|

|

Post by letitride on Jan 21, 2023 17:38:59 GMT -5

When they start penalizing the perpetrators of naked shorting with prison instead of fines this %#*@ would end quick. Doubtful. Prison time will make it more risky, but until there is proper oversight of trading little will change. Look at Martin Squirelli, he already violated his lifetime ban just less than a year out of the pen. Every single trade and transaction can be monitored and tracked today but we’re not doing it. There’s too many loopholes in the system for the Big Guys to get away with naked shorting (which is illegal). We have the technological capabilities to prevent this from happening yet we don’t implement it. Too many hands in the pie. My guess is people in high positions of power benefit too much from allowing it to do anything about it on their own. We need more billionaires and influential people speaking out about it. I believe Martin forgot one important thing hes on parole he can find himself back in prison finishing his sentence for just being him. I had to smile when she ordered him to stay out of the drug business, because it was just giving him rope to hang himself with. Maybe what we need is a million retail investors emailing the SEC demanding action. Squeaky wheel getting the grease you know. |

|

|

|

Post by prcgorman2 on Jan 22, 2023 11:17:58 GMT -5

Naked shorting is not illegal if there is a high probability that shares of the equity being sold can be obtained to replace the shares sold without first borrowing them. Selling unborrowed (essentially counterfeit) shares is permissible per SEC rules. I remember reading some countries disallowed the practice during the COVID pandemic in 2020 and 2021 but no idea if that was a temporary ban. Personally, I loathe the practice because it permits easy manipulation and unhelpful volatility. Don’t just write the SEC. Write your congressman and senators. The SEC is rife with insiders and unlikely those foxes will help the retail chickens.

|

|

|

|

Post by harryx1 on Jan 22, 2023 14:04:35 GMT -5

Naked shorting is not illegal if there is a high probability that shares of the equity being sold can be obtained to replace the shares sold without first borrowing them. Selling unborrowed (essentially counterfeit) shares is permissible per SEC rules. I remember reading some countries disallowed the practice during the COVID pandemic in 2020 and 2021 but no idea if that was a temporary ban. Personally, I loathe the practice because it permits easy manipulation and unhelpful volatility. Don’t just write the SEC. Write your congressman and senators. The SEC is rife with insiders and unlikely those foxes will help the retail chickens. Naked Short Selling can only be done by a bonafide Market Maker, but who can be a market maker? That's the loophole. If a retail investor tried selling stock they did not own and did not locate it, they would be arrested. www.sec.gov/answers/nakedshortsaleThe loophole is abused and abused to the extent that it can flood the market with millions upon millions of phantom shares, artificially depressing share prices for years. Just keep in mind that FINRA is a self regulated entity. Hopefully the attention needed on this abused practice is coming to a head... |

|

|

|

Post by dh4mizzou on Jan 23, 2023 10:13:01 GMT -5

|

|

|

|

Post by harryx1 on Jan 23, 2023 10:47:25 GMT -5

If anyone has doubts or is absolutely convinced that there is no way Naked Short selling could be a major systemic problem in the market and take billions of dollars a year from investors & companies without all the gov't entities doing something about it or even possibly being involved or just turning a blind eye to it all, then I suggest you watch the following docuseries on Netflix... MADOFF: The Monster of Wall Street www.netflix.com/title/81466159 |

|

|

|

Post by harryx1 on Jan 23, 2023 12:14:43 GMT -5

Sound familiar?

|

|

|

|

Post by longliner on Jan 23, 2023 12:29:27 GMT -5

One of the comments under the DOJ article was "nobody cares about your penny stock". Oh, I think there are some folks caring about GNS and HLBZ this fine morning. To the tune of 58,000,000 + and 295,000,000 + shares traded respectively. I would love to see MNKD movement if we "rattled the cage " right about....NOW! Here is the starting point MC, "Shareintel". I'm just saving you some legwork!  finance.yahoo.com/news/helbiz-hires-shareintel-due-diligence-172500788.html finance.yahoo.com/news/helbiz-hires-shareintel-due-diligence-172500788.html |

|

|

|

Post by harryx1 on Jan 23, 2023 13:39:45 GMT -5

Some really good info in the roundtable they just did. A lot of what John, Mark & Roger talk about has been happening to MNKD in the last 10+ years.

|

|

|

|

Post by radgray68 on Jan 23, 2023 19:57:30 GMT -5

Announce a share buy-back program at MNKD. We have $177 million, why can't we announce a $50 million buy-back program? (nobody needs to know we don't plan to complete the buyback right away, if ever)

Okay maybe we need to reach cashflow breakeven first and see how much we have then. Or, get a couple hundred million dollar partnership award first, but then would we still have 14% sold short? Probably with this cohort.

Go ahead and let me have it. I'm naive for thinking we could do it right? Or am I simply behaving as the shorts would do? Also, if it is possible, would it get the cabal off our stock.

|

|

|

|

Post by hellodolly on Jan 23, 2023 20:22:16 GMT -5

Announce a share buy-back program at MNKD. We have $177 million, why can't we announce a $50 million buy-back program? (nobody needs to know we don't plan to complete the buyback right away) Okay maybe we need to reach cashflow breakeven first and see how much we have then. Or, get a couple hundred million dollar partnership award first, but would we still have 14% sold short? Go ahead and let me have it. I'm naive for thinking we could do it right? Or am a I? Might have been a good idea in the recent past, but we now have the FEDS 1) still trying to unwind the balance sheet with (quantitative tightening (QT) to get to their goal of $1T, 2) JP is going to continue to raise rates at least 3X in 2023 at .25 each hike (per industry analysts), 3) share buy back programs artificially propped up the market during QE and with rate hikes costing business more money to borrow, it's likely they go into cash preservation mode to address future CAPEX issues, i.e.,; when/where they can deploy it, and 4) since buy backs aren't an option to artificially inflate or prop up markets...we could see another year like we did in 2022 (not as severe). I love the idea but, it's all about timing. |

|

|

|

Post by longliner on Jan 24, 2023 11:04:52 GMT -5

The combination of a strong earnings coupled with a defense from illegal short practices sent GNS on a 10 bagger run in a week......

We all (Longs) anticipate a blowout earnings report, any chance we could get a little payback here?

|

|

|

|

Post by harryx1 on Jan 24, 2023 11:27:19 GMT -5

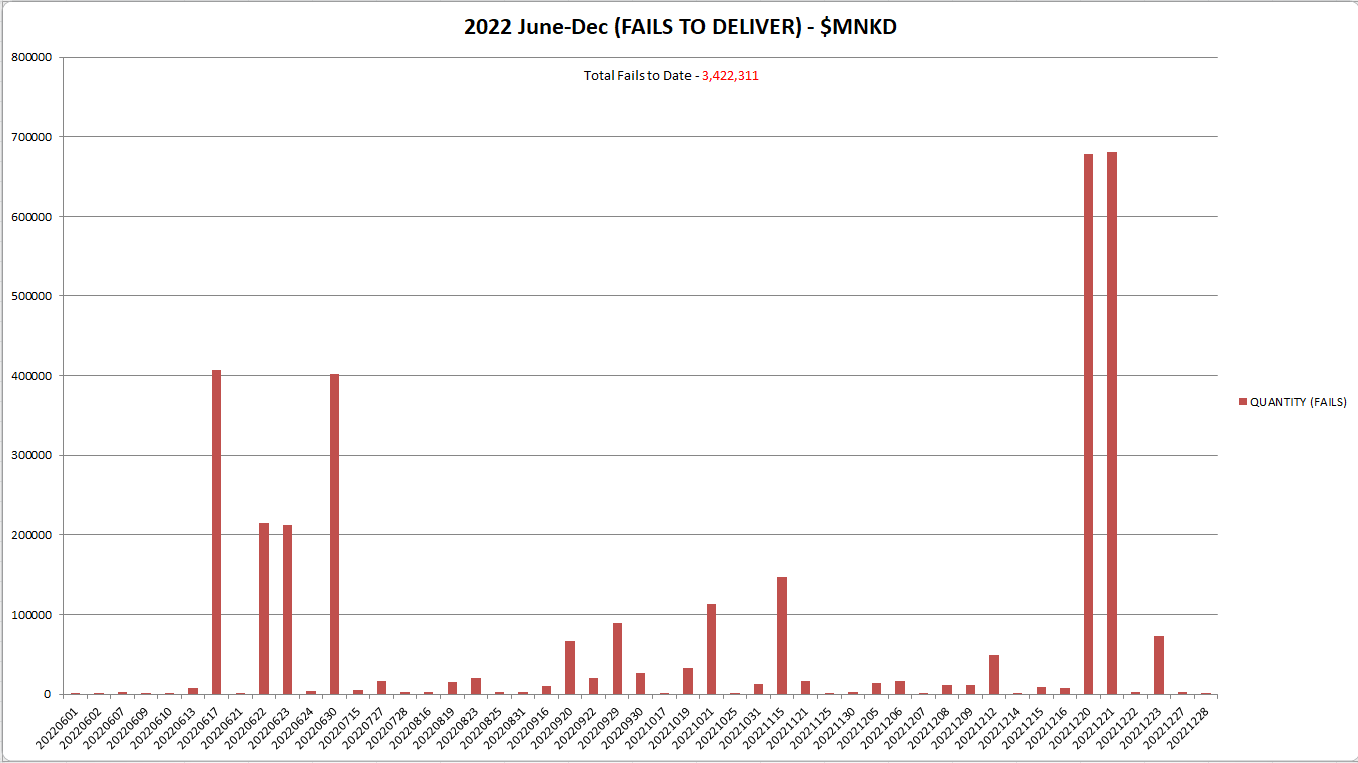

After all the Naked Shorting talk happening recently, I decided to go and do a quick look at last year to see if any FTDs showed up in the data files. I only did a quick look using the last 6-7 months of 2022. Here's what I found...they still seem to be naked shorting some.  |

|

|

|

Post by cretin11 on Jan 24, 2023 11:38:09 GMT -5

The combination of a strong earnings coupled with a defense from illegal short practices sent GNS on a 10 bagger run in a week...... We all (Longs) anticipate a blowout earnings report, any chance we could get a little payback here? 10x return puts us back at $50. What is the hold up, what are we waiting for? It worked for GNS, we have the playbook. Let's go! |

|

|

|

Post by celo on Jan 24, 2023 11:58:43 GMT -5

Stock is behaving a little strangely this morning, as if it has no resistance at the sell side. Low volume and pushing slightly upward. Maybe there is something to the undeliverable short shares. 3.5 million is still a lot of shares to be only on the sell side.

|

|

|

|

Post by prcgorman2 on Jan 24, 2023 12:19:38 GMT -5

I checked naked shorting FTDs on MNKD a couple of times last year. It happens. I've assumed it was used as a tool to pour cold water on the occasional intra-day rally, but didn't try to study it enough to be sure.

|

|