|

|

Post by uvula on Nov 21, 2022 21:13:33 GMT -5

Why the heck isn't mnkd putting out some guidance on this topic? If we are having trouble figuring this out there is no way a typical patient is going to put in the effort required to sort this out.

|

|

|

|

Post by prcgorman2 on Nov 22, 2022 7:18:46 GMT -5

If you check the record, you will find ample evidence where Congress says,“Go”, regulators say, “Go”, and companies say “No”.

It may require advocacy (lobbying) and lawyers to get action. Insulin, in particular, has been politicized, and that should help any advocacy group(s) that report to Congress, “no fair!”.

|

|

|

|

Post by sayhey24 on Nov 22, 2022 9:40:45 GMT -5

Peppy - concerning your question on dosage form here are the words from the IRA. I think someone did a replace all "pen" with inhaler although pens still are required to be a covered "form". 15 ‘‘(b) DEFINITIONS.—In this section: 16 ‘‘(1) SELECTED INSULIN PRODUCTS.—The term 17 ‘selected insulin products’ means at least one of each 18 dosage form (such as vial, pump, or inhaler dosage 19 forms) of each different type (such as rapid-acting, 20 short-acting, intermediate-acting, long-acting, ultra 21 long-acting, and premixed) of insulin (as defined 22 below), when available, as selected by the group 23 health plan or health insurance issuer. Fish - I have confirmation from the CMS through a 3rd party the $35 does apply to afrezza. They were 100% confident of this. The question is will the beneficiary need to go through a prior authorization process or is their plan now required to "cover" afrezza as a required form "inhaled". I hope your 3rd party is right, but sr71 said this on another thread:

"... I also called my Part D provider (Aetna), who stated that Afrezza is not on their formulary for 2023, is not covered, and therefore is not subject to the $35 monthly copay amount."

mnkd.proboards.com/post/244450/threadI have confidence in my source. We will see. I expect a PR after the new year after CMS takes some action. SR71 is 100% correct at least for now. Nothing for MNKD has ever come easy but this should have a positive ending. Assuming it ends positively and better than the 2021 "fail" with the $35 announcement I would hope Mike will start working with the CGM vendors and is developing a plan. Afrezza at $35 would be cheaper than most of the orals. Ozempic's cost under several Plan D's I checked is about $65 month. This would seem like a great opportunity for DXCM and Abbott to now want to push afrezza in the T2 space as afrezza will help sell CGMs. With MNKD hope springs eternal but Mike should be able to develop a solid business plan with these vendors. Of course the rub is still the SoC and afrezza not being a Step 2 or 3 T2 solution but we know afrezza is better at controlling PPG and it will now be cheaper. That's a difficult one two punch for the ADA to ignore. Lets hope the two biggest issues afrezza has faced; insurance coverage; and cost, will be solved in the new year. Maybe Mike can get an Ozempic/Mounjaro PPG pilot together sooner than later as part of his plan. |

|

|

|

Post by peppy on Nov 22, 2022 10:13:31 GMT -5

Peppy - concerning your question on dosage form here are the words from the IRA. I think someone did a replace all "pen" with inhaler although pens still are required to be a covered "form".

15 ‘‘(b) DEFINITIONS.—In this section: 16 ‘‘(1) SELECTED INSULIN PRODUCTS.—The term 17 ‘selected insulin products’ means at least one of each 18 dosage form (such as vial, pump, or inhaler dosage 19 forms) of each different type (such as rapid-acting, 20 short-acting, intermediate-acting, long-acting, ultra 21 long-acting, and premixed) of insulin (as defined 22 below), when available, as selected by the group 23 health plan or health insurance issuer. Fish - I have confirmation from the CMS through a 3rd party the $35 does apply to afrezza. They were 100% confident of this. The question is will the beneficiary need to go through a prior authorization process or is their plan now required to "cover" afrezza as a required form "inhaled". quote; "someone did a replace all "pen" with inhaler although pens still are required to be a covered "form"." Going through the IRA act the whole thing was replace this with that, add this here, blah, blah, blah. Sounds like it could be there. What we need to find is insurers need to offer all forms of insulin. |

|

|

|

Post by sayhey24 on Nov 22, 2022 10:48:32 GMT -5

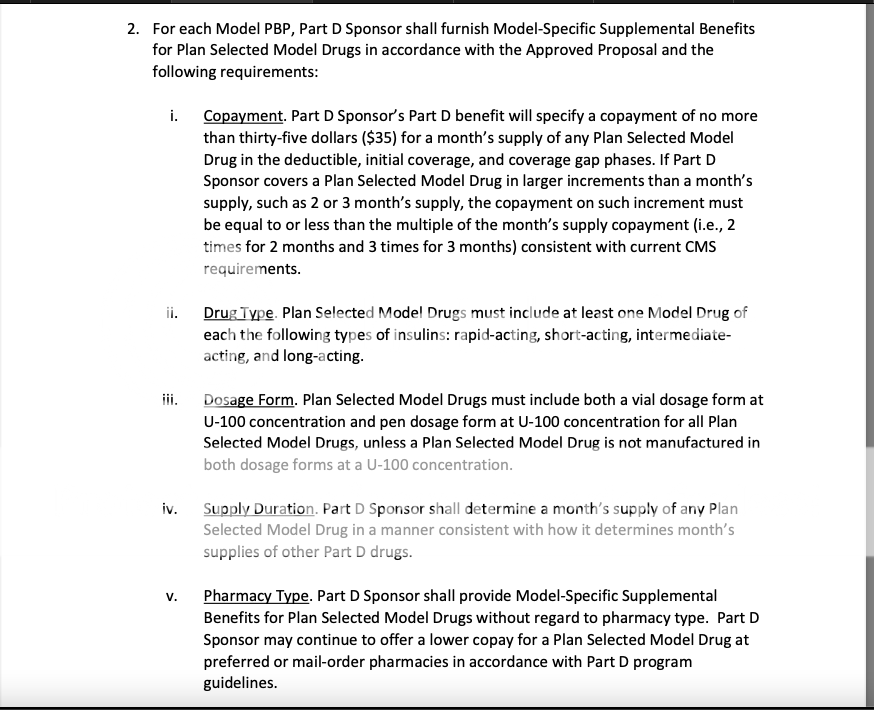

Peppy - start here innovation.cms.gov/innovation-models/part-d-savings-modelYou will see 2023 Part D Senior Savings Model Landscape File (XLSX): which lists the plans CMS thinks are part of the program You will also see the issue CMS will need to fix. The dosage form below is in conflict with the legislation which specifically lists "inhaled". I think in this case the "law" wins but the current plan participants have no idea. innovation.cms.gov/media/document/pdss-cy23-payer-addendum-file-finalDosage Form. Plan Selected Model Drugs must include both a vial dosage form at U-100 concentration and pen dosage form at U-100 concentration for all Plan Selected Model Drugs, unless a Plan Selected Model Drug is not manufactured in both dosage forms at a U-100 concentration. |

|

|

|

Post by prcgorman2 on Nov 22, 2022 12:15:20 GMT -5

I hope your 3rd party is right, but sr71 said this on another thread:

"... I also called my Part D provider (Aetna), who stated that Afrezza is not on their formulary for 2023, is not covered, and therefore is not subject to the $35 monthly copay amount."

mnkd.proboards.com/post/244450/threadI have confidence in my source. We will see. I expect a PR after the new year after CMS takes some action. SR71 is 100% correct at least for now. Nothing for MNKD has ever come easy but this should have a positive ending. Assuming it ends positively and better than the 2021 "fail" with the $35 announcement I would hope Mike will start working with the CGM vendors and is developing a plan. Afrezza at $35 would be cheaper than most of the orals. Ozempic's cost under several Plan D's I checked is about $65 month. This would seem like a great opportunity for DXCM and Abbott to now want to push afrezza in the T2 space as afrezza will help sell CGMs. With MNKD hope springs eternal but Mike should be able to develop a solid business plan with these vendors. Of course the rub is still the SoC and afrezza not being a Step 2 or 3 T2 solution but we know afrezza is better at controlling PPG and it will now be cheaper. That's a difficult one two punch for the ADA to ignore. Lets hope the two biggest issues afrezza has faced; insurance coverage; and cost, will be solved in the new year. Maybe Mike can get an Ozempic/Mounjaro PPG pilot together sooner than later as part of his plan. Great work sayhey (as usual). I have argued the two biggest challenges facing Afrezza success are the lack of prescribers and the lack of insurance coverage. I see cost as an issue contributing to the insurance coverage problem. If Afrezza is covered (or will be covered after someone wakes up CMS and gets them to correct their guidance), that still leaves lack of prescriber acceptance, but having that issue as the one single remaining challenge between Mannkind and "epic" success will be monumental. I agree that Mannkind partnering with CGM manufacturers (in ways I hope you can talk about) will be more clearly aligned with their business models if/once Afrezza is covered as required to be in compliance with the language in the Inflation Reduction Act. I am still convinced by agedhippie and stevil that a full-scale trial with the key objectives of proving SAFETY and superiority is required to change the SOC and cleanly break into the T2 marketplace. |

|

|

|

Post by hopingandwilling on Nov 22, 2022 12:49:50 GMT -5

SayHey:

You have a good discussion ongoing as it relates to the $35.00 cap insulin for those covered under Medicare. With this being the issue, and often is the case—what is good for one party is not good for the other party that is part of this relationship.

First let me point out that the $35.00 cap is a very positive thing for those who need insulin for treating their medical condition. However, with how we pay for our health care needs and drugs we need, there is a very powerful entity that has control over our needs and what they will reimburse to the parties that are involved in the chain for getting the drug to those covered for the clients. These are the insurance companies. We must never forget—a person gets sick, and they go to their doctor---the doctor calls their insurance provider to determine benefits. Doctor prescribes a prescription—first thing the drug store does—call the insurance company to see if it is cover and what they will pay for the drug.

Allow me now to digress to 1890 when the US Congress created a bill, and it was signed into law by President Benjamin Harrison. The law is known as the Sherman Anti-Trust Law. A law that prevents two parties from colluding where they agree to price-setting their product. Since colluding and the application of this 1890 law is probably one of the largest used laws still today—the federal court registries are filled with cases involving price setting events.

Since this is federal law is adjudicated by federal courts, when it comes to insulin, the federal government should not and isn't allowed to break the law by telling an insulin drug company or the insurance companies providing coverage for insulin and how much they must reimburse the parties involved in getting insulin to the patient needing it. Each insurance company is allowed to negotiate how much they will reimburse for a given drug. The issue is that MannKind has not made the case for justifying their 100X cost should the insurance company cover the drug.

In one of the earlier posts on this board the price of Afrezza was shown as being 10X more expensive than the other insulin products being covered by insurance companies. I will not belabor the point that Afrezza is produced by an elaborate manufacturing process---with all the mixing, blending, additional ingredients, drying the product---vs. a simple vial of a liquid form of insulin.

The $35.00 cap is in my opinion a huge detriment to MannKind and at the end of the day doing more clinical testing is not going to solve the problem that Afrezza presents. Whether we like it or not insurance companies are not in the business of losing money---and they have a lobbying arm that is always going to work to preserve their business model. The only way our health care system can be preserved is creating a standard policy that will cover all drugs that are given FDA approval. But as we see in the case of Afrezza---the company is obviously forced into charging 10X as much for their inhaled version vs. an injectable form. At the end of the day—the insurance company is and will continue to hold the upper hand in this debate. And that is a shame when you compare our system to the other industrial countries of the free world. This $35.00 cap is not a friend for Afrezza users, IMO, it only adds to the problem and will remain until which time the gap from the $35.00 and the related other expense must be allocate based on what the insurance company will pay in ‘total’ reimbursement to the user. The cost of the manufacturing the insulin, the marketing expenses and the end profit still must be considered -- not just the $35.00 cap to the patient. For the insurance company—the $35.00 is not their problem.

There is no doubt that Afrezza can be useful for certain patients needing insulin. The $35.00 is the limit of money paid by the patient---you can't ignore gap between the $35.00 and what the insurance companies pay based on their negotiated contract with the drug companies!

All--just my opinon!

Happy T=Day to All!

|

|

|

|

Post by cretin11 on Nov 22, 2022 13:01:08 GMT -5

Why the heck isn't mnkd putting out some guidance on this topic? If we are having trouble figuring this out there is no way a typical patient is going to put in the effort required to sort this out. Guidance! What a concept! But perhaps a bad word in Mannkind Land. |

|

|

|

Post by sayhey24 on Nov 22, 2022 13:04:46 GMT -5

Why the heck isn't mnkd putting out some guidance on this topic? If we are having trouble figuring this out there is no way a typical patient is going to put in the effort required to sort this out. Guidance! What a concept! But perhaps a bad word in Mannkind Land. I think MNKD is waiting on guidance from the CMS. This legislation is all brand new. |

|

|

|

Post by sayhey24 on Nov 22, 2022 13:10:11 GMT -5

SayHey: You have a good discussion ongoing as it relates to the $35.00 cap insulin for those covered under Medicare. With this being the issue, and often is the case—what is good for one party is not good for the other party that is part of this relationship. First let me point out that the $35.00 cap is a very positive thing for those who need insulin for treating their medical condition. However, with how we pay for our health care needs and drugs we need, there is a very powerful entity that has control over our needs and what they will reimburse to the parties that are involved in the chain for getting the drug to those covered for the clients. These are the insurance companies. We must never forget—a person gets sick, and they go to their doctor---the doctor calls their insurance provider to determine benefits. Doctor prescribes a prescription—first thing the drug store does—call the insurance company to see if it is cover and what they will pay for the drug. Allow me now to digress to 1890 when the US Congress created a bill, and it was signed into law by President Benjamin Harrison. The law is known as the Sherman Anti-Trust Law. A law that prevents two parties from colluding where they agree to price-setting their product. Since colluding and the application of this 1890 law is probably one of the largest used laws still today—the federal court registries are filled with cases involving price setting events. Since this is federal law is adjudicated by federal courts, when it comes to insulin, the federal government should not and isn't allowed to break the law by telling an insulin drug company or the insurance companies providing coverage for insulin and how much they must reimburse the parties involved in getting insulin to the patient needing it. Each insurance company is allowed to negotiate how much they will reimburse for a given drug. The issue is that MannKind has not made the case for justifying their 100X cost should the insurance company cover the drug. In one of the earlier posts on this board the price of Afrezza was shown as being 10X more expensive than the other insulin products being covered by insurance companies. I will not belabor the point that Afrezza is produced by an elaborate manufacturing process---with all the mixing, blending, additional ingredients, drying the product---vs. a simple vial of a liquid form of insulin. The $35.00 cap is in my opinion a huge detriment to MannKind and at the end of the day doing more clinical testing is not going to solve the problem that Afrezza presents. Whether we like it or not insurance companies are not in the business of losing money---and they have a lobbying arm that is always going to work to preserve their business model. The only way our health care system can be preserved is creating a standard policy that will cover all drugs that are given FDA approval. But as we see in the case of Afrezza---the company is obviously forced into charging 10X as much for their inhaled version vs. an injectable form. At the end of the day—the insurance company is and will continue to hold the upper hand in this debate. And that is a shame when you compare our system to the other industrial countries of the free world. This $35.00 cap is not a friend for Afrezza users, IMO, it only adds to the problem and will remain until which time the gap from the $35.00 and the related other expense must be allocate based on what the insurance company will pay in ‘total’ reimbursement to the user. The cost of the manufacturing the insulin, the marketing expenses and the end profit still must be considered -- not just the $35.00 cap to the patient. For the insurance company—the $35.00 is not their problem. There is no doubt that Afrezza can be useful for certain patients needing insulin. The $35.00 is the limit of money paid by the patient---you can't ignore gap between the $35.00 and what the insurance companies pay based on their negotiated contract with the drug companies! All--just my opinon! Happy T=Day to All! Hoping - The Supplemental Medical Insurance trust fund is financed by general tax revenue and the premiums enrollees pay. The Supplemental Medical Insurance (SMI) trust fund finances two voluntary Medicare programs: Part B, which mainly covers physician services and medical supplies, and Part D. Does this still hold if SMI is paying the bill and if the Senior Saver Program is voluntary and no one is forcing the insurance companies to join? "the federal government should not and isn't allowed to break the law by telling an insulin drug company or the insurance companies providing coverage for insulin" |

|

|

|

Post by hopingandwilling on Nov 22, 2022 14:33:14 GMT -5

SayHey:

Medicare claims are handled by the various insurance companies—this is why currently if you are eligible for Medicare you email address and home address mailbox is flooded with solicitations from insurance companies wanting you to select their plan benefits. My point is that when it comes to our healthcare ...benefits should be the same. Unless the law has been changed recently..the federal government is banned from negotiating the price we pay for drugs. The drug companies and insurance companies have the best lobbies of all industries.

I have a friend who was the cofounder of a healthcare management firm—this required him being in Washington DC nearly every week.—lobbying Congress.He was good at his job but on a personal level he hated what he was doing. He and his two cofounders sold their company for several hundred million dollars. They sold it to a major venture capitalist firm. Needless to say..my friend retired at a young age.

|

|

|

|

Post by peppy on Nov 22, 2022 14:52:35 GMT -5

SayHey: Medicare claims are handled by the various insurance companies—this is why currently if you are eligible for Medicare you email address and home address mailbox is flooded with solicitations from insurance companies wanting you to select their plan benefits. My point is that when it comes to our healthcare ...benefits should be the same. Unless the law has been changed recently. .the federal government is banned from negotiating the price we pay for drugs. The drug companies and insurance companies have the best lobbies of all industries.

I have a friend who was the cofounder of a healthcare management firm—this required him being in Washington DC nearly every week.—lobbying Congress.He was good at his job but on a personal level he hated what he was doing. He and his two cofounders sold their company for several hundred million dollars. They sold it to a major venture capitalist firm. Needless to say..my friend retired at a young age. quote: .the federal government is banned from negotiating the price we pay for drugs. The drug companies and insurance companies have the best lobbies of all industries. hopingandwilling , I know you are correct, however what changed is Biden administration legislation that allows for I believe 10 drugs a year price to be negotiated. When I scrolled through this stuff looking for the insulin portion, there are rules about which drugs and how much price reduction can be done a year. H.R.5376 - Inflation Reduction Act of 2022 www.congress.gov/bill/117th-congress/house-bill/5376/textBTW all, when was the last time, any of us scrolled through legislation. agedhippie made me do it. I believe through this legislation Medicare is allowed to negotiate 10 medication prices per year. |

|

|

|

Post by peppy on Nov 22, 2022 15:13:50 GMT -5

Peppy - start here innovation.cms.gov/innovation-models/part-d-savings-modelYou will see 2023 Part D Senior Savings Model Landscape File (XLSX): which lists the plans CMS thinks are part of the program You will also see the issue CMS will need to fix. The dosage form below is in conflict with the legislation which specifically lists "inhaled".

I think in this case the "law" wins but the current plan participants have no idea.

innovation.cms.gov/media/document/pdss-cy23-payer-addendum-file-finalDosage Form. Plan Selected Model Drugs must include both a vial dosage form at U-100 concentration and pen dosage form at U-100 concentration for all Plan Selected Model Drugs, unless a Plan Selected Model Drug is not manufactured in both dosage forms at a U-100 concentration. I see it, for now this is the law.  |

|

|

|

Post by hopingandwilling on Nov 22, 2022 15:32:06 GMT -5

Peppy,

You are correct about the new legislation allowing the $35.00 cap for the patient. As for addressing the real problem is that it appears the only penalty for the drug/insurance companies is that they will pay a penalty only for the amount of increase that is above the inflation rate.

This gleaned from the following report--see if you agree with my interpretation---

Limitations on Out-of-Pocket Costs: The bill includes several provisions aimed at reducing patient out-of-pocket costs, particularly costs in Medicare Part D. Specifically, the bill eliminates the 5% coinsurance requirement for spending above the Part D catastrophic coverage threshold beginning in 2024 and caps Part D out-of-pocket spending at $2,000 beginning in 2025. The bill also eliminates any cost-sharing on adult vaccines covered under Part D.

Limitations on Drug Price Growth: The bill aims to reduce spikes in drug prices by requiring manufacturers whose drug prices increase over the rate of inflation to pay rebates to the federal government. The rebates will only apply to drugs purchased for Medicare beneficiaries. The provision would take effect in 2023, with 2021 used as the baseline to calculate inflation rates.

The impact of high prescription drug prices on patient care has been one of ASHP’s highest and longstanding public policy priorities.

“ASHP will be closely monitoring the implementation of the bill at the agency level to ensure it is tailored to reduce patient out-of-pocket costs without disrupting established care delivery models or threatening patient access to medications,” said Tom Kraus, ASHP vice president of government relations.

Although the House of Representatives will still need to vote on the bill, it is expected to be signed into law. ASHP will be monitoring the bill’s progress and updating members on new developments.

|

|

|

|

Post by peppy on Nov 22, 2022 15:43:18 GMT -5

|

|