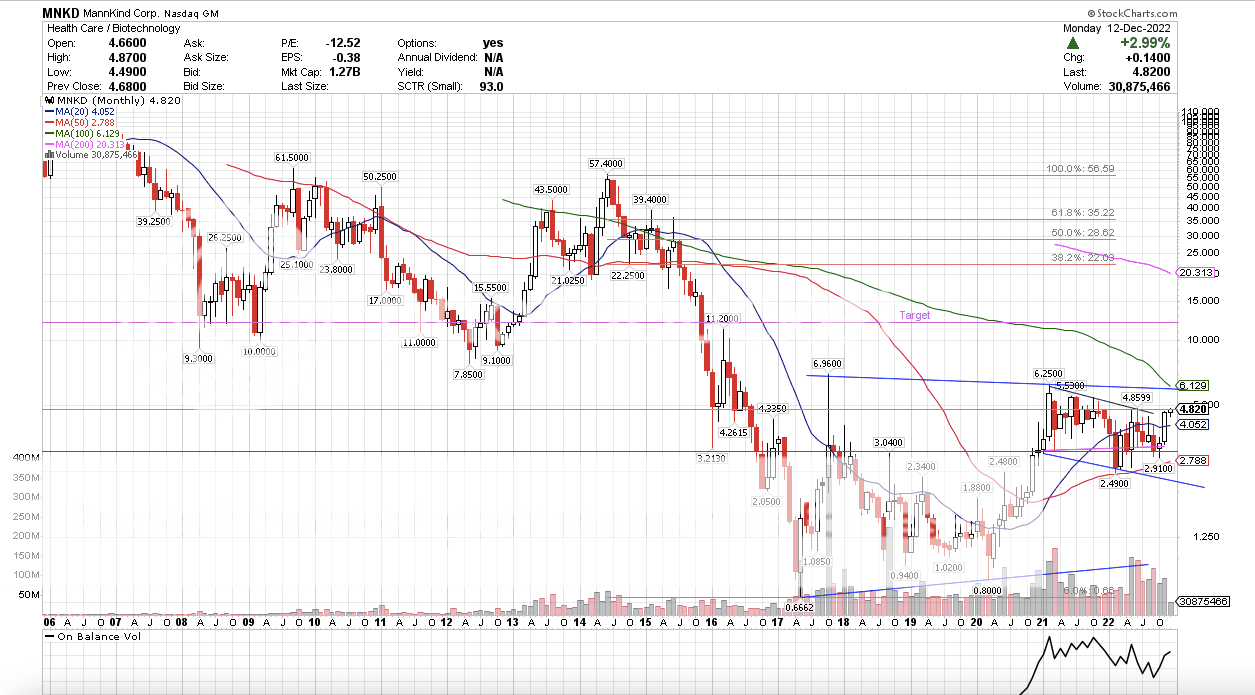

I can not help myself from talking, I have been watching this trade, leaving it's point of entry and the set up. Everything seems to be working. So here is the trade once again. the break and hold of $4.40 wedge is targeting the top of the wedge which is $6.50. Stop, $4.35. On prices way to $6.50 the second trade set up seen on the chart, the 5 year cup and handle triangle break sets up for a break and hold of $6.25 that targets $12. sportsrancho compound26MNKD volume at the half day of trade, real time, 1,017,501 summary, 1,017,517 Avg. Volume 4,550,639 4.655. +0.085. (+1.8600%) As of 12:45PM EST. Market open. $4.66, $4.75, $4.86  |

|

|

|

Post by peppy on Dec 7, 2022 16:06:38 GMT -5

MNKD Nasdaq real time volume, 3,178,260 shares.

MNKD Nasdaq summary volume, 3,171,645...............15 mins prior to the close, 2,098,503....a million shares came in at the end of the day.

Avg. Volume 4,550,639

$4.70. +0.13 (+2.84%)

We have ignition, we have targets, price behavior is par for the course.

|

|

|

|

Post by hellodolly on Dec 7, 2022 16:14:37 GMT -5

MNKD Nasdaq real time volume, 3,178,260 shares. MNKD Nasdaq summary volume, 3,171,645...............15 mins prior to the close, 2,098,503....a million shares came in at the end of the day. Avg. Volume 4,550,639 $4.70. +0.13 (+2.84%) We have ignition, we have targets, price behavior is par for the course. These last minute increases in volume we've been seeing, along with the rise in SP...do you suspect big money has been quietly accumulating to keep a lid on it so it won't get out of hand on them? I looked at volume almost an hour after the open and we hadn't even hit 10% of the 10d avg. |

|

|

|

Post by peppy on Dec 7, 2022 16:25:21 GMT -5

MNKD Nasdaq real time volume, 3,178,260 shares. MNKD Nasdaq summary volume, 3,171,645...............15 mins prior to the close, 2,098,503....a million shares came in at the end of the day. Avg. Volume 4,550,639 $4.70. +0.13 (+2.84%) We have ignition, we have targets, price behavior is par for the course. These last minute increases in volume we've been seeing, along with the rise in SP...do you suspect big money has been quietly accumulating to keep a lid on it so it won't get out of hand on them? I looked at volume almost an hour after the open and we hadn't even hit 10% of the 10d avg. The volume was slow this morning. 3 mins between trades.... The end of day stuff. What I think. I think MNKD share price is going to be brought up now. (Took long enough) Yes, accumulation. Get the price over 5 dollars the next move. Did you see celo's post? 12 US dollars is 3 billion dollar market cap. that is the target, for now. "4q 2022 will really be a bellwether for revenue going forward for Tyvaso DPI. At the end of this year, United has said they want 6k patients on Tyvaso. From the 3Q report, Tyvaso and Tyvaso DPI are splitting those patients evenly. For ease and simplification, half or 3k patients using Tyvaso DPI by end of 2022. Probably that ratio will swing more in favor of DPI going forward. From the November 2022 United report, they believe they will have 25k patients by the end of 2025. At that point in time, DPI should dominate with 60% of the patient mix. Probably be higher percentage, but we will say 60%. That is a growth of 3k patients now, to 15k patients by the end of 2025. That represents a 5x growth in revenue in 3 years. The 4Q will allow us to see DPI revenue potential because it will be the first qtr of stable week to week usage. Therefore, projecting 4Q tyvaso revenue for Mannkind at 40 million (manufacturing and royalty payments) for 4Q 2022 gives the potential of 200 million revenue for 4Q25 or almost 800 million in annual revenue. Using an 8 to 10x revenue multiple for market cap which is conservative as this would be a growth stock, allows for an 10 to 12 billion market cap. Or a price of 35-40 by 2025. Mannkind does have dilution due to the debt which would knock the price down a bit. There should be other revenue possibilities knocking on the door after the multiple quarters success of Tyvaso DPI. Those should bear out at the end of 2023 as pharm companies see the continued uptake and use of DPI. Those factors into the price are hard to ascertain and may be large." |

|

|

|

Post by peppy on Dec 7, 2022 19:06:18 GMT -5

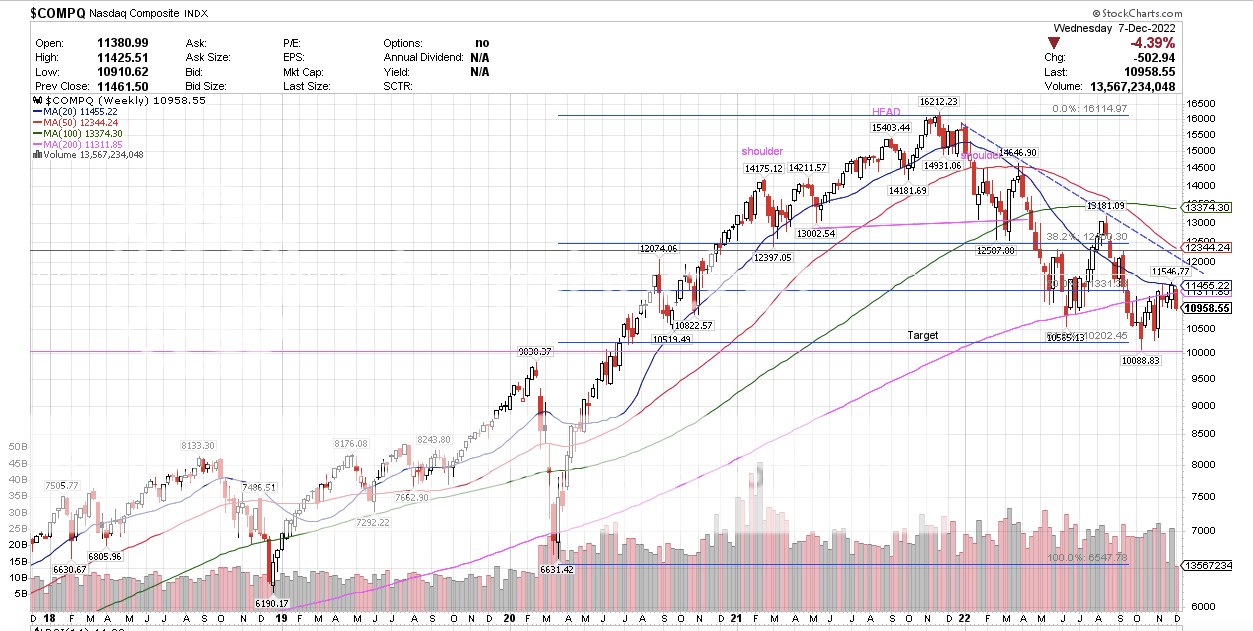

ad nauseam  Both packing inside weeks.   Have you seen the $COMPQ? MNKD and UTHR look locked and loaded. The name of the thread, Volume Ten, tell me when... WHEN, WHEN, WHEN. |

|

|

|

Post by peppy on Dec 8, 2022 10:32:26 GMT -5

MNKD volume at one hour of trade,

real time, 490,034 shares.

summary, 490,034

Avg. Volume 4,532,195

$4.78. +0.08 (+1.70%)

$4.86 next resistance which is the 52 week high.

Let's see if more volume comes in.

|

|

|

|

Post by peppy on Dec 8, 2022 16:22:45 GMT -5

MNKD Nasdaq real time volume, 2,954,878 shares. MNKD Nasdaq summary volume, 2,916,668 Avg. Volume 4,532,195 $4.82. +0.12 (+2.55%) 6 cents away from the 52 week high of $4.86, 7 cents away from a new 52 week high. I am thinking it happens tomorrow. No volume up shot at the end of day today. 1 million shares traded the last two hours of trade. MNKD daily, the 50 day is going through the 100 day, all moving averages are lining up it order on the daily. Always good.  Hopefully MNKD will push the resistance tomorrow, see it?   The $compq daily. looks like tiny little bear flag.  |

|

|

|

Post by peppy on Dec 9, 2022 9:37:20 GMT -5

MNKD new 52 week high. Let's break $5.00 today. $4.97 resistance.  |

|

|

|

Post by peppy on Dec 9, 2022 10:31:31 GMT -5

MNKD volume at 1 hour of trade,

real time, ::485,611 shares.

summary, 486,827

Avg. Volume 4,525,590

$4.805. -0.015 (-0.3112%)

As of 10:30AM EST. Market open.

$4.87 the new 52 week high, 5 and 1/2 cents away.

|

|

|

|

Post by peppy on Dec 9, 2022 16:16:08 GMT -5

MNKD Nasdaq real time volume, 4,452,361 shares. MNKD Nasdaq summary volume, 4,439,816 Avg. Volume 4,525,590 $4.67. -0.15 (-3.11%) two hours prior to the close, the volume was, 1,482,166 shares. 1 million shares came in between 3.30 est. and 3:37 est.. the share price stayed the same at $4.752. Close, but no cigar.   |

|

|

|

Post by peppy on Dec 12, 2022 11:02:51 GMT -5

1 and 1/2 hours of trade,

811,764 shares.

Avg. Volume 4,522,315

$4.815. +0.145. (+3.1049%)

|

|

|

|

Post by runner on Dec 12, 2022 15:32:25 GMT -5

Very healthy volume today with 30 minutes to go.

|

|

|

|

Post by peppy on Dec 12, 2022 16:20:18 GMT -5

MNKD Nasdaq real time volume, 5,192,682 shares. times $4.84 = 25 million. MNKD Summary volume, 5,968,042 Avg. Volume 4,522,315 $4.84. +0.17 (+3.64%) At close: 04:00PM EST   We can see the resistance MNKD is going to break on the monthly chart, look left. Volume coming in well. I want see MNKD go up on increased volume. One more pride thingy, after reading the board. I managed to call a head and shoulders on the US markets and give the measured move. scroll up. The monthly MNKD chart has a price target. The MNKD price target is going to meet just like the NASDAQ and $SPX and $DOW targets met.  |

|

|

|

Post by runner on Dec 12, 2022 17:24:08 GMT -5

Pep, Do you think this is the week we get to break out the cigars for a new 52 week high?

|

|