|

|

Post by harryx1 on Jan 24, 2023 12:20:27 GMT -5

|

|

|

|

Post by cretin11 on Jan 24, 2023 12:20:28 GMT -5

I like this strange behavior, hope it gets even stranger...

|

|

|

|

Post by prcgorman2 on Jan 24, 2023 12:22:31 GMT -5

I like this strange behavior, hope it gets even stranger... Nice. I assume you mean the naked shorting. |

|

|

|

Post by cretin11 on Jan 24, 2023 14:47:56 GMT -5

I like this strange behavior, hope it gets even stranger... Nice. I assume you mean the naked shorting. Whatever behavior is driving the share price movement today. Nah, I doubt naked shorting is doing that. 😆 |

|

|

|

Post by harryx1 on Jan 25, 2023 13:47:23 GMT -5

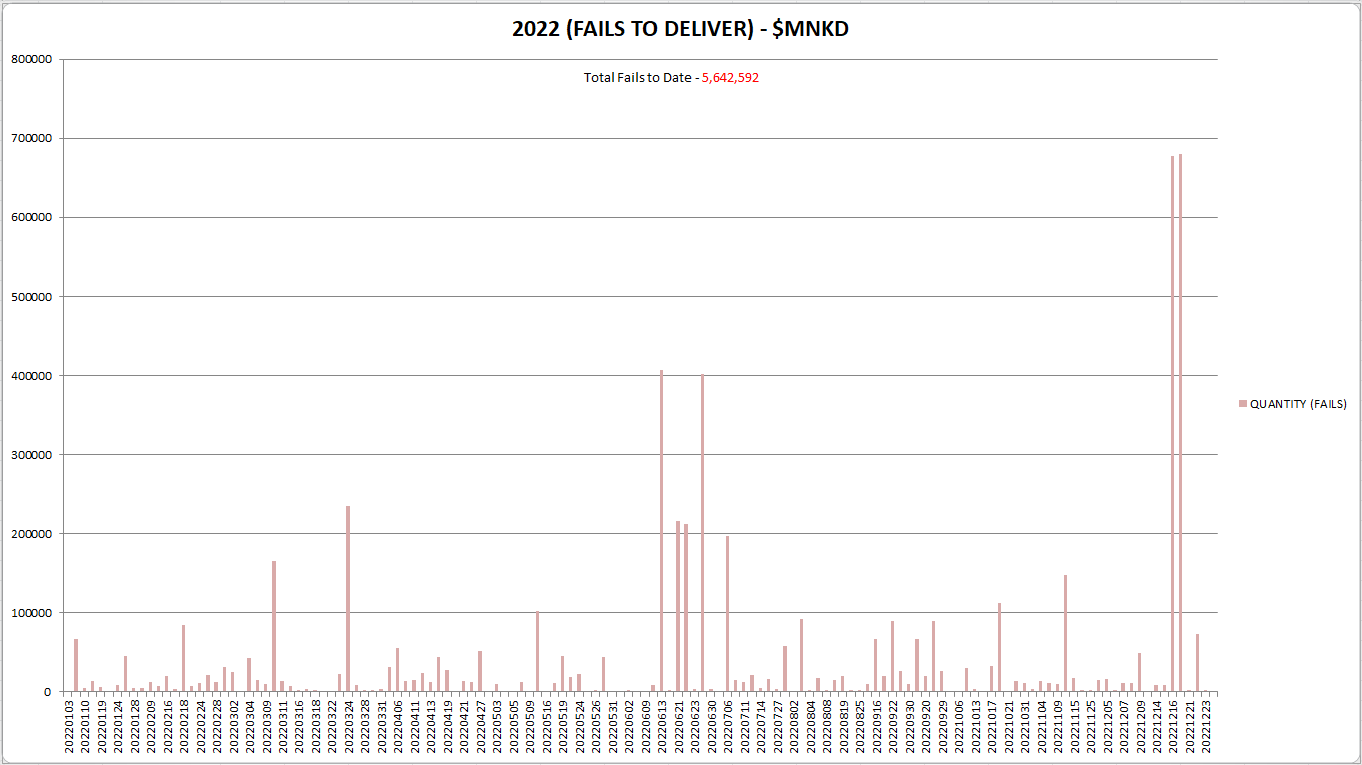

Full year...  |

|

|

|

Post by JEvans on Jan 25, 2023 14:11:29 GMT -5

Thats great info and is proof that over 5 million phantom shares are floating around (like monoply money) and being traded without any accountabiity what so ever (just pure stock manipulation). The DTCC and brokers just keep passing the buck and profiting off honest share holders.

Naked shorting is a real problem and is accountable for MNKD lower PPS cost.

|

|

|

|

Post by caesar on Jan 25, 2023 16:59:28 GMT -5

Check this out - shorts are doubling down. Should be interesting how this plays out!

$MNKD Short Interest 1/13/23: 32,805,775

Days to cover: 8.226132

Short Interest 12/30/22: 29,270,258

Change: 3,535,517

|

|

|

|

Post by prcgorman2 on Jan 25, 2023 17:31:46 GMT -5

Thats great info and is proof that over 5 million phantom shares are floating around (like monoply money) and being traded without any accountabiity what so ever (just pure stock manipulation). The DTCC and brokers just keep passing the buck and profiting off honest share holders. Naked shorting is a real problem and is accountable for MNKD lower PPS cost. You bring up an interesting point. The SEC Regulation SHO has a process for making the buyers of the counterfeit shares whole via a close out procedure where the seller must purchase "securities of like kind and quantity". I'd love an explanation of what that means. I assume it means the same security and if the shares were preferred for example, then the seller must purchase preferred shares of the security it failed to deliver. But I've never seen an explicit description of what that phrase actually means, so I'm just guessing. If that interpretation is correct, you might expect that the seller with open FTDs could be at substantial risk if the price of the security they failed to deliver increased significantly. Whether the risk is real assumes that there is good monitoring and enforcement of Regulation SHO. I don't know if the SEC is required to report on their monitoring and enforcement of their regulations. I've seen where federal regulatory agencies make rules that permit, but do not require, enforcement which is an obvious opportunity for capricious compliance to the regulations. Ugh. |

|

|

|

Post by mnlearner on Jan 25, 2023 18:51:01 GMT -5

Harryx1

"

If you don't really understand Naked Shorting, the article below is very detailed but easy to read and understand how Naked Short Selling impacts the market and how it's done.

news.investorturf.com/how-wall-street-creates-counterfeit-shares-for-amc-and-gamestop"

THANK YOU VERY MUCH FOR THIS! I APPRECIATE THAT YOU HELP ME UNDERSTAND.

|

|

|

|

Post by JEvans on Jan 25, 2023 22:14:30 GMT -5

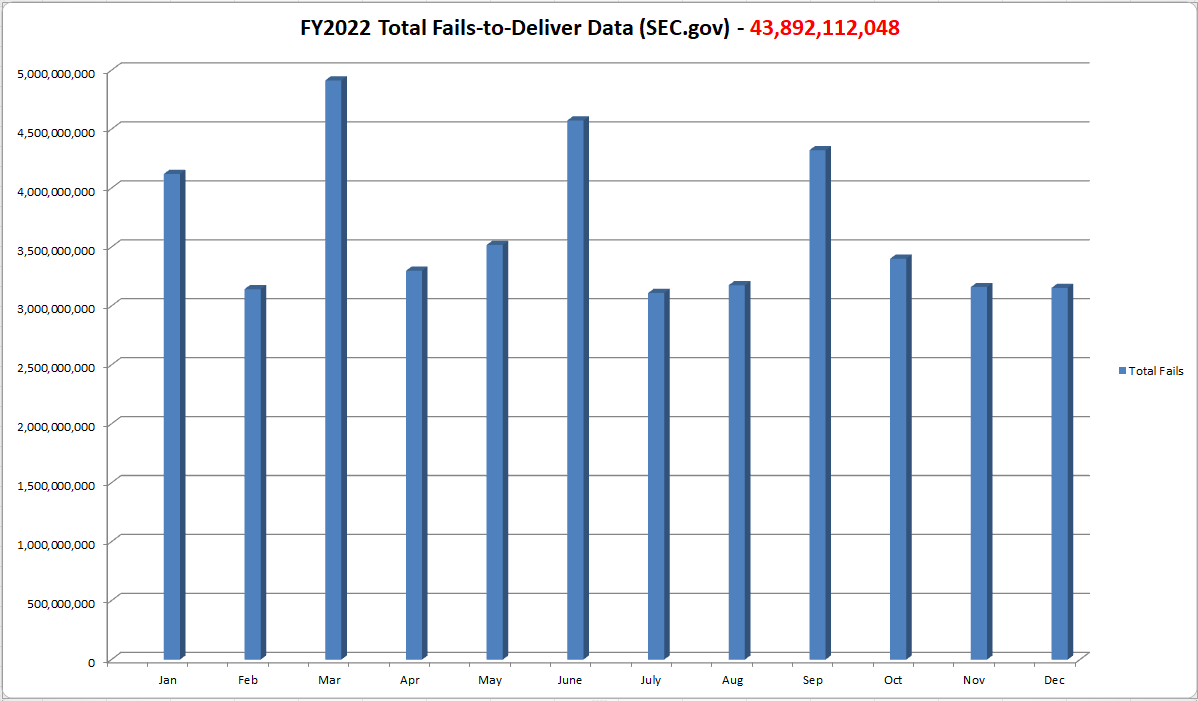

Thats great info and is proof that over 5 million phantom shares are floating around (like monoply money) and being traded without any accountabiity what so ever (just pure stock manipulation). The DTCC and brokers just keep passing the buck and profiting off honest share holders. Naked shorting is a real problem and is accountable for MNKD lower PPS cost. You bring up an interesting point. The SEC Regulation SHO has a process for making the buyers of the counterfeit shares whole via a close out procedure where the seller must purchase "securities of like kind and quantity". I'd love an explanation of what that means. I assume it means the same security and if the shares were preferred for example, then the seller must purchase preferred shares of the security it failed to deliver. But I've never seen an explicit description of what that phrase actually means, so I'm just guessing. If that interpretation is correct, you might expect that the seller with open FTDs could be at substantial risk if the price of the security they failed to deliver increased significantly. Whether the risk is real assumes that there is good monitoring and enforcement of Regulation SHO. I don't know if the SEC is required to report on their monitoring and enforcement of their regulations. I've seen where federal regulatory agencies make rules that permit, but do not require, enforcement which is an obvious opportunity for capricious compliance to the regulations. Ugh. We know the DTCC (Depository Trust Clearing Corporation) is clearing trades even when they can't locate the shares through the stock borrow program (SBP). In those cases the SBP claims theirs shares but never finds them. This little hole in the system is grown into a black hole. The DTCC through its SBP has in effect created 100s of millions of phantom shares and it multiplies on a continual bases. On any given day there are 500M - 1B shares have been sold and Failed to Deliver (FTD). Everyday your stock, my stock, our stock is getting lent to this firm, to that firm, to this firm, to that firm. Each firm gives each firm an IOU, but at the end of the day if everyone went and claimed thier stock and said give me my physical certificates they would not be able to do it. This goes on totally off the record and totally invisable and wields enormous impact and power on what's going on. Frankley driving some companies and share holders to BC or at least big loses. |

|

|

|

Post by prcgorman2 on Jan 26, 2023 7:33:36 GMT -5

You bring up an interesting point. The SEC Regulation SHO has a process for making the buyers of the counterfeit shares whole via a close out procedure where the seller must purchase "securities of like kind and quantity". I'd love an explanation of what that means. I assume it means the same security and if the shares were preferred for example, then the seller must purchase preferred shares of the security it failed to deliver. But I've never seen an explicit description of what that phrase actually means, so I'm just guessing. If that interpretation is correct, you might expect that the seller with open FTDs could be at substantial risk if the price of the security they failed to deliver increased significantly. Whether the risk is real assumes that there is good monitoring and enforcement of Regulation SHO. I don't know if the SEC is required to report on their monitoring and enforcement of their regulations. I've seen where federal regulatory agencies make rules that permit, but do not require, enforcement which is an obvious opportunity for capricious compliance to the regulations. Ugh. We know the DTCC (Depository Trust Clearing Corporation) is clearing trades even when they can't locate the shares through the stock borrow program (SBP). In those cases the SBP claims theirs shares but never finds them. This little hole in the system is grown into a black hole. The DTCC through its SBP has in effect created 100s of millions of phantom shares and it multiplies on a continual bases. On any given day there are 500M - 1B shares have been sold and Failed to Deliver (FTD). Everyday your stock, my stock, our stock is getting lent to this firm, to that firm, to this firm, to that firm. Each firm gives each firm an IOU, but at the end of the day if everyone went and claimed thier stock and said give me my physical certificates they would not be able to do it. This goes on totally off the record and totally invisable and wields enormous impact and power on what's going on. Frankley driving some companies and share holders to BC or at least big loses. The quantity of securities available in the stock markets has shrunk dramatically in this century. I don’t think anybody can say for sure exactly why each security that is no longer available was removed from the marketplace. You mention bankruptcy and that is certainly one of the reasons. Mergers and acquisitions would account for some too of course. I remember reading articles on the negative effect of Sarbanes-Oxley (SOX) persuading numerous, and in some cases, well-known large companies to take their companies private. I expect the vagueries of the stock market, naked short selling hedge funds and market makers (often one and the same?) have to also be a contributing factor to the taking-a-company-private movement. My education in corporate finance had a central focus on “the cost of capital”. The two main areas of raising operating capital are debt instruments such as bonds, and issuance of securities through investment bankers which are then traded on the secondary markets which is how we all acquired MNKD shares. We were frequentlly reminded that the cost of capital through selling shares of ownership in a company was a more expensive method of raising capital than borrowing money using loans and bonds. Bonds and loans are retired and paid off, but shares of a company, sooner or later, result in paying dividends. Mature companies pay dividends. And in the long run, the money paid in interest on operating capital raised using loans and bonds is less than the money paid in dividends. So whether bankruptcy, M&A, SOX, predatory (and/or illegal) investment strategies, or conservation of cash (is king) and minimization of cost of capital, the US stock markets have shrunk significantly. If this trend never reversed, the equity markets would eventually disappear and trading would be confined to bonds, and banking would be confined to interest on credit and processing fees. Indeed, my Corporate Finance professor asserted that the foreign capital markets are dominated by debt, not equity. Maybe that’s how the fat cats prefer it. I think it concentrates wealth and that a healthy stock market helps distribute wealth to retail investors and investors in retirement savings and pension plans. I think the significant reduction in equities is a sign of an unhealthy stock market and an obvious contributing factor is shady trading practices, especially naked shorting. The SEC Regulation SHO language goes into some detail regarding why there can be legitimate reasons for Failures To Deliver, such as a failure in the (digital) systems used to manage trades, and maintains that naked shorting is needed to ensure liquidity. Apparently the regulators in jurisdictions that eliminated naked shorting were not overly concerned about liquidity or systemic failures. Neither am I. I’d love to see naked shorting banned in the US. |

|

|

|

Post by sr71 on Jan 26, 2023 8:49:08 GMT -5

Thanks PRC for the excellent write-up! I was not aware that the domestic stock market has been shrinking. Your corporate finance background sheds light on some otherwise dark corners for some of us.

|

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jan 26, 2023 8:57:52 GMT -5

Thanks PRC for the excellent write-up! I was not aware that the domestic stock market has been shrinking. Your corporate finance background sheds light on some otherwise dark corners for some of us. Agree 100% Thank you so much. |

|

|

|

Post by akemp3000 on Jan 26, 2023 9:08:21 GMT -5

Is there any downside to Michael Castagna casually announcing that the company is, or will be, looking into identifying the disparities of naked shorting with MNKD stock?

|

|

|

|

Post by harryx1 on Jan 26, 2023 9:49:20 GMT -5

Here's a chart I created yesterday from the data downloaded from the sec.gov that tracks Fails-to-Deliver data... That's a lot of shares failed to deliver. The problem is we don't have any idea if that's the actual number or 10x that number. We also don't have any idea if any of those shares were ever located and bought back. If only a fraction of those shares were bought back that puts a lot of counterfeit shares in the system.  |

|