|

|

Post by agedhippie on Nov 21, 2022 12:28:30 GMT -5

The cost is borne entirely by the insurer, it's a condition of plan approval. The insurer will negotiate rebates with their suppliers. Actually they already have those it's just that today they keep that money rather than pass it on. The Supplemental Medical Insurance trust fund is financed by general tax revenue and the premiums enrollees pay. The Supplemental Medical Insurance (SMI) trust fund finances two voluntary Medicare programs: Part B, which mainly covers physician services and medical supplies, and Part D, the newer prescription drug program. I am not sure the $35 insulin law is now built on supplier rebates. Can you explain how you think this is now working? I don't really want to go into the whole structure of CMS because it's a rats nest. There is a government cover component in Medicare to Medicaid, for low income groups, and as a global subsidy for insurers. What we are talking about here is an insurers decision and not the edge cases. Basically the government pays a subsidy and the insurer assumes the risk (and formulary). The insulin cap isn't built into the current system, but the rebates exists (see PBMs). All that will happen is that rebate will be used to offset the cost of capping prices. This will all resolve itself in a month or two when the system goes live and we will see if Afrezza is suddenly universally available at $35 per month, or if availability remains as is. Based on my reading I expect the latter. |

|

|

|

Post by peppy on Nov 21, 2022 12:29:10 GMT -5

sayhey24, we need to find the wording in the act. inhaler. I haven't found it yet.

|

|

|

|

Post by peppy on Nov 21, 2022 12:53:55 GMT -5

|

|

|

|

Post by oldfishtowner on Nov 21, 2022 13:09:31 GMT -5

If the $35 doesn't apply to Afrezza, does the $2000 annual cap on prescription drug out-of-pocket costs apply?

|

|

|

|

Post by uvula on Nov 21, 2022 13:32:00 GMT -5

matt, we could really use your expertise right now. Are you still here?

|

|

|

|

Post by sayhey24 on Nov 21, 2022 13:55:52 GMT -5

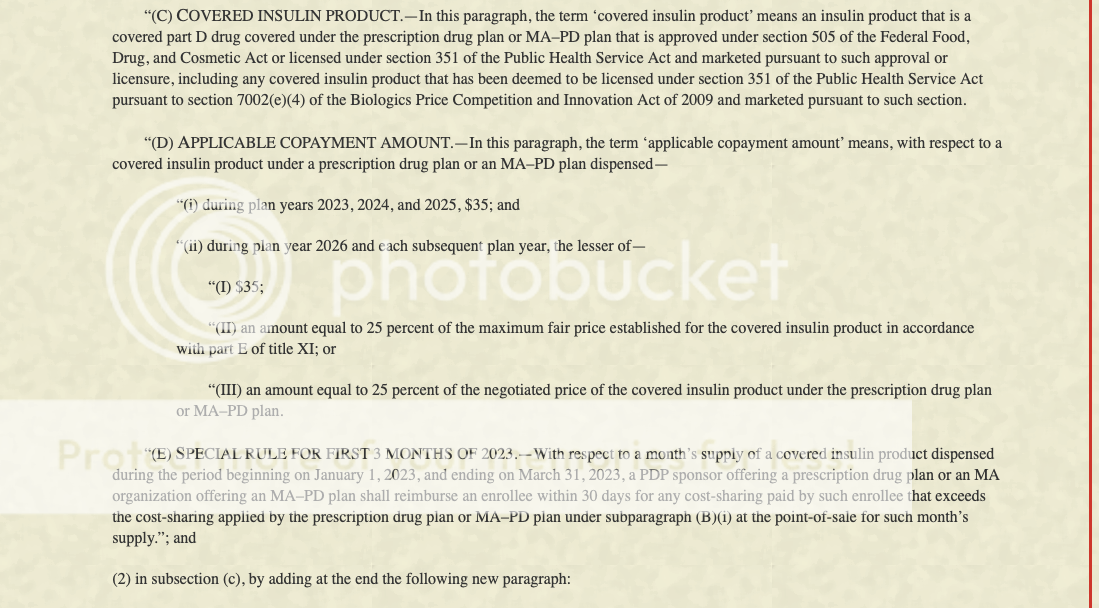

Peppy - concerning your question on dosage form here are the words from the IRA. I think someone did a replace all "pen" with inhaler although pens still are required to be a covered "form".

15 ‘‘(b) DEFINITIONS.—In this section:

16 ‘‘(1) SELECTED INSULIN PRODUCTS.—The term

17 ‘selected insulin products’ means at least one of each

18 dosage form (such as vial, pump, or inhaler dosage

19 forms) of each different type (such as rapid-acting,

20 short-acting, intermediate-acting, long-acting, ultra

21 long-acting, and premixed) of insulin (as defined

22 below), when available, as selected by the group

23 health plan or health insurance issuer.

Fish - I have confirmation from the CMS through a 3rd party the $35 does apply to afrezza. They were 100% confident of this. The question is will the beneficiary need to go through a prior authorization process or is their plan now required to "cover" afrezza as a required form "inhaled".

|

|

|

|

Post by agedhippie on Nov 21, 2022 13:59:25 GMT -5

... Fish - I have confirmation from the CMS through a 3rd party the $35 does apply to afrezza. They were 100% confident of this. The question is will the beneficiary need to go through a prior authorization process or is their plan now required to "cover" afrezza as a required form "inhaled". I definitely agree with that. If they cover Afrezza then it's subject to the $35 cap. |

|

|

|

Post by agedhippie on Nov 21, 2022 14:01:33 GMT -5

If the $35 doesn't apply to Afrezza, does the $2000 annual cap on prescription drug out-of-pocket costs apply? No because it's not part of the insurance plan and hence outside Medicare. You could use an FSA to reduce costs. |

|

|

|

Post by agedhippie on Nov 21, 2022 14:07:46 GMT -5

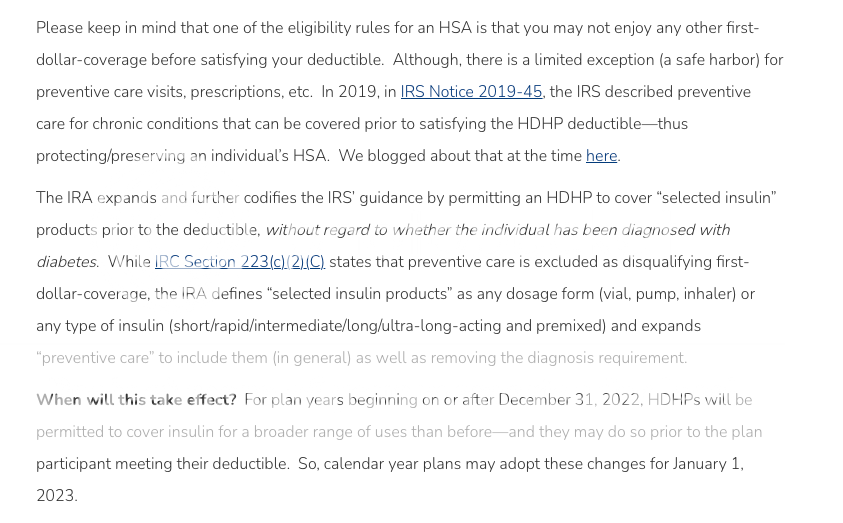

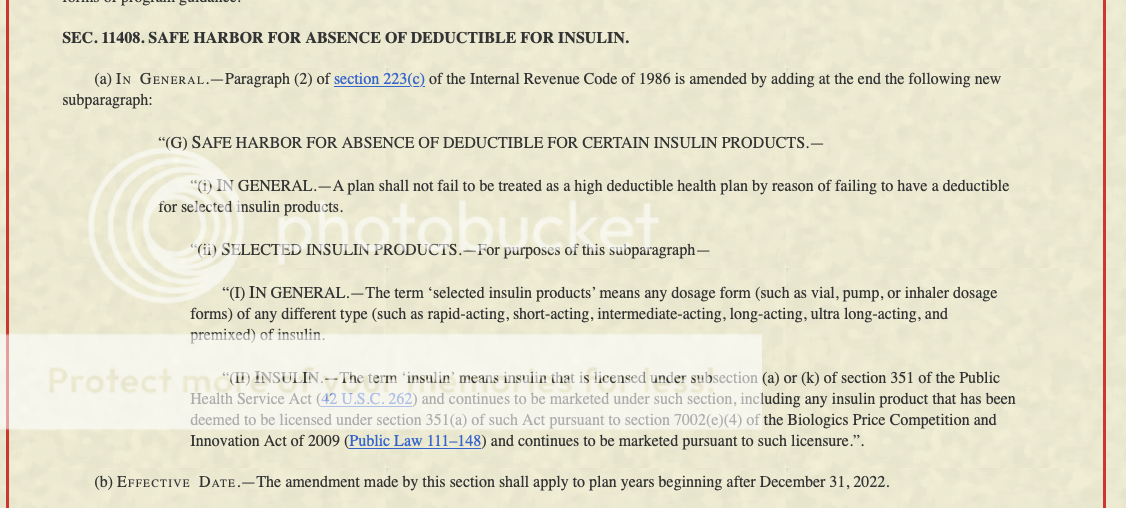

That is saying that insulins in those forms (and proceeds to list every type and delivery method possible!) are covered by the Safe Harbor clause. This lets HDHPs provide capped price insulin before your deductible is reached, otherwise you would have to pay full price up to the deductible limit. Effectively they are removing insulin in all forms from the deductibles equation. |

|

|

|

Post by peppy on Nov 21, 2022 14:16:55 GMT -5

Sayhey, the more I read the inflation reduction accounts, the more I come upon HSA, Health savings accounts. Am I reading this correctly, the $35 insulin cap applies to HSA's. (?) with out meeting the deductible stuff. If that is the case, people with HSA's are employed, with health insurance.  By the way all help looking through this chit is welcome. |

|

|

|

Post by peppy on Nov 21, 2022 14:19:39 GMT -5

Peppy - concerning your question on dosage form here are the words from the IRA. I think someone did a replace all "pen" with inhaler although pens still are required to be a covered "form". 15 ‘‘(b) DEFINITIONS.—In this section: 16 ‘‘(1) SELECTED INSULIN PRODUCTS.—The term 17 ‘selected insulin products’ means at least one of each18 dosage form (such as vial, pump, or inhaler dosage19 forms) of each different type (such as rapid-acting, 20 short-acting, intermediate-acting, long-acting, ultra 21 long-acting, and premixed) of insulin (as defined 22 below), when available, as selected by the group 23 health plan or health insurance issuer. Fish - I have confirmation from the CMS through a 3rd party the $35 does apply to afrezza. They were 100% confident of this. The question is will the beneficiary need to go through a prior authorization process or is their plan now required to "cover" afrezza as a required form "inhaled". Bingo, the definitions/ terms in the inflation reduction act? or where? hahaha, so many acts...and sections. Bingo? |

|

|

|

Post by peppy on Nov 21, 2022 15:06:36 GMT -5

|

|

|

|

Post by agedhippie on Nov 21, 2022 16:54:41 GMT -5

There are some conditions like PCOS that require insulin as well. My guess is that they are drawing this to cover all conditions so there is no argument. |

|

|

|

Post by nylefty on Nov 21, 2022 19:45:10 GMT -5

Peppy - concerning your question on dosage form here are the words from the IRA. I think someone did a replace all "pen" with inhaler although pens still are required to be a covered "form". 15 ‘‘(b) DEFINITIONS.—In this section: 16 ‘‘(1) SELECTED INSULIN PRODUCTS.—The term 17 ‘selected insulin products’ means at least one of each 18 dosage form (such as vial, pump, or inhaler dosage 19 forms) of each different type (such as rapid-acting, 20 short-acting, intermediate-acting, long-acting, ultra 21 long-acting, and premixed) of insulin (as defined 22 below), when available, as selected by the group 23 health plan or health insurance issuer. Fish - I have confirmation from the CMS through a 3rd party the $35 does apply to afrezza. They were 100% confident of this. The question is will the beneficiary need to go through a prior authorization process or is their plan now required to "cover" afrezza as a required form "inhaled". I hope your 3rd party is right, but sr71 said this on another thread:

"... I also called my Part D provider (Aetna), who stated that Afrezza is not on their formulary for 2023, is not covered, and therefore is not subject to the $35 monthly copay amount."

mnkd.proboards.com/post/244450/thread |

|

|

|

Post by peppy on Nov 21, 2022 20:48:09 GMT -5

Inhaler dosage forms. we need section 351 of the public service act 42 U.S.C. 262?  |

|