|

|

Post by gareaudan on Jun 1, 2018 20:08:47 GMT -5

i liked your post but to be fair, for many of us who bought some shares between 2013 and 2015, a 5 bagger from now dont make us come even close to braking even on those shares so its not that much. The sad fact of dilution. It may well be unrealistic to ever reach levels that would make all investors whole. I acquired quite a lot of options a year ago and brought my break even point down significantly. At this point I'd be thrilled with $10 and have a nice, if not huge profit. I do think ultimately there is potential to hit $12 to $16, perhaps higher if future dilution is at low end of range I think possible. Dbc, i read a lot of your post over the years and i have often thought you were very negative about mnkd. Unfortunatly, it turn out you were often right. I would like to know what do you think is the potential mc in 3 years for mnkd if afrezza became successful enough to keep the lights on and the growth in script continu. The potential is huge in long terme no? 12-16$ or 2-2,5b mc seems low for a product AND a delivery system that can change the world dont you think? |

|

|

|

Post by agedhippie on Jun 1, 2018 21:20:44 GMT -5

I mean the market. There has to be some event that attracts attention. That could be a couple of things; exceeding projected revenue, or a substantial foreign contract with a revenue commitment are the obvious ones. Everything gets viewed through the perspective of revenue - if it hasn't markedly increase revenue it's not going to increase the share price. That was my thought. i agree. Money is king. Script HAVE to go up. No more time, no more excuses. After that speculative value for the rest of the pipeline may come back and rise the sp to new high. That was an item I forgot. The market would like to see a pipeline of drugs so if Afrezza continues as weak as it is today then the next drug in the pipeline must rescue their investment. A pipeline is not an absolute necessity, but the market really wants to see one to have a hedge and it will discount the price if there is not a convincing pipeline. |

|

|

|

Post by gareaudan on Jun 1, 2018 21:39:43 GMT -5

i agree. Money is king. Script HAVE to go up. No more time, no more excuses. After that speculative value for the rest of the pipeline may come back and rise the sp to new high. That was an item I forgot. The market would like to see a pipeline of drugs so if Afrezza continues as weak as it is today then the next drug in the pipeline must rescue their investment. A pipeline is not an absolute necessity, but the market really wants to see one to have a hedge and it will discount the price if there is not a convincing pipeline. Unfortunatly, i dont think the pipeline can save mnkd at this point. To little to late. If afrezza does not become a success, it is game over imho. But on the other hand if afrezza does become as valuable as i think it can/should, the rest of the pipeline could substantially raise the value of company even if its not approved yet. Once profitable and sustainable, the possibilities of this company are huge. |

|

|

|

Post by rockstarrick on Jun 2, 2018 1:19:39 GMT -5

That was an item I forgot. The market would like to see a pipeline of drugs so if Afrezza continues as weak as it is today then the next drug in the pipeline must rescue their investment. A pipeline is not an absolute necessity, but the market really wants to see one to have a hedge and it will discount the price if there is not a convincing pipeline. Unfortunatly, i dont think the pipeline can save mnkd at this point. To little to late. If afrezza does not become a success, it is game over imho. But on the other hand if afrezza does become as valuable as i think it can/should, the rest of the pipeline could substantially raise the value of company even if its not approved yet. Once profitable and sustainable, the possibilities of this company are huge. While I agree things could be, and needs to be much better, I still find it hard to understand why people still throw out this “mnkd better or its over crap”,, This Company and it’s shareholders have been to the gates of hell and back,, we have been in way worse shape than we are today, yet we’re still here. This clatter of how it’s either this or the parties over is just a bunch of garbage. Afrezza and mnkd are here to stay, the worst of times are behind us. Watch and learn boys and girls,, The Rock Star has Spoken ✌🏻🎸😎 |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jun 2, 2018 1:26:29 GMT -5

Unfortunatly, i dont think the pipeline can save mnkd at this point. To little to late. If afrezza does not become a success, it is game over imho. But on the other hand if afrezza does become as valuable as i think it can/should, the rest of the pipeline could substantially raise the value of company even if its not approved yet. Once profitable and sustainable, the possibilities of this company are huge. While I agree things could be, and needs to be much better, I still find it hard to understand why people still throw out this “mnkd better or its over crap”,, This Company and it’s shareholders have been to the gates of hell and back,, we have been in way worse shape than we are today, yet we’re still here. This clatter of how it’s either this or the parties over is just a bunch of garbage. Afrezza and mnkd are here to stay, the worst of times are behind us. Watch and learn boys and girls,, The Rock Star has Spoken ✌🏻🎸😎 Rock on! |

|

|

|

Post by dreamboatcruise on Jun 2, 2018 2:24:34 GMT -5

The sad fact of dilution. It may well be unrealistic to ever reach levels that would make all investors whole. I acquired quite a lot of options a year ago and brought my break even point down significantly. At this point I'd be thrilled with $10 and have a nice, if not huge profit. I do think ultimately there is potential to hit $12 to $16, perhaps higher if future dilution is at low end of range I think possible. The eternal optimistic in me ponders that as Dr. Kendall thinks Afrezza is the new "gold standard" and current treatments are "barbaric". I would argue that we still have a lot of market to penetrate, not just in the US, but the world. Thus $12-$16 a share even with massive dilution, is underestimating its potential. We are patent protected for years to come. I would relate Afrezza to the first iPods. No competion no one even came close to Apple for years. That will be us. Imagine Apple without Android phones to compete with. While our market is constrained to those with diabetes, that market grows yearly, sadly. So, I conclude by saying, stay long. We never know when our time will come. The "barbaric" statement to me lowers my expectations for him. It seems hyperbole that a scientist should not be using. But I realize many love that non-scientific hyperbole. I'm not sure he ever said "gold standard". Hope you are right about Mannkind financial potential. Certainly many have been predicting awesome returns for many years. I certainly do plan on holding, at least until I'm back to even... which for me is in the $8 range. |

|

|

|

Post by dreamboatcruise on Jun 2, 2018 2:33:07 GMT -5

The sad fact of dilution. It may well be unrealistic to ever reach levels that would make all investors whole. I acquired quite a lot of options a year ago and brought my break even point down significantly. At this point I'd be thrilled with $10 and have a nice, if not huge profit. I do think ultimately there is potential to hit $12 to $16, perhaps higher if future dilution is at low end of range I think possible. Dbc, i read a lot of your post over the years and i have often thought you were very negative about mnkd. Unfortunatly, it turn out you were often right. I would like to know what do you think is the potential mc in 3 years for mnkd if afrezza became successful enough to keep the lights on and the growth in script continu. The potential is huge in long terme no? 12-16$ or 2-2,5b mc seems low for a product AND a delivery system that can change the world dont you think? Being conservative I think we'll have 250 million shares outstanding before profitability. $12-$16/sh is then $3-$4B mc. That is assuming Afrezza is successful but doesn't "change the world". Resistance to Afrezza is much greater than I would have assumed years ago. I now assume that will not disappear quickly. The landscape has changed for drugs, and MNKD has a big uphill struggle. I think they will prevail, but it will be slow and I think there will be pressures on pricing that din't exist 5 years ago. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jun 2, 2018 3:40:15 GMT -5

The eternal optimistic in me ponders that as Dr. Kendall thinks Afrezza is the new "gold standard" and current treatments are "barbaric". I would argue that we still have a lot of market to penetrate, not just in the US, but the world. Thus $12-$16 a share even with massive dilution, is underestimating its potential. We are patent protected for years to come. I would relate Afrezza to the first iPods. No competion no one even came close to Apple for years. That will be us. Imagine Apple without Android phones to compete with. While our market is constrained to those with diabetes, that market grows yearly, sadly. So, I conclude by saying, stay long. We never know when our time will come. The "barbaric" statement to me lowers my expectations for him. It seems hyperbole that a scientist should not be using. But I realize many love that non-scientific hyperbole. I'm not sure he ever said "gold standard". Hope you are right about Mannkind financial potential. Certainly many have been predicting awesome returns for many years. I certainly do plan on holding, at least until I'm back to even... which for me is in the $8 range. Chief scientific and medical officer of the ADA, and his "barbaric" statement lowers expectations. Perhaps we could go back to Hakan asking for potential partners on conference calls. Or maybe Matt's slip of the tongue, "embarrassment of riches". For me Dr. Kendall must have seen something in Afrezza, in past studies, in Afrezza's overall profile to warrant such strong langauge as to call the current regime for diabetics as "barbaric". But come to think about there is something "barbaric" to the current standard of care. Inject yourself several times a day, being careful to not use the same spot on your body for fear of poor insulin absorption. Finger pricks. Having to time injections in order to avoid highs and lows. The list goes on. My point. While current treatments are acceptable and well accepted. Afrezza has proven to allow diabetics to run a normal almost non-diabetic life. In this way Dr. Kendall in my interpretation labeled current treatments as "barbaric". Long. And buying weekly. |

|

|

|

Post by gareaudan on Jun 2, 2018 5:54:23 GMT -5

Unfortunatly, i dont think the pipeline can save mnkd at this point. To little to late. If afrezza does not become a success, it is game over imho. But on the other hand if afrezza does become as valuable as i think it can/should, the rest of the pipeline could substantially raise the value of company even if its not approved yet. Once profitable and sustainable, the possibilities of this company are huge. While I agree things could be, and needs to be much better, I still find it hard to understand why people still throw out this “mnkd better or its over crap”,, This Company and it’s shareholders have been to the gates of hell and back,, we have been in way worse shape than we are today, yet we’re still here. This clatter of how it’s either this or the parties over is just a bunch of garbage. Afrezza and mnkd are here to stay, the worst of times are behind us. Watch and learn boys and girls,, The Rock Star has Spoken ✌🏻🎸😎 You're right, a more accurate way of saying it and what I should have said is that the value of the shares that i bought in 2013 is over, not mnkd. If we need another product to be successful, it will take many more years and probably many more big dilutions. Mnkd will still be there but it will be hard to recover the lost in value of those shares. You realise that some people bought at 30-35$. It is x15 from now just to get even or around 6,5 b in mc... Witout anymore dilution... Ultimately, It is very Nice if mnkd survive and all but what I want is to see my money back and more. I didnt invest in mnkd in 2013 as a charity so they can survive but to make more money. That being said, i do think 10b is attainable at some point in the futur if every things goes well and thats why i also bought a lot below 2$ so im confident that overall Ill be good but still thinking about my 2013 shares. Maybe im seeing it the wrong way. Of course if you think the mc can go to 25b, 50b dilution doesnt really matter so it is a question of perspective but i think this is a bit stretching, especially if afrezza is not a success. |

|

|

|

Post by gareaudan on Jun 2, 2018 6:04:17 GMT -5

Dbc, i read a lot of your post over the years and i have often thought you were very negative about mnkd. Unfortunatly, it turn out you were often right. I would like to know what do you think is the potential mc in 3 years for mnkd if afrezza became successful enough to keep the lights on and the growth in script continu. The potential is huge in long terme no? 12-16$ or 2-2,5b mc seems low for a product AND a delivery system that can change the world dont you think? Being conservative I think we'll have 250 million shares outstanding before profitability. $12-$16/sh is then $3-$4B mc. That is assuming Afrezza is successful but doesn't "change the world". Resistance to Afrezza is much greater than I would have assumed years ago. I now assume that will not disappear quickly. The landscape has changed for drugs, and MNKD has a big uphill struggle. I think they will prevail, but it will be slow and I think there will be pressures on pricing that din't exist 5 years ago. thank dbc. I agree with your numbers but still have a more optimistic vue of afrezza. I still think it can ''change the world'' of diabetics. Apparently Dr Kendall think that to. If so, i do believe things can change quickly. |

|

|

|

Post by peppy on Jun 2, 2018 7:18:28 GMT -5

The eternal optimistic in me ponders that as Dr. Kendall thinks Afrezza is the new "gold standard" and current treatments are "barbaric". I would argue that we still have a lot of market to penetrate, not just in the US, but the world. Thus $12-$16 a share even with massive dilution, is underestimating its potential. We are patent protected for years to come. I would relate Afrezza to the first iPods. No competion no one even came close to Apple for years. That will be us. Imagine Apple without Android phones to compete with. While our market is constrained to those with diabetes, that market grows yearly, sadly. So, I conclude by saying, stay long. We never know when our time will come. But I realize many love that non-scientific hyperbole. I'm not sure he ever said "gold standard". Hope you are right about Mannkind financial potential. Certainly many have been predicting awesome returns for many years. I certainly do plan on holding, at least until I'm back to even... which for me is in the $8 range. Barbaric savagely cruel; exceedingly brutal. primitive; unsophisticated. We have words for a reason.    |

|

|

|

Post by peppy on Jun 2, 2018 7:31:35 GMT -5

Break out Hockey stick forming We need health insurance coverage.  |

|

|

|

Post by agedhippie on Jun 2, 2018 10:27:58 GMT -5

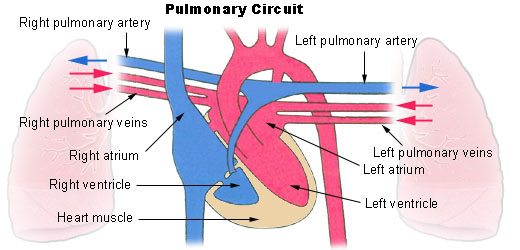

Barbaric savagely cruel; exceedingly brutal. primitive; unsophisticated. We have words for a reason.  The history of that image is interesting. It comes from a campaign by Diabetes UK back when they were called the British Diabetes Association (they changed the name in 2000) and was part of a larger campaign to prevent the NHS from making people use syringes by withdrawing insulin pens. The campaign was wildly successful with the prime minister himself standing up in parliament to announce the withdrawal of the proposed policy. The image is problematic now as most diabetics or endos would look at you strangely if you suggested that they use syringes as it's virtually all pumps and pens (even back then it was mostly pens which was the point of the campaign). |

|

|

|

Post by peppy on Jun 2, 2018 10:36:04 GMT -5

|

|

|

|

Post by boca1girl on Jun 2, 2018 14:09:22 GMT -5

Barbaric savagely cruel; exceedingly brutal. primitive; unsophisticated. We have words for a reason.  The history of that image is interesting. It comes from a campaign by Diabetes UK back when they were called the British Diabetes Association (they changed the name in 2000) and was part of a larger campaign to prevent the NHS from making people use syringes by withdrawing insulin pens. The campaign was wildly successful with the prime minister himself standing up in parliament to announce the withdrawal of the proposed policy. The image is problematic now as most diabetics or endos would look at you strangely if you suggested that they use syringes as it's virtually all pumps and pens (even back then it was mostly pens which was the point of the campaign). I think that image is extremely powerful. The syringes represent the number of times the needle penetrates the skin, regardless if the dose is delivered by a “pen”. I hope MNKD uses that image in conjunction with the word “barbaric” in upcoming advertising. |

|