|

|

Post by nylefty on Nov 19, 2022 19:41:41 GMT -5

Peppy: The key words are "each insulin product covered by our plan." Do they cover Afrezza? Their message doesn't say. Maybe you should ask.

|

|

|

|

Post by peppy on Nov 19, 2022 20:02:17 GMT -5

Peppy: The key words are "each insulin product covered by our plan." Do they cover Afrezza? Their message doesn't say. Maybe you should ask. It s in their formulary. nylefty help me out here, does that mean covered? When I saw the formulary and I saw it once when I went in, Afrezza was there on tier 6 perhaps, I am guessing, perhaps tier 5. It was there on a tier. What is your take? Also MTOI messaged me and pointed out, Mike C said this was coming during the conference call, I could scroll back and copy and paste. What do you think?  If I have to, I guess I could dig up the passwords and stuff to look at their formulary. |

|

|

|

Post by agedhippie on Nov 19, 2022 20:06:04 GMT -5

today in my mailbox from Aetna. Changes to the SilverScrip SmartSaver (PDP) 2023 Annual Notice of Change (ANOC) agedhippie sayhey24  What do we think now? Contact the Customer Care number? My summary is if the insulin isn't in the plan it's not covered by the $35 cap. For those with time and who want to see the workings behind that statement... The site has been updated which is not surprising since that is usually faster physical mail. I ran some dummy costings through the site. The monthly premium + co-pay is slightly less than $35 in all cases (I think the difference is tax). The site also has this boxed insert: Important message about what you pay for insulin

You won’t pay more than $35 for a one-month supply of each insulin product covered by our plan, no matter what cost-sharing tier it’s on, even if your plan has a deductible that you haven’t paid.The operative part is the phrase " covered by our plan". The IRA only applies to insulins in the formulary, not all insulins. Now lets look at the cms.gov site for the official description as opposed to the Medicare PR: Insulin cost-sharing

Starting January 1, people enrolled in a Medicare prescription drug plan will not pay more than $35 for a month’s supply of each insulin that they take and is covered by their Medicare prescription drug plan and dispensed at a pharmacy or through a mail-order pharmacy. Also, Part D deductibles won’t apply to the covered insulin product. Again, that phrased, " covered by their Medicare prescription drug plan". Now, and only if you have more time that sense, read the actual Act itself: H.R.5376 - Inflation Reduction Act of 2022. Specifically Section 11406 and 11408. Section 11406 sets out the how the Social Security Act is amended to account for this (yes, you are going to have to go and read the Social Security Act as well, there are links in the doc), and Section 11408 sets out how section 223(c) of the Internal Revenue Code of 1986 is amended to protect people from tax complications if their plans are not compliant. This stuff is complicated and I am still not 100% certain I have it right, but I find it always pay to check the sources (Aetna's formulary and the relevant legislation) rather than rely on PR releases. For those with a life; this is the relevant text in Sec 11406 that defines a covered insulin (my emphasis): (C) COVERED INSULIN PRODUCT.—In this paragraph, the term ‘covered insulin product’ means an insulin product that is a covered part D drug covered under the prescription drug plan or MA–PD plan that is approved under...

So we have a thread from the Act with the definition of a covered insulin, through the CMS with the directive for implementation, to Aetna and the boxed call out on the impact on their plans. With that I think we can close the book, certainly I am done! |

|

|

|

Post by peppy on Nov 19, 2022 20:19:05 GMT -5

agedhippie covered or not? What is your take in this woman needs the simple language from some one who read the stuff.

You said once the secret to know if it is covered by their formulary is, Is it cheaper? (An aside, Kind of humorous, I got another letter saying silver script price when down to like $4.98 or something like that today as well.) Also, agedhippie ; Mike C; First, we want to quick start program to get patients started quickly here in Q4 to pilot that as we get ready for next year to house scale our business. In 2023, we fully expect that Afrezza will be covered in Medicare at $35 under the inflation protection act bill that was passed. That changes the game as one of the major objections for Afrezza is around access, I really want you to see that patients can only pay $35 for Afrezza and it's not a short while a low-cost cash program available. We expect to finally launch BluHale [Inaudible], which is our patient addition integrated with CGM in Q1 as a pilot with a full-scale launch in Q2 next year soon if that goes well. you know it is over my head, what isn't over my head is the price set up. That is what I recognize. November, December, January!

|

|

|

|

Post by agedhippie on Nov 19, 2022 20:53:58 GMT -5

agedhippie covered or not? What is your take in this woman needs the simple language from some one who read the stuff.... Afrezza is not in your 2023 formulary so it is not covered by the $35 cap for you. If anyone else wants to check - look in your 2023 formulary, it's the only site that matters. If Afrezza is not there then you are not getting Afrezza capped at $35. |

|

|

|

Post by uvula on Nov 19, 2022 21:29:56 GMT -5

Wouldn't insurance companies be less likely to add afrezza to their formulary if it will cost them a lot of money due to the $35 cap? (Patients in the long run will be better off but I doubt the insurance companies care about stuff like that.)

|

|

|

|

Post by lennymnkd on Nov 20, 2022 6:35:10 GMT -5

Wouldn't insurance companies be less likely to add afrezza to their formulary if it will cost them a lot of money due to the $35 cap? (Patients in the long run will be better off but I doubt the insurance companies care about stuff like that.) Isn’t the government subsidizing the balance Of all cost … to pharma / insurance |

|

|

|

Post by sayhey24 on Nov 20, 2022 8:52:45 GMT -5

Peppy: The key words are "each insulin product covered by our plan." Do they cover Afrezza? Their message doesn't say. Maybe you should ask. You are correct. At Medicare.gov it clearly lists the details on afrezza as if it is covered in the plan. However under the $30k cost it says Covers 0 of 1 drugs This question needs to go back to Mannkind as to who will have afrezza coverage. I guess we can also ask our local congressman for how this is going to work with the new legislation. Here is Mike's PR from 2021 investors.mannkindcorp.com/news-releases/news-release-details/mannkind-participate-2022-medicare-part-d-senior-savings-model |

|

|

|

Post by sayhey24 on Nov 20, 2022 9:20:25 GMT -5

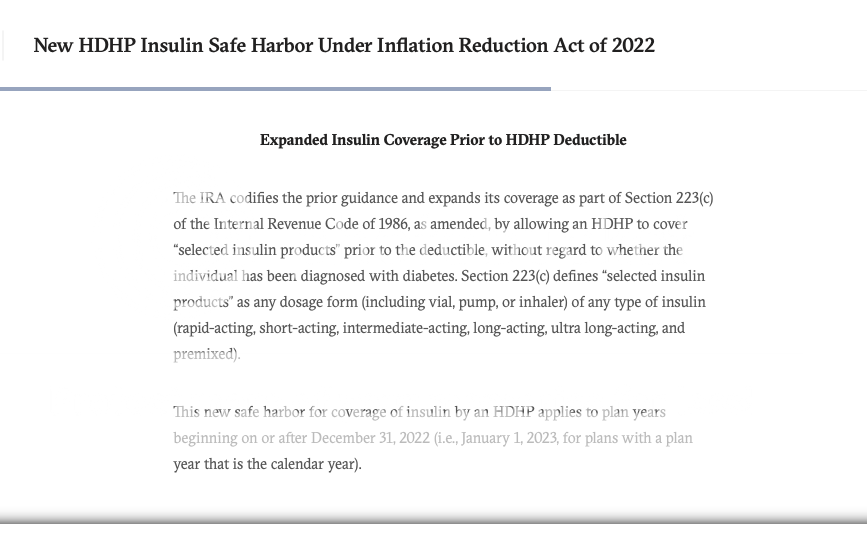

Wouldn't insurance companies be less likely to add afrezza to their formulary if it will cost them a lot of money due to the $35 cap? (Patients in the long run will be better off but I doubt the insurance companies care about stuff like that.) Isn’t the government subsidizing the balance Of all cost … to pharma / insurance Part D prescription drugs are funded by general revenues and premiums paid for out of separate accounts in the Supplementary Medical Insurance (SMI) trust fund. Its managed by private companies who are contracted by the government. I guess I will contact my congressman to try and figure out what it going on. afrezza is of dosage form "inhaled" under type "rapid acting". Based on the below explanation it would need to be covered but while its listed in the details of each plan on Medicare.gov in the banner of each plan it also says 0 of 1 drug covered. IMO few will ever notice this banner when selecting a plan. "Currently, Medicare beneficiaries can choose to enroll in a Part D plan participating in an Innovation Center model in which enhanced drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit. Participating plans do not have to cover all insulin products at the $35 monthly copayment amount, just one of each dosage form (vial, pen) and insulin type (rapid-acting, short-acting, intermediate-acting, and long-acting). In 2022, a total of 2,159 Part D plans are participating in this model, or roughly one third of all Part D plans. Nearly half (45%) of non-LIS enrollees are in PDPs participating in the insulin model in 2022, based on August 2021 enrollment." www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-inflation-reduction-act/Here is the link to the Innovation Center Model which is the Part D Senior Saver Model which Mannkind joined in 2021. innovation.cms.gov/innovation-models/part-d-savings-model |

|

|

|

Post by agedhippie on Nov 20, 2022 10:04:48 GMT -5

Wouldn't insurance companies be less likely to add afrezza to their formulary if it will cost them a lot of money due to the $35 cap? (Patients in the long run will be better off but I doubt the insurance companies care about stuff like that.) Isn’t the government subsidizing the balance Of all cost … to pharma / insurance The cost is borne entirely by the insurer, it's a condition of plan approval. The insurer will negotiate rebates with their suppliers. Actually they already have those it's just that today they keep that money rather than pass it on. |

|

|

|

Post by nylefty on Nov 20, 2022 17:06:30 GMT -5

In March of last year there was much excitement expressed on this board after Mike announced that in 2022 seniors on Medicare would be able to buy Afrezza for $35 a month. What was mostly lost in all the excitement was that this would only be true if the insurance companies agreed to cover Afrezza. As it turned out, that program was a big flop (for MannKind). Now we have another $35 a month program, but again the insurance plans have to cover Afrezza. Will this be a "huge" development for MannKind this time? I'm afraid that the answer is nope.

WESTLAKE VILLAGE, Calif., March 15, 2021 (GLOBE NEWSWIRE) -- MannKind Corporation (Nasdaq: MNKD), announced today that it will participate in the 2022 Medicare Part D Senior Savings Model, which is intended to improve the affordability of insulin for Medicare beneficiaries by capping the co-pay per 30-day supply at $35. MannKind will offer all dosage strengths of Afrezza® (insulin human) Inhalation Powder, an ultra rapid-acting inhaled insulin indicated to improve glycemic control in adults with diabetes.

According to the Centers for Medicare & Medicaid Services (CMS), a third of Medicare beneficiaries have diabetes, and over 3.3 million beneficiaries use one or more dosage forms of insulin. For many, the cost of insulin can become a barrier to accessing appropriate medical treatment for diabetes management. The Medicare Part D Senior Savings Model, which launched earlier this year, provides seniors greater, and more affordable, access to the treatment options they need.

"MannKind is pleased to participate in the 2022 Medicare Part D Senior Savings Model and we are excited to partner with Part D plans to ensure their members have affordable access to the only inhaled insulin therapy,” said Michael Castagna, Chief Executive Officer of MannKind. “There are gaps in our current healthcare system when it comes to access and affordability, and we believe the Model is an important step toward addressing these issues and a potential improvement in the quality of care for seniors living with diabetes.”

|

|

|

|

Post by sayhey24 on Nov 21, 2022 9:44:52 GMT -5

Prior to the Inflation Reduction Act the Part D Senior Savings Model was voluntary. You are correct no plans covered afrezza but it was available with a prior authorization - if the plan had volunteered to participate in the SSM. I am told about 80% of the plans had volunteered but who knew? Since doctors did not see afrezza as a covered drug and who could afford $1500 especially when its not even step 1, 2 or 3 in the SoC, no doctors were prescribing and there was no focused sales effort.

I have asked for some legal help but I think what has happened is the legislation now requires all Plan D plans to cover one form of each type of insulin. The legislation specifically included inhaled insulin as a dosage form. As of right now while Medicare.gov has included it, its not listed as a "covered" drug by the plans.

When I get some clarity on this I will let you know. If in fact they are required to include one form of each type, it may take a letter from CMS notifying each plan manager that at least one dosage form of "inhaled" is required to be included in their plan. They are also required by law to refund any amount over the $35 which the patient may have paid starting 1/1/2023.

|

|

|

|

Post by sayhey24 on Nov 21, 2022 9:50:49 GMT -5

Isn’t the government subsidizing the balance Of all cost … to pharma / insurance The cost is borne entirely by the insurer, it's a condition of plan approval. The insurer will negotiate rebates with their suppliers. Actually they already have those it's just that today they keep that money rather than pass it on. The Supplemental Medical Insurance trust fund is financed by general tax revenue and the premiums enrollees pay. The Supplemental Medical Insurance (SMI) trust fund finances two voluntary Medicare programs: Part B, which mainly covers physician services and medical supplies, and Part D, the newer prescription drug program. I am not sure the $35 insulin law is now built on supplier rebates. Can you explain how you think this is now working? |

|

|

|

Post by peppy on Nov 21, 2022 10:10:42 GMT -5

Prior to the Inflation Reduction Act the Part D Senior Savings Model was voluntary. You are correct no plans covered afrezza but it was available with a prior authorization - if the plan had volunteered to participate in the SSM. I am told about 80% of the plans had volunteered but who knew? Since doctors did not see afrezza as a covered drug and who could afford $1500 especially when its not even step 1, 2 or 3 in the SoC, no doctors were prescribing and there was no focused sales effort. I have asked for some legal help but I think what has happened is the legislation now requires all Plan D plans to cover one form of each type of insulin. The legislation specifically included inhaled insulin as a dosage form. As of right now while Medicare.gov has included it, its not listed as a "covered" drug by the plans. When I get some clarity on this I will let you know. If in fact they are required to include one form of each type, it may take a letter from CMS notifying each plan manager that at least one dosage form of "inhaled" is required to be included in their plan. They are also required by law to refund any amount over the $35 which the patient may have paid starting 1/1/2023. The above will be oh happy day. One of each type of insulin including inhaled.  |

|

|

|

Post by peppy on Nov 21, 2022 12:08:19 GMT -5

today in my mailbox from Aetna. Changes to the SilverScrip SmartSaver (PDP) 2023 Annual Notice of Change (ANOC) agedhippie sayhey24  What do we think now? Contact the Customer Care number? My summary is if the insulin isn't in the plan it's not covered by the $35 cap. For those with time and who want to see the workings behind that statement... The site has been updated which is not surprising since that is usually faster physical mail. I ran some dummy costings through the site. The monthly premium + co-pay is slightly less than $35 in all cases (I think the difference is tax). The site also has this boxed insert: Important message about what you pay for insulin

You won’t pay more than $35 for a one-month supply of each insulin product covered by our plan, no matter what cost-sharing tier it’s on, even if your plan has a deductible that you haven’t paid.The operative part is the phrase " covered by our plan". The IRA only applies to insulins in the formulary, not all insulins. Now lets look at the cms.gov site for the official description as opposed to the Medicare PR: Insulin cost-sharing

Starting January 1, people enrolled in a Medicare prescription drug plan will not pay more than $35 for a month’s supply of each insulin that they take and is covered by their Medicare prescription drug plan and dispensed at a pharmacy or through a mail-order pharmacy. Also, Part D deductibles won’t apply to the covered insulin product. Again, that phrased, " covered by their Medicare prescription drug plan". Now, and only if you have more time that sense, read the actual Act itself: H.R.5376 - Inflation Reduction Act of 2022. Specifically Section 11406 and 11408. Section 11406 sets out the how the Social Security Act is amended to account for this (yes, you are going to have to go and read the Social Security Act as well, there are links in the doc), and Section 11408 sets out how section 223(c) of the Internal Revenue Code of 1986 is amended to protect people from tax complications if their plans are not compliant. This stuff is complicated and I am still not 100% certain I have it right, but I find it always pay to check the sources (Aetna's formulary and the relevant legislation) rather than rely on PR releases. For those with a life; this is the relevant text in Sec 11406 that defines a covered insulin (my emphasis): (C) COVERED INSULIN PRODUCT.—In this paragraph, the term ‘covered insulin product’ means an insulin product that is a covered part D drug covered under the prescription drug plan or MA–PD plan that is approved under...

So we have a thread from the Act with the definition of a covered insulin, through the CMS with the directive for implementation, to Aetna and the boxed call out on the impact on their plans. With that I think we can close the book, certainly I am done! saids inhaled is listed. I looked through the inflation reduction act looking for the verbiage. Then I googled it. Vial, pump, or INHALER

|

|